A mortgage is a type of loan intended to finance the purchase of a property, such as a home. It may also be used to refinance an existing home loan. The property involved serves as the collateral to secure the loan. If the borrower defaults or fails to fulfill payments, the lender can foreclose and take ownership of the property. The debt acquired through a mortgage is lowered through monthly payments in a process known as amortization. These payments cover both the principal amount borrowed and the interest rate imposed by the lenders. Once the mortgage has been fully paid off, the borrower retains full rights and ownership of the property. A mortgage is an excellent choice for purchasing a home, especially for individuals who cannot make a lump sum payment. Unfortunately, not everyone can obtain one on excellent terms. Mortgage applications are extensively underwritten. Mortgage underwriters check credit reports, employment history, and income to decide whether or not to approve a loan. The loan's chance of approval and the interest rate the borrower must pay depends primarily on their credit score and the amount of their down payment. Once a mortgage is approved, the borrower can use the money provided by the lender to purchase a home. They agree to pay back the loan with interest over several years. The lender retains property ownership rights until the mortgage is paid in full. The lender will release an amortization schedule which is a table illustrating each payment's breakdown. This schedule demonstrates how the loan balance decreases over time, and the proportion of principal to interest the borrower is paying. If the borrower defaults on their payments, the lender has the right to begin foreclosure and use the property as collateral. This means that lenders can sell the property and use the proceeds to cover the amount that the borrower should have paid. When obtaining a mortgage, you will go through the following four distinct stages. Before you shop for a home, you might need to determine the price range you can afford by checking how much money you have available for a down payment and how much you can set aside monthly to pay for a mortgage. You can also review your credit scores and report to discover whether you qualify for a loan. Generally, higher credit scores signify a more favorable credit history and make you eligible for a mortgage at lower interest rates. Once you have this information, you can compare your budget with the price range of homes in your desired location. You will also discover how much you need to borrow and what your ideal interest rates are. The second step of obtaining a mortgage is reviewing the many types of loans available. A 30-year fixed-rate loan is an excellent option for most borrowers, but it is not the only type available. You can also take the time to research the related costs and payment choices involved in each loan type. This will help you consider which option is most appropriate for your circumstances. Once you have a general concept of the loan you wish to seek, it is time to begin communicating with lenders. Different lenders may offer slightly different terms even for the same type of loan. Thus, you may want to explore your possibilities in greater depth by asking follow-up questions. Several factors must also be considered when selecting a lender, including the cost of the loan, your confidence in the loan officer's ability to answer your questions, and the lender's capacity to fulfill your closing deadline. Once you are ready to proceed, you may select the mortgage loan provider with the most favorable terms for your situation. Contact the lender of your choice to inform them that you are ready to submit an application. It is also advisable to review the important conditions with your mortgage loan officer before you sign to ensure that everyone is on the same page. After the seller of the property has approved your purchase offer and you have selected a loan and a lender, it is time to focus on the closing procedure. You might need to furnish your lender with more documentation, so be on the lookout for requests. You will also need to schedule a house inspection and search for homeowners and title insurance. You will obtain your copy of the Closing Disclosure three business days before closing, as required by law. You can also request that the lender send