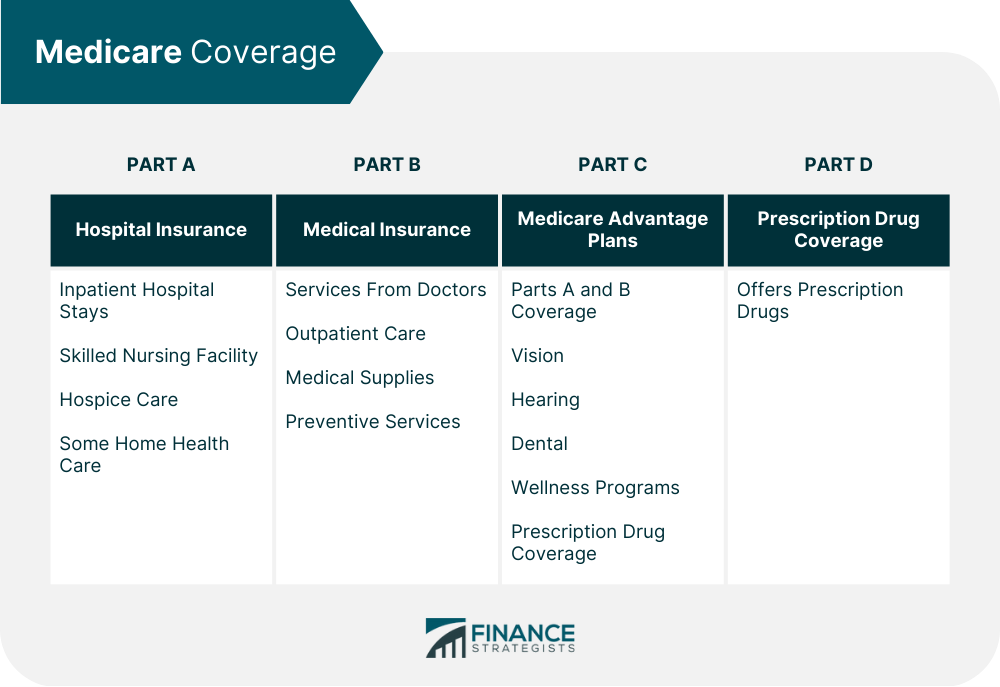

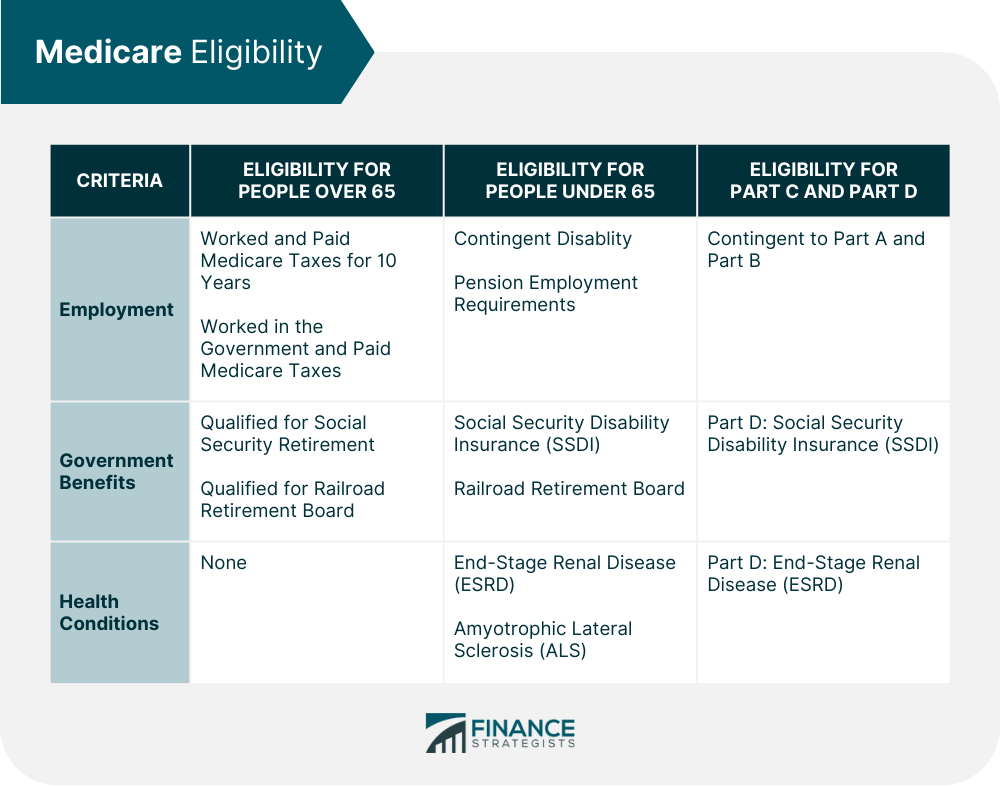

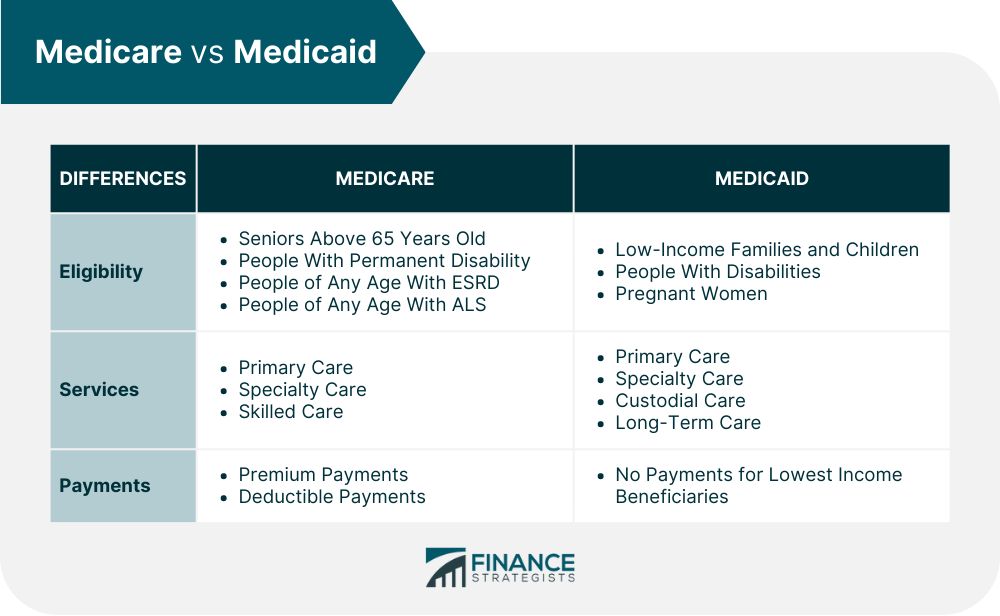

Medicare is a federal health insurance program governed by the Centers for Medicare & Medicaid Services (CMS). It is designed to provide health coverage to individuals 65 or older and those under 65 with specific disabilities. Social Security, Medicare income taxes, Medicare premiums, and the government budget finance the Medicare program. The program lessens the overall cost of health care, although it does not cover all expenses or the majority of long-term care costs. Medicare has four components: Part A - Hospital Insurance, Part B - Medical Insurance, Part C - Medicare Advantage Plans, and Part D - Prescription Drug Coverage. Medicare was introduced in 1965 as part of President Lyndon B. Johnson's program. It was designed to provide health care coverage for Americans over 65 who were no longer covered by employer-sponsored health insurance plans. Initially, it only provided coverage for hospital and medical insurance. Still, over the years, additional coverage and benefits have been added, including prescription drug coverage, Medicare Advantage, and supplemental insurance plans. The 1972 amendment expanded coverage to include people with disabilities, those with an end-stage renal disease requiring dialysis or a kidney transplant, and those 65 and older who choose Medicare coverage. The most significant change was the Medicare Prescription Drug Improvement and Modernization Act (MMA) of 2003. Under this legislation, private health plans approved by Medicare became known as Medicare Advantage Plans. The program has been expanded to make more individuals eligible for coverage and cover a broader range of medical issues. It continues to meet such requirements as the population, technology, and society constantly change. There are four types of coverage offered by Medicare: Part A covers inpatient hospital stays, care in a skilled nursing facility, hospice care, and home health care. However, Part A does not cover the cost of treatment procedures. Most people do not pay premiums for Part A coverage due to their work history. You can purchase it if you are not eligible for Part A with no premium. Additional procedures not covered by Part A may be covered under Part B. This part covers services from doctors, outpatient care, medical supplies, and preventive services. Included in the cost of Part B is a monthly premium, with the amount varying based on income. This is considered the all-in-one alternative to Original Medicare and covers both Parts A and B, as well as additional benefits such as vision, hearing, dental, and wellness programs offered by private companies. Some companies have prescription drug coverage. Medicare Part C, often known as Medicare Advantage, is private insurance. Part C enrollment is optional. These plans are marketed by insurance companies with which the federal government has authorized. Health maintenance, preferred provider organizations, special needs programs, private fee-for-service plans, and Medicare medical savings account plans are included in these programs. Medicare