An income tax is a tax that the government imposes on individuals or businesses that have earned income during the year. The amount of tax you owe is based on your income level and filing status. If you are a US citizen or resident alien, you will need to file a return if your income is above a certain amount. This amount varies depending on your filing status, age, and whether you are claiming any dependents. The tax brackets have changed since Congress passed new legislation in 2017 that altered the brackets and how taxes are submitted. The top rate for five of the seven tax brackets was lowered as a result of President Trump and Congressional Republicans' tax reform. It also boosted the standard deduction to near-double its previous amount. Any individual with earned income, such as salaries, wages, tips, commissions, or net earnings from self-employment, may be required to file a federal income tax return. The specific income threshold that triggers the filing requirement can vary from year to year and depends on factors such as the taxpayer's age and filing status. However, even if you don't meet the income threshold, it's often beneficial to file a tax return anyway. That's because you might be eligible for tax credits that can provide a refund, even if you owe no tax. There are also certain situations where individuals are required to file an income tax return regardless of their income level. For instance, if you owe special taxes, such as the Alternative Minimum Tax or household employment taxes, you must file a return. Similarly, if you received distributions from a Health Savings Account or received advance payments of the premium tax credit, you are also required to file. Self-employed individuals must file a tax return if their net earnings from self-employment were $400 or more. It's not just earned income that can trigger the need to file a tax return. If you have unearned income, such as interest, dividends, alimony, social security benefits, or income from an estate or trust, you may need to file a return. The rules for different types of unearned income can be complex, so it's worth consulting with a tax professional or reviewing IRS guidelines to ensure you're meeting your tax filing obligations. Your total income is one of the primary factors that affect how much federal income tax you owe. In general, the more income you have, the more tax you will owe. However, it's important to note that not all income is taxable, and there are adjustments, deductions, and credits that can reduce your taxable income or tax. Your filing status – whether you're single, married filing jointly, married filing separately, head of household, or qualifying widow(er) – also significantly impacts your federal income tax. Your filing status determines your tax rates and the amount of your standard deduction. It can also affect your eligibility for certain tax deductions and credits. Deductions and credits are crucial factors in your federal income tax. Deductions reduce your taxable income, while credits reduce your tax. There are various deductions and credits available, each with its own eligibility requirements. For example, you might be able to claim a deduction for student loan interest, or a credit for child and dependent care expenses. Taking advantage of these deductions and credits can significantly reduce your federal income tax. Gross income is all income you receive in the form of money, goods, property, and services that is not exempt from tax. It includes both earned income (like wages and salaries) and unearned income (like interest and dividends). However, gross income does not equal taxable income. To determine your taxable income, you need to make certain adjustments and deductions to your gross income. Certain types of income are excluded from gross income, meaning they're not subject to tax. Common exclusions include certain gifts and inheritances, life insurance proceeds received due to the death of the insured person, child support payments, welfare benefits, and some types of educational scholarships and fellowships. Adjustments to income, also known as above-the-line deductions, further reduce your gross income. These include deductions for contributions to certain retirement accounts, student loan interest, tuition and fees, alimony payments, and others. These adjustments are subtracted from your gross income to arrive at your adjusted gross income (AGI). After you've calculated your AGI, you can then subtract your tax deductions. You have the option of taking the standard deduction, which is a flat amount that reduces your taxable income, or itemizing your deductions. This involves subtracting eligible expenses like mortgage interest, state and local taxes, and charitable contributions. Whichever method lowers your tax bill the most is the one you should use. Tax brackets for individual federal income taxes determine the percentage of income that taxpayers owe to the government based on their income level. These brackets consist of several income ranges, each associated with a specific tax rate. As income increases, individuals move into higher tax brackets, resulting in a higher tax rate on the additional income earned. They are periodically adjusted to account for inflation and changes in tax laws. Understanding the tax brackets is crucial for individuals to accurately calculate their tax liability and plan their finances accordingly. The Child Tax Credit is designed to provide tax relief for parents or guardians of children under 17. The credit can significantly reduce a taxpayer's federal income tax, and it is partially refundable, meaning that you can benefit from the credit even if you owe no tax. The Earned Income Tax Credit (EITC) is a refundable tax credit for low- to moderate-income working individuals and couples, particularly those with children. The amount of the EITC varies depending on your income and the number of qualifying children you have. There are two primary education tax credits: the American Opportunity Tax Credit (AOTC) and the Lifetime Learning Credit (LLC). The AOTC is partially refundable and provides a credit for the first four years of college education. The LLC is nonrefundable and provides credit for any level of post-secondary education and for courses to acquire or improve job skills. Itemized deductions allow you to subtract certain eligible expenses from your AGI. Common itemized deductions include state and local taxes paid, home mortgage interest, medical and dental expenses, and charitable contributions. However, it's important to note that some itemized deductions are subject to limits. Before you can file your federal income taxes, you need to gather all necessary documents and information. This includes W-2 forms from your employer(s), 1099 forms for other income like interest or dividends, receipts for deductible expenses, and information for credits you plan to claim. Choosing the correct filing status is crucial because it affects your tax rates, standard deduction amount, and eligibility for certain tax credits and deductions. Your filing status depends on your marital status and family situation. If more than one filing status applies to you, the IRS allows you to choose the one that gives you the lowest tax. Completing your tax return involves inputting your income, deductions, and credits into the appropriate lines of the tax return form (usually Form 1040 or 1040-SR). You can fill out the form manually, use tax preparation software, or hire a tax professional. The federal income tax return is typically due on April 15 of the year following the tax year. However, if April 15 falls on a weekend or holiday, the deadline is moved to the next business day. If you can't file by the deadline, you can apply for an extension, which gives you until October 15 to file. But remember, an extension to file is not an extension to pay any tax you owe. A tax audit is an examination of your tax return by the IRS to verify that your income and deductions are accurate. There are three main types of audits: correspondence audits (conducted by mail), office audits (conducted in an IRS office), and field audits (conducted at your home, business, or accountant's office). Certain factors can increase your chances of being audited, such as making a lot of money, having large charitable deductions, claiming the home office deduction, or making errors on your tax return. However, an audit does not necessarily mean you've done something wrong; sometimes, returns are chosen at random. If the IRS determines that you owe more tax, you may have to pay penalties and interest in addition to the tax itself. Common penalties include the failure-to-file penalty, if you don't file your tax return by the deadline, and the failure-to-pay penalty, if you don't pay all the taxes you owe by the deadline. An additional penalty is an accuracy-related penalty if you underpay your tax due to negligence or disregard of rules or regulations. Individual federal income taxes are taxes imposed by the government on individuals based on the income they have earned during a given year. These taxes are calculated based on factors such as total income, filing status, deductions, and credits. Understanding these factors is essential for taxpayers to accurately determine their tax liabilities and fulfill their obligations. The tax rates and brackets vary depending on the filing status, and certain credits and deductions can significantly reduce the amount owed. Filing taxes involves gathering necessary documents, choosing the appropriate filing status, and completing the tax return form. It is important to be aware of the tax filing deadline and potential penalties for non-compliance. By seeking professional assistance or referring to IRS guidelines, taxpayers can navigate the complexities of individual federal income taxes and ensure proper adherence to tax laws. Overall, having a comprehensive understanding of individual federal income taxes is crucial for taxpayers to effectively manage their tax obligations and minimize their tax burden.What Is an Income Tax?

