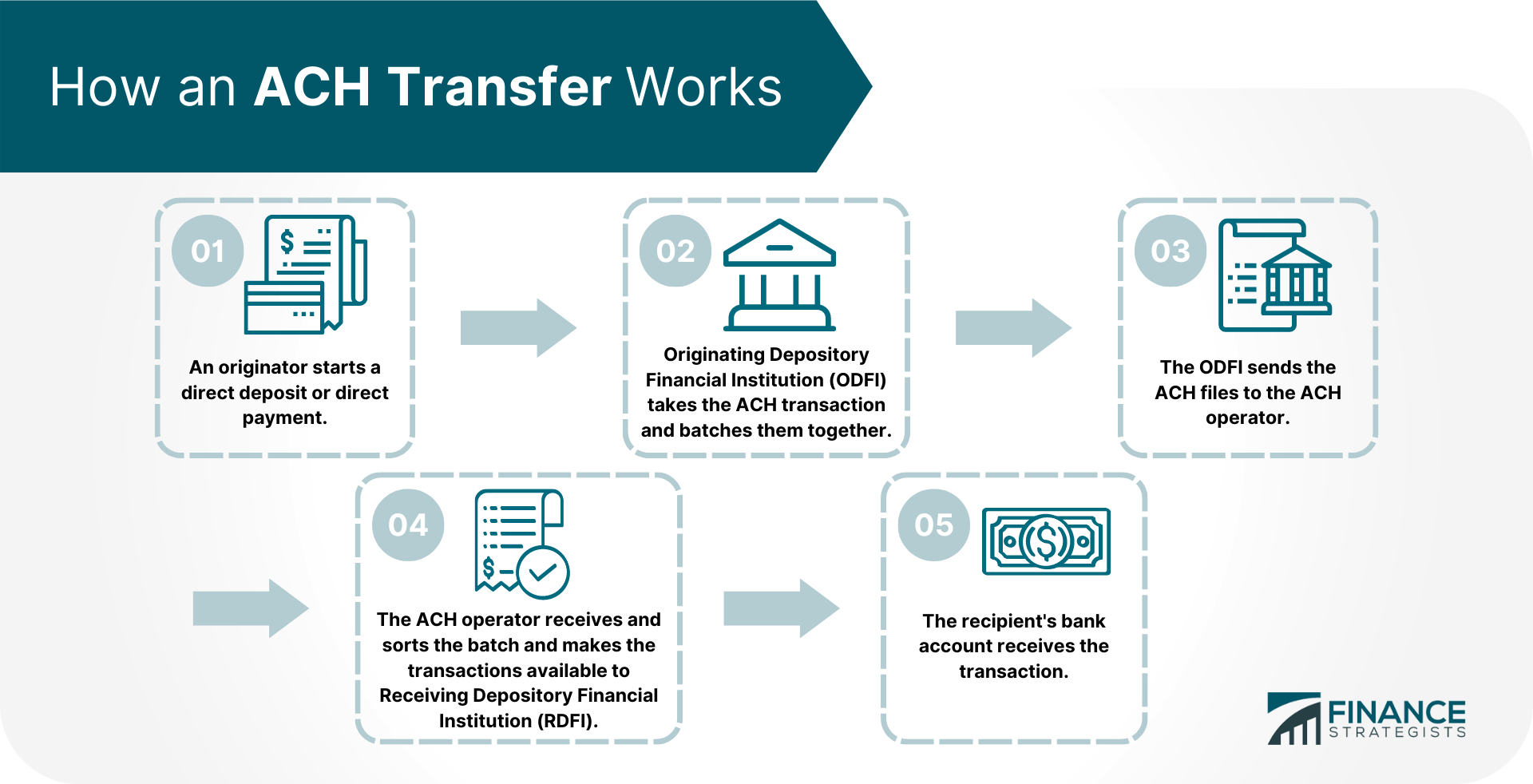

An Automated Clearing House (ACH) is a network that processes electronic payments and transfers across the United States. Governed by NACHA (National Automated Clearing House Association) since 1974, this network enables ACH transactions with direct deposit, payroll, consumer bills, tax refunds, tax payments, and other payment services in the U.S. The ACH network allows billions of electronic financial transactions, including Social Security and government statements, direct deposits, person-to-person (P2P), electronic bill payments, and business-to-business (B2B) payments. With its rule-making and supervisory function, NACHA delivers the foundation for electronic payment systems to operate effectively while also working on updating technologies and implementing new payment systems. Using the ACH Network, an originator starts a direct deposit or direct payment. Originators can be individuals, organizations, or government bodies, and can be either debit or credit. The Originating Depository Financial Institution (ODFI) takes the ACH transaction and batches them together with other ACH transactions to be sent out regularly throughout the day. The ACH operator, either a clearinghouse or the Federal Reserve, receives the ACH transactions by batch from the ODFI with the transaction of originator. The ACH operator then sorts the batch and makes the transactions available to the financial institution of the recipient, also known as the Receiving Depository Financial Institution (RDFI). Afterwards, the recipient's bank account receives the transaction, reconciling both accounts and completing the process. ACH transactions require the name of the financial institution receiving the funds, account type, routing/ABA numbers, and receiving bank account numbers. The ACH Network has two types of ACH transfers: direct deposits and direct payments. ACH direct deposits are ACH transfers for putting money into an account. Direct deposits are most commonly used in: The recipient of the direct deposit will see an ACH credit reflected on their account for these transactions. It is important to note that financial institutions may choose to have ACH credits processed and sent within the same day or in one to two business days. ACH direct payments are the "pushing" of money from one account to another. Popular apps such as Zelle, Paypal, CashApp, and Venmo use the ACH network to transfer and receive funds from family and friends. Direct payments may include: In this case, the party initiating the payment will see an ACH debit reflected in their account. The recipient, on the other hand, will see the transaction as an ACH credit. Per guidelines by NACHA, ACH debit transactions must be processed by the next business day. To set up an ACH transaction, you need to follow these steps: The first step to making a transfer is to provide the necessary information, including your name, receiving financial institution’s name, the recipient’s name, routing/ABA number, account number, account type, and transaction amount. After you gather the necessary information, you will need to determine between an ACH debit and an ACH credit to perform the correct payment. An ACH credit happens whenever someone instructs to "push" money from their account to another account using the ACH network. Your bank account details stay with your financial institution and are not sent to the payee. While an ACH debit, you set up the transaction with the person or company you are paying. This means that you give them your payment details, such as account and routing number. An ACH debit is riskier than an ACH credit, but both types of payments are just as convenient and cost-effective. You must do some paperwork before transferring funds through the Automated Clearing House. This usually involves e-paperwork, or hard-copy forms, which some financial institutions still use. To have this, here are the steps you must take. First, link accounts, for which you must supply the ACH