beneficiaries have to pay a monthly premium for Part D, which covers the cost of prescription drugs and is available from private insurers. Participants in Medicare Part D pay a monthly fee, and coverage varies depending on the provider and plan. Medicare is reserved exclusively for those who are 65 or older. If you are disabled, have an end-stage renal disease (ESDR), a permanent kidney failure necessitating dialysis or a transplant, or have ALS (amyotrophic lateral sclerosis), commonly known as Lou Gehrig's disease, you might be eligible for Medicare sooner. Original Medicare, covering Parts A and B, is typically available to people who are U.S. citizens or have been residents for at least five years in a row, and you meet one of the prerequisites listed above. The eligibility requirements for Medicare and the timing of Parts A and B enrollment are very complicated. Knowing when to enroll in the different parts of Medicare is crucial. Your age, whether you are retired or still employed, and whether you receive Social Security payments all influence how much you pay. Qualifying for Part A and Part B programs is not automatic. Here is how to figure out if you qualify. You are eligible to get Part A full benefits without paying premiums if: You are eligible for Part B if: You qualify for Medicare if the following conditions apply: A monthly premium for Part B's optional program is paid for each month of coverage. This is only free if you have a low income and are enrolled in one of the Medicare Savings Programs. You can enroll in Medicare Part C or Part D if you are new to Medicare during your initial enrollment period. You are eligible for Part C if: You are eligible for Part D if: It is vital to understand that a Part D plan can only be obtained as an add-on to original Medicare. You cannot enroll in a Part D plan if you have Part C. The moment an individual becomes eligible is the optimal moment to enroll for Medicare, and one can do so by considering the following: There are three alternatives for individuals who wish to enroll in Medicare: Individuals can enroll online on the Social Security Administration (SSA) website. Instructions are provided upon starting the application process, and the Medicare card is automatically sent approximately 30 days after the approval of the application. Contact the SSA by dialing 1-800-772-1213 to register for Medicare benefits. They are available in most U.S. time zones from Monday to Friday from 8 a.m. to 7 p.m. Applicants must inform the representative that their purpose is Medicare enrollment. Those who prefer face-to-face interaction can visit their local Social Security office. For this method, individuals are required to set an appointment in advance. It is also necessary to bring a valid ID and proof of age, such as a passport or birth certificate. Depending on their situation, people can sign up for Medicare during one of the following enrollment periods: This is the seven-month period that starts when an individual turns 65 and is the first time they are eligible to enroll in Medicare Part A and Part B. This period begins three months before a person’s 65th birthday