you other essential documents in advance, such as the promissory note and deed of trust, so you can review them thoroughly before signing. The most common types of mortgage are the following: A fixed-rate mortgage has a consistent interest rate and principal/interest payment for the life of the loan. If you are currently living in your "permanent home," a fixed-rate mortgage may be your best option. A fixed interest rate helps you budget and plan for the future by providing a clearer picture of your monthly mortgage payment. If interest rates are high in your location, you might want to avoid fixed-rate mortgages. Unless you refinance, you cannot change your interest rate after you have locked it in. If rates are high and you lock in your interest rate, you could pay hundreds of dollars in excess interest. Consult with a local real estate agent or home loan professional for further information on market interest rate trends. An adjustable-rate mortgage is a house loan with a variable interest rate. An ARM's initial interest rate is fixed for a length of time and then reset annually or monthly after that. ARMs are sometimes known as variable-rate mortgages or floating mortgages. The interest rate on adjustable-rate mortgages is updated based on a benchmark or index plus a spread known as an ARM margin. In most cases, ARMs limit the amount by which the interest rate and payments can increase annually or during the life of the loan. An ARM can be an excellent financial choice for homebuyers who want to keep the loan for a limited time and can afford any future interest rate hikes. An interest-only mortgage is one in which the borrower is expected to pay just the interest for a specified term, such as five, seven, or ten years. The principal may be returned in a lump sum at a certain date or in subsequent payments thereafter. After that, the loan converts to a regular schedule — a fully amortized basis, in lender parlance — and the borrower's payments will increase to include interest and a portion of the principal. While interest-only mortgages result in lower payments for a while, they also prevent the accumulation of equity and significantly increase payments after the interest-only period expires. Individuals who are at least 62 years old and need money to supplement their income or cover medical expenses can opt to explore a reverse mortgage. It allows them to convert a portion of their home's equity into cash without selling their house or incurring additional monthly expenses. Generally, they do not have to repay the loan as long as they continue to reside in the home. The debt would have to be paid in full upon their death, the sale of the house, or their relocation to a new home. However, a reverse mortgage might deplete a home's equity, leaving their heirs with fewer assets. It is advisable to review the many forms of reverse mortgages and shop around before deciding to pursue one. The U.S. Department of Agriculture (USDA) home loans program provides mortgages to low-income rural individuals who cannot qualify for a traditional mortgage. Borrowers residing in a rural location and not eligible for a conventional loan may qualify for either a USDA-guaranteed loan or a USDA direct loan. Depending on their circumstances, qualified candidates may be provided either a federal guarantee of a mortgage through a commercial bank or a government loan directly. Both loans need no down payment. A Federal Housing Administration (FHA) loan is guaranteed by the government and is issued by an approved lender. Many conventional loans have higher minimum down payments than FHA loans, but applicants for FHA loans might have lower credit ratings than what is typically required. The FHA loan program is intended to assist families with low to moderate incomes in becoming homeowners. They are especially common among individuals purchasing their first homes. A VA loan is a mortgage option backed by the federal government that is available to Veterans, service members, and surviving spouses. Private lenders, such as mortgage companies and banks, make VA loans, not the Department of Veterans Affairs (VA). VA home loans offer reasonable interest rates and terms and can be used to acquire a primary residence, repair an existing one or refinance a previous mortgage. A jumbo loan is a kind of financing that exceeds the Federal Housing Finance