instructions discussed above to the financial institution responsible for initiating the transaction. Then, specify the transaction if it is credit or debit to the account where the transaction begins. After which, enter the payment, and lastly, be specific with the payment date. ACH is a popular method for online payments because of its low fees. However, some businesses may experience a fee for outgoing ACH transactions while incoming transfers are free to discourage you from moving money out. ACH transaction fees often charge $3 on average for standard delivery and between $6-$10 for next-day delivery. Other banks will waive this fee if you send it online or sign up for automatic bill payments. The costs for ACH transactions ensure funds are securely transferred. However, ACH transfers will always remain one of the most affordable options available for sending money quickly. For ACH payments, the median internal cost is $.29, but the total cost may vary with accepting ACH payments. It is important to note that there are fees involved when accessing ACH through a third-party payment processor (TPPP). These may include: Customers should be cautious because there are times when service providers can charge extra or hidden fees. It is vital to read all terms and conditions first to know if there are charges upfront before doing business with any third-party provider. Additionally, fees can be significantly lower for larger enterprises that are capable of accessing ACH directly through their financial institution. Using the bank-to-bank infrastructure to handle transactions has several benefits for businesses and organizations that must process payments on a regular basis. Specifically: ACH payment tends to be a cheaper method for electronically transferring funds since the relatively expensive card network does not route it. ACH payments are processed as a priority over traditional checks, which can be put on hold while your bank confirms the validity of the checks. According to the report of the 2024 AFP Payments Fraud and Control Survey, check writing is the most fraud-susceptible payment method. ACH payments are safer than checks because the funds are transferred between banks electronically, which reduces the risk of check fraud. Account numbers and other confidential information are also not divulged during the transaction. The digitization brought about by ACH payments meant that businesses no longer have to print and mail paper checks, which can be lost or stolen. This also reduces the chances of human error, as all information is entered into the system electronically. Additionally, this has introduced auto-pay options for customers, which is a safe and convenient way to make sure that bills are paid on time. This has eliminated the need for customers to be reminded about delayed payments. Likewise, it has removed the hassle of writing paper checks and going to the bank. Paying via the ACH system is open to anybody with a U.S. bank account. Both businesses and consumers are eligible. Even with the ACH network in place, there are certain risks that come along with it. Businesses should be aware of these before using the ACH for their transactions. ACH credit risk occurs with an ACH credit and when there is a failure of one party to make the required payment to settle as stipulated in the ACH credit contract. This might happen when a company suffers large financial losses, like bankruptcy. The bank usually takes the greatest fall in cases of payment failure, especially if they do not adhere to NACHA recommended procedures and use risky practices when processing same-day ACH transfers. ACH debit risk is the most common way that scammers can manipulate the ACH debit system. Malicious attackers can obtain customers' account details, such as routing and bank account numbers, and perform unauthorized debit from this account. For cases like this, most banks will support the owner of the bank account that falls victim to ACH fraud. However, there are some financial