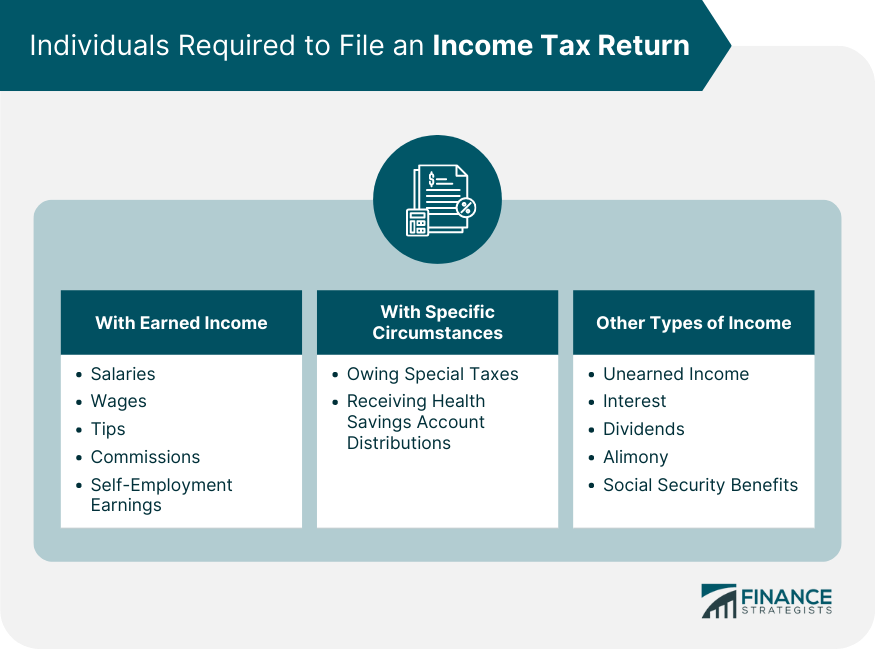

Who Is Required To File an Income Tax Return?