Agency's lending limits and cannot be acquired, insured, or securitized by Fannie Mae or Freddie Mac. The credit requirements for prospective borrowers of jumbo loans are stricter than those for traditional loan applicants. Approval requires an excellent credit score and a debt-to-income ratio (DTI) that is extremely low. Typically, the average annual percentage rate (APR) for a jumbo mortgage is comparable to that of a conventional mortgage, and the average down payment ranges from 10 to 15 percent of the purchase price. There are five factors that play a role in the calculation of a mortgage payment: down payment, principal, interest rate, closing costs, and insurance. The down payment is a lump sum borrowers can afford to pay immediately to purchase a home. The down payment requirements vary from lender to lender and loan to loan but are typically no more than 20%. The principal balance of the borrower’s mortgage is, in essence, the amount they have borrowed from the lender (excluding interest) to purchase the home. The interest rate is the amount lenders charge individuals for borrowing money. It is based on a percentage of the principal amount. Mortgage interest rates can be either fixed or variable. When borrowers close on their house, they will be required to pay certain administrative expenses, referred to as "closing costs." These may also include inspection fees, origination fees, and title insurance. Those who fall short on the down payment will likely be required to purchase mortgage insurance. This could come in the form of private mortgage insurance (PMI) or government loan insurance, depending on the type of mortgage borrowers select. The primary mortgage market is the market in which lenders provide borrowers the funds they need to purchase a home. Primary mortgage market lenders can be commercial banks, savings and loan associations, and mortgage banking companies. Commercial banks are the largest source of funds for mortgages in the primary market. They often cost less, require smaller down payments and are more flexible. They can also "portfolio" (or hold) difficult loans that could not otherwise be sold on the secondary market. A savings and loan association (S&L) is a type of financial organization often owned and supervised by its customers or shareholders. Because of this "pool" structure, savings and loan associations can offer mortgages and other financial products to customers who otherwise would not have access to them. They are required by law to devote the majority of their lending to financing residential properties and frequently have a local presence. A mortgage bank is a financial institution that specializes in mortgage loans. It may originate mortgage loans, service mortgage loans, or both. The banks may lend their own money to borrowers and collect payments in installments along with a specified interest rate, or they could sell the loans on the secondary market. Mortgage rates have more than quadrupled over the past years due to the Federal Reserve's extraordinary campaign to raise interest rates to combat skyrocketing inflation. Therefore, prospective borrowers are advised to carefully consider their options before selecting the mortgage type that is most appropriate for their situation. A mortgage refers to a loan that is used to purchase a home. Mortgages allow borrowers to use their homes as collateral for the loan. If the borrower cannot repay the loan, the lender can take possession of the home and sell it to recoup their losses. Once a mortgage is approved, the borrower can use the money provided by the lender to purchase a home. They agree to pay back the loan with interest over several years. The lender retains property ownership rights until the mortgage is paid in full. Mortgage payments are typically made monthly and include five main components: down payment, principal, interest rate, closing costs, and insurance. The mortgage application process involves several steps that may be started well before purchasing a home. Many different types of mortgages are available, such as fixed-rate mortgages, adjustable-rate mortgages, and interest-only loans. There are also a variety of lenders offering these loans. With all these options and the rise of mortgage rates in recent months, it has become even more critical to select the best mortgage for your needs.What Is a Mortgage?