institutions that are unable to provide this service. Clerical and electronic errors made during ACH transactions can result in risk. Computer network failures, power failures, telecommunication failures, hard and software failures, and other security system failures are some of these errors. Risks for these errors might be data alteration, data loss, and data duplication. Fraud risks can happen when employees of ACH operators change or alter customer account data and embezzle funds. These employees usually have access to the accounts of the customers and may illegally obtain protected terminals, files, or data and use them to misappropriate funds. The bank gets to set up security measures to protect their customer's account against fraud on ACH systems. This will put an extra line of defense so that sensitive financial data will be secured from fraud. Here are three best practices to secure ACH payments against data fraud: This entails the deciphering and ciphering of data by passing the characters through an algorithm locked with a key. Same way applies to unlocking the data so that anyone with key access can decipher the ciphered text. Encryption may also come through the cryptocurrency transfer. This involves verifying the identity of the receiver of the ACH transaction in congruence with account verification. Organizations take into account the type of transaction, the type of customer, and the stakeholders involved using a risk-based approach to authentification. This happens when the originator and the receiver of an ACH transaction enter into an agreement that permits the originator to begin a debit entry to the receiver's bank account. This is crucial because the receiver is permitting access to the bank account and the receiver is required to prove that they trust the other party. ACH transfers are processed automatically through a clearinghouse while wire transfers are initiated and processed by banks. These two also differ in terms of speed, cost, and geographical limitation. Typically, wire transfers consume a shorter time to process than ACH transfers. Some ACH transfers take a couple of business days to process while wire transfers can be processed for a few hours. In terms of cost, ACH transfers are much cheaper than wire transfers. Usually, wire transfers within the U.S. can run from $25-$30, and transfers outside the U.S. are mostly between $45-$50. On the other hand, an ACH payment for business could be less than a dollar and could at times be free for consumers. Moreover, ACH transfers are typically used between accounts that are U.S. based although global payments can be made through Global ACH. Wire transfers do not have cross-border limitations as long as the transactions adhere to the Office of Foreign Assets Control (OFAC) guidelines. A social payment money transfer app is helpful if you want a faster method to send money online. These apps enable you to send money to people using their email addresses or phone numbers. The source of money you can send may come from your bank account, credit card, or an in-app balance. Another method could be traditional money transfer services, like Western Union and MoneyGram. You can send money online and pay your bills by setting up an account with either of these services and linking it to your credit or debit card. Aside from being easy to use, another huge advantage of these apps is the speed they can provide for transfers. You may be able to complete the transfer of money in just a snap, depending on which apps you use. ACH transfers are a safe, efficient, and cost-effective way to move money. However, like any other system, it has its own set of risks that you should be aware of. When deciding whether to use an ACH transfer or not, consider the urgency of the payment and if you are comfortable with the risks involved. If you are, then ACH transfers could be a great solution for you. If not, there are plenty of other alternatives that you can explore. Automated Clearing House (ACH) Definition