Individuals With Earned Income

Individuals With Specific Circumstances

Individuals With Other Types of Income

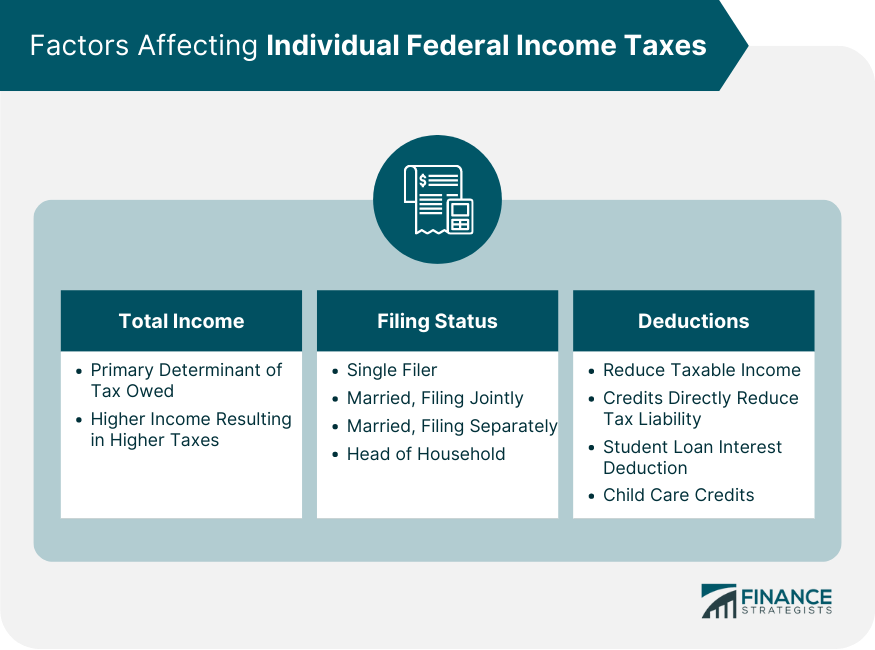

Factors That Affect Individual Federal Income Taxes

Total Income

Filing Status

Deductions and Credits

How To Determine Taxable Income

Gross Income

Exclusions From Income

Adjustments to Income

Tax Deductions

Tax Brackets for Individual Federal Income Taxes

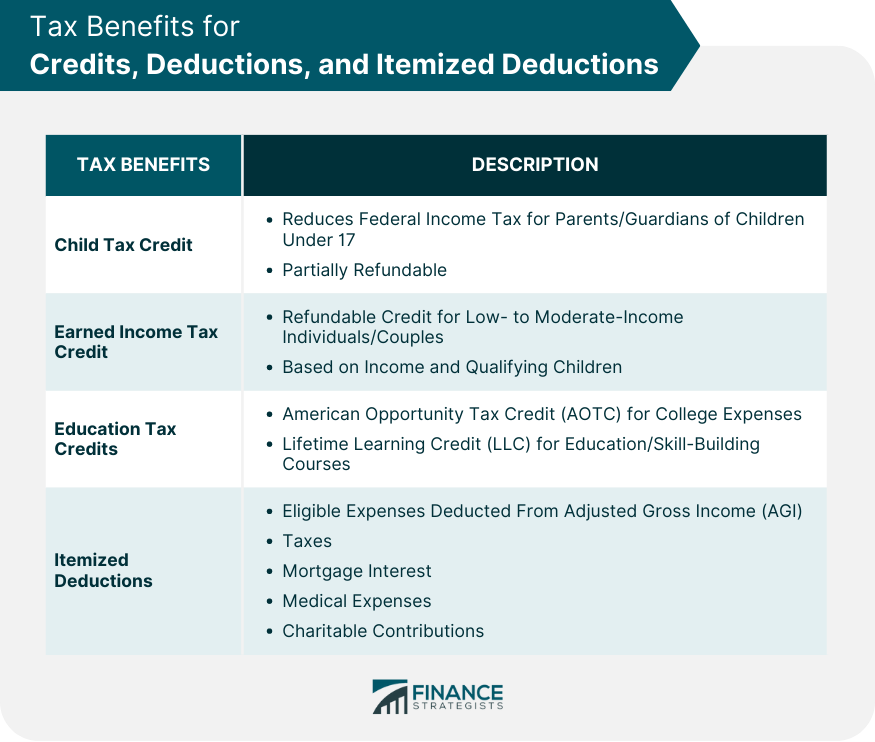

Tax Credits and Deductions

Child Tax Credit

Earned Income Tax Credit

Education Tax Credits

Itemized Deductions

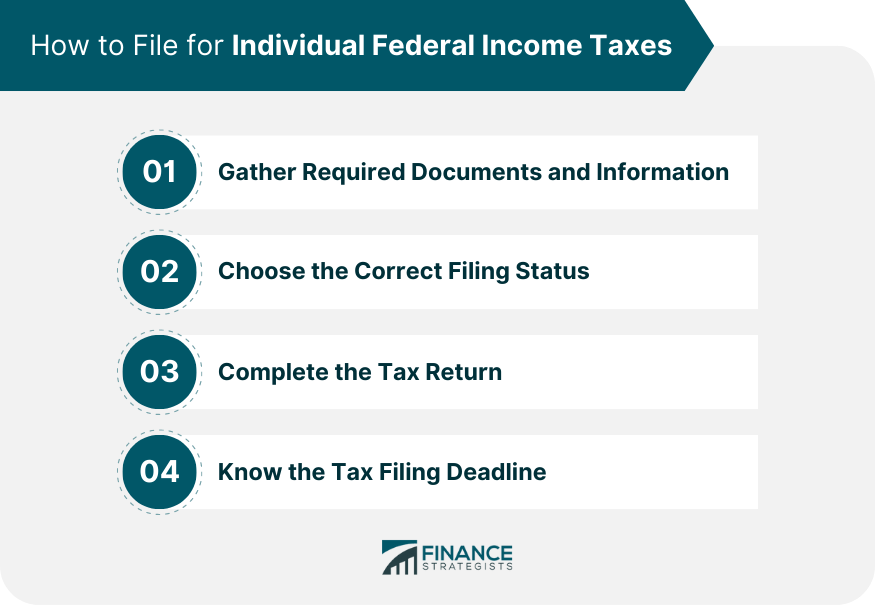

How to File for Individual Federal Income Taxes

Gather Required Documents and Information

Choose the Correct Filing Status

Complete the Tax Return

Know the Tax Filing Deadline

Tax Audits and Penalties

Tax Audits

Common Audit Triggers

Penalties for Non-compliance

Conclusion

Individual Federal Income Taxes FAQs

Most people are required to file a tax return if they earn income. The specific income thresholds depend on factors such as age, filing status, and the type of income received. In addition, certain other circumstances, such as owing special taxes, can also require individuals to file a tax return.

Taxable income is your total income minus any exclusions, adjustments, and deductions. Not all income is taxable. Your total income, filing status, and the deductions and credits you claim all affect how much tax you owe.

Tax brackets divide your taxable income into portions that are taxed at different rates. The U.S. has a progressive tax system, so higher income levels are taxed at higher rates.

Yes, Individual Federal Income Taxes can change each year due to many factors, such as changes in your income and filing status, deductions and credits you qualify for, and the tax bracket you are in. It is important to check with a tax professional or do your own research to understand how taxes can change each year.

Taxes are important because they fund the government and its various programs. They also help to provide for the common good, such as infrastructure and defense. Additionally, taxes can help to redistribute wealth and provide for those who are less fortunate.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.