How Mortgages Work

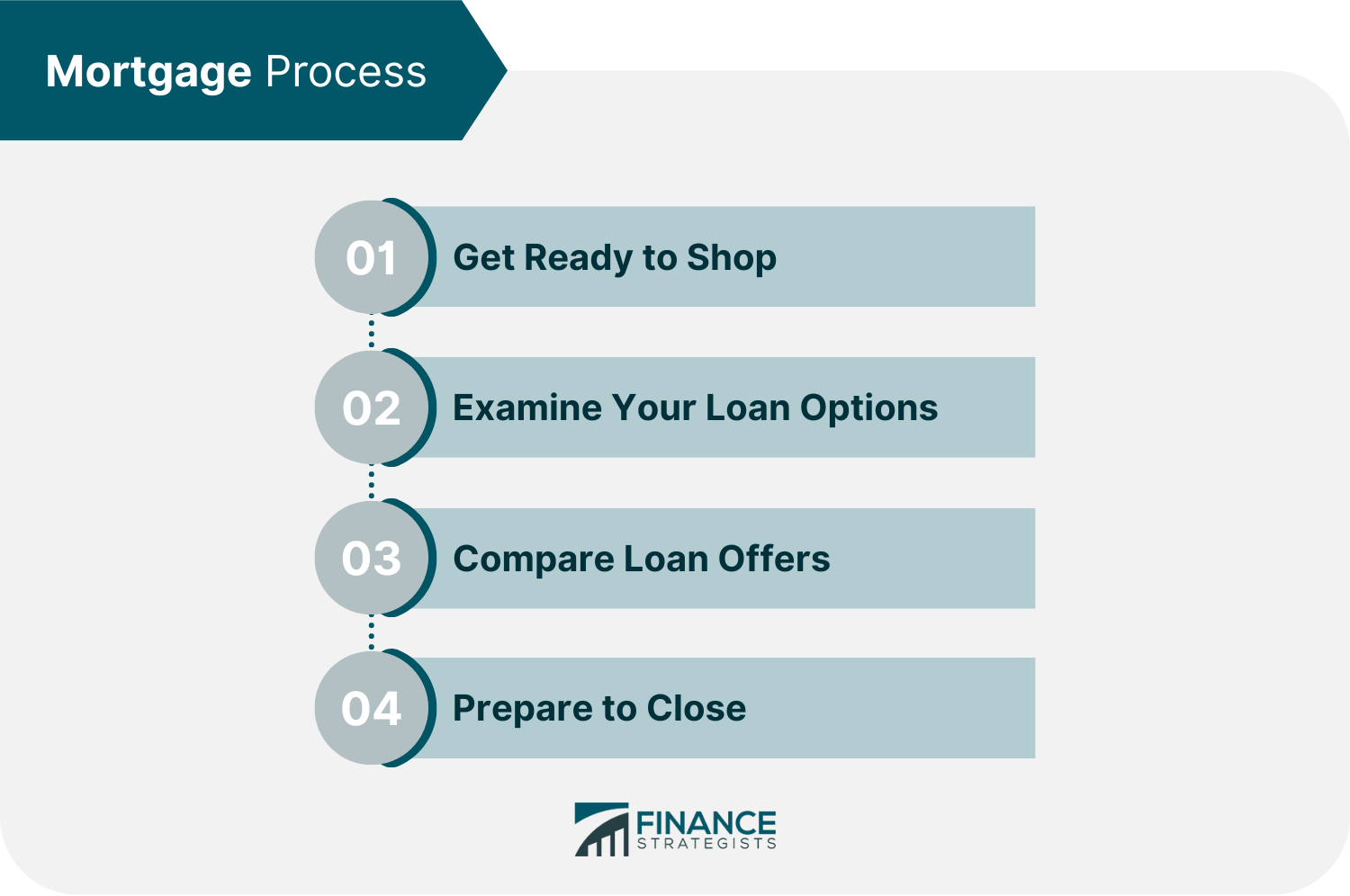

Mortgage Process

Step 1: Get Ready to Shop

Step 2: Examine Your Loan Options

Step 3: Compare Loan Offers

Step 4: Prepare to Close

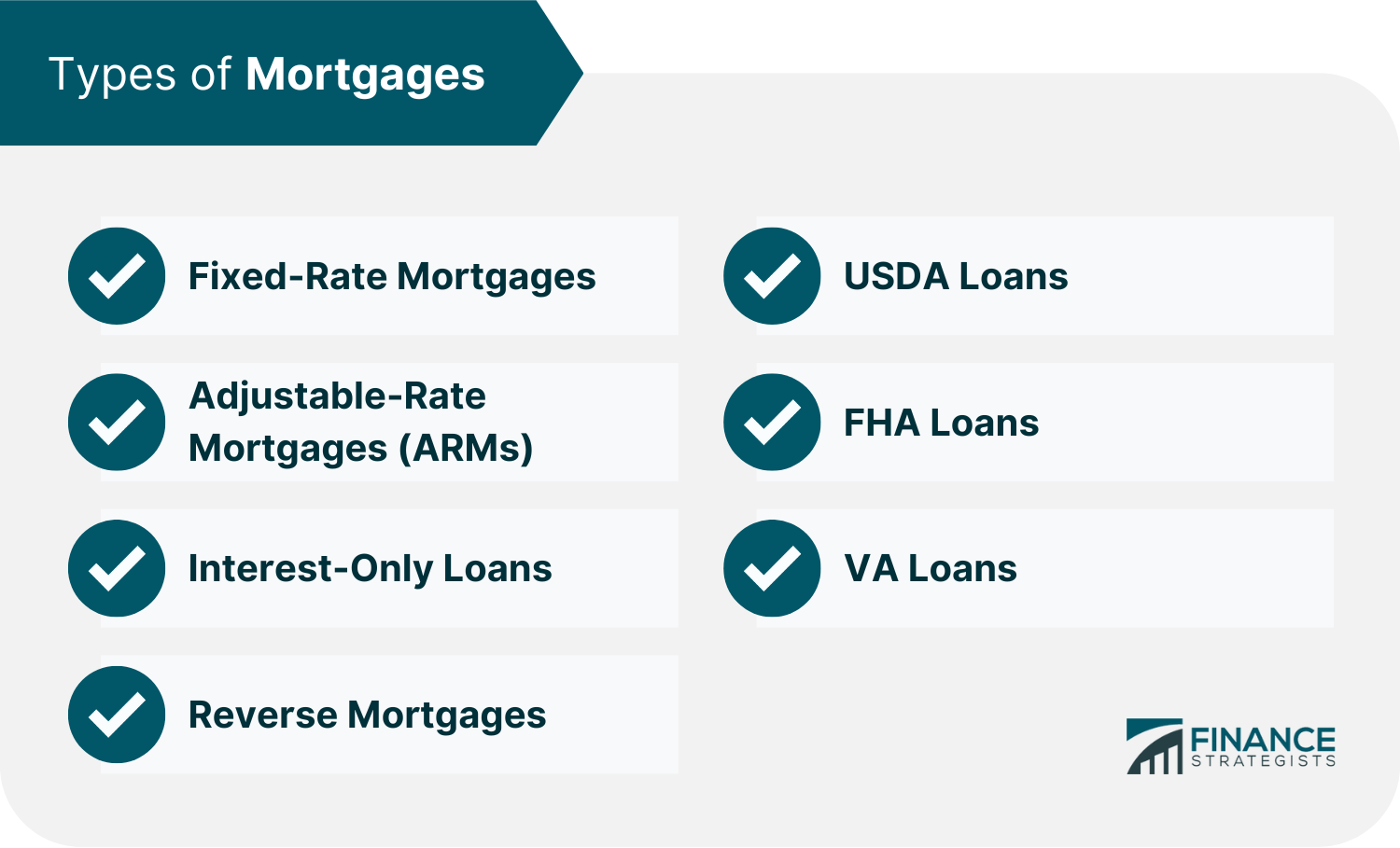

Types of Mortgages

Fixed-Rate Mortgages

Adjustable-Rate Mortgages (ARMs)

Interest-Only Loans

Reverse Mortgages

USDA Loans

FHA Loans

VA Loans

Jumbo Loans

Mortgage Payments

Down Payment

Principal

Interest Rate

Closing Costs

Insurance

Primary Mortgage Market Lenders

Commercial Banks

Savings and Loan Associations

Mortgage Banking Companies

National Mortgage Rates

Final Thoughts

Mortgage FAQs

A mortgage refers to a loan that is used to purchase a home. Mortgage payments are typically made monthly and include five main components: down payment, principal, interest rate, closing costs, and insurance.

You need to obtain a mortgage if you cannot pay the total price of a home with cash. In some instances, it makes sense to have a mortgage on your property despite having the funds to pay it off. For example, investors may mortgage houses to free up capital for other ventures.

Specific eligibility requirements must be met to qualify for the loan. Therefore, a person who obtains a mortgage will generally have a consistent and reliable income and a good credit score.

Technically, there is no limit to the number of mortgages a person may hold. When you demonstrate sufficient wealth or collateral, there are minimal restrictions on the number of mortgages you can hold at once. Nonetheless, certain qualifications may limit your total.

By obtaining a mortgage, you agree to repay the principal, plus interest, within a specified time frame. This means you might have to pay significantly more than you borrowed. Furthermore, if you default on your payments, your lender may sell your home to recoup their losses.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.