includes their birthday month, and ends three months after their birthday. Suppose an individual did not enroll in Medicare when they were first eligible. In that case, they can during the General Enrollment Period. This period runs from January 1st to March 31st each year. Coverage starts on July 1st of that year. Those who failed to sign up during the initial or general enrollment period can qualify for a particular enrollment period if certain circumstances apply. An example would be going beyond their current coverage area or losing their employer-sponsored health insurance. Medicare does not provide comprehensive coverage. Suppose you require services that Part A or Part B does not cover, such as the ones below. You must pay for them unless you have additional insurance to cover the expenses. Consider the following factors when selecting or updating your Medicare plan to ensure that it provides the required services. Medicare and Medicaid are two government healthcare programs offering Americans health coverage. Medicare is the federal health insurance program for those over 65 and younger adults with disabilities. Medicare covers hospital stays, doctor visits, preventive care, and prescription drugs. Medicaid provides health care services to low-income individuals and families. Medicaid typically covers in-home care, long-term nursing home stays, and other services not covered by Medicare. Some states may offer increased pharmaceutical, physical therapy, dental, and medical transportation coverage. Medicaid does not have premiums, deductibles, or co-pays. On the other hand, Medicare has payment requirements. Medicare is a federal health insurance program developed to provide health coverage to individuals 65 or older and some people under 65 with particular disabilities. The program enables older Americans to have their health concerns addressed when they retire. Social Security, Medicare income taxes, Medicare premiums, and the government budget finance the Medicare program. It was first introduced in 1965 as part of President Lyndon to provide healthcare coverage for Americans. 65-year-olds can obtain Part A hospital and facility coverage without paying premiums if they or their spouse worked and paid Medicare taxes for at least ten years. Those under 65 who have received SSDI or have ESRD or ALS are eligible. During the assigned enrollment periods, eligible individuals can enroll online, by phone, or at a Social Security office. Medicare beneficiaries can choose between Original Medicare, which consists of Part A (hospitalization insurance) and Part B (medical insurance). They can also choose a private Part C (Medicare Advantage plan) or a Part D which covers prescription drug costs. Medical expenses such as long-term care, dental care, vision care, hearing aids, and other services are not covered under Medicare. Medicare and Medicaid are two government healthcare programs offering Americans health coverage. They differ in eligibility, services offered, and payment requirements. When selecting the right Medicare plan, a financial advisor can help you weigh your options to address your specific needs.What Is Medicare?

History of the Medicare Program

Medicare Coverage

Part A: Hospital Insurance

Part B: Medical Insurance

Part C: Medicare Advantage Plans

Part D: Prescription Drug Coverage

Who Is Eligible for Medicare?

Medicare Eligibility for People Over 65

Part A

Part B

Medicare Eligibility for People Under 65

Medicare Eligibility for Part C and Part D

Part C

Part D

How to Enroll in Medicare

Three Ways To Enroll in Medicare

Online

Phone

In Person

Medicare Enrollment Periods

Initial Medicare Enrollment Period

General Enrollment Period

Special Enrollment Period

What Medicare Does Not Cover

How to Choose a Medicare Plan

Medicare vs Medicaid

Final Thoughts

Medicare FAQs

The main difference between Medicare and Medicaid is that Medicare is for those over 65 and younger adults with disabilities. At the same time, Medicaid provides health care services to low-income individuals and families. Medicare covers hospital stays, doctor visits, preventive care, and prescription drugs. Medicaid typically covers in-home care, long-term nursing home stays, and other services not covered by Medicare.

The CARES Act is a federal law enacted in 2020 to provide economic relief due to the impact of COVID-19. The CARES Act provides additional funds for Medicare and Medicaid services, including expanded telehealth coverage and waived cost sharing for certain healthcare services. It also offers financial assistance to individuals, such as one-time stimulus payments, extended unemployment benefits, and reduced student loan payments. Additionally, the CARES Act provided additional federal funding to states for Medicaid programs.

The basic benefits of Medicare include hospital insurance (Part A), medical insurance (Part B), and prescription drug coverage (Part D). Part A covers inpatient care, such as hospital stays. In contrast, Part B covers outpatient services, such as doctor visits and preventive care. Part D is optional coverage for prescription drugs.

Yes, there is a monthly fee for Medicare. The Part B premium, which covers medical insurance, is typically deducted from Social Security benefits. Additional costs may be associated with other parts of Medicare, such as deductibles and coinsurance. Additionally, some people who purchase supplemental plans or enroll in Medicare Advantage Plans may also have to pay additional premiums.

It all depends. Suppose you receive Social Security, or Railroad Retirement Board (RRB) benefits at least four months before turning 65. In that case, you do not need to sign up. You will automatically get Part A and Part B beginning the first day of the month you turn 65.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.