Types of ACH Transfers and How They Work

Direct Deposits

Direct Payments

How to Set Up an ACH Transaction

Step 1: Gather the Necessary Information to Complete an ACH Transfer

Step 2: Choose Between ACH Debit and ACH Credit

Step 3: Execute the ACH Transfer

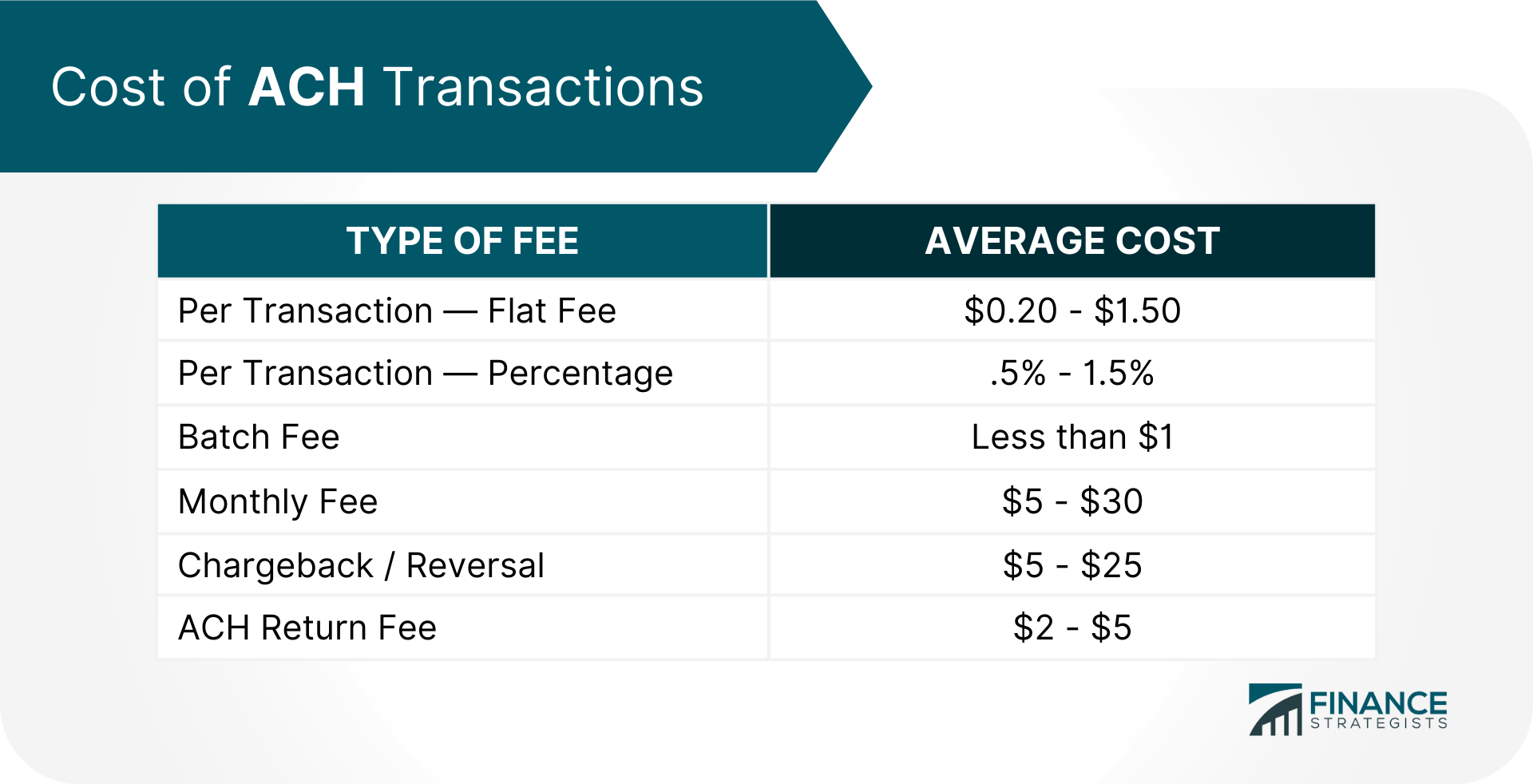

Cost of ACH Transactions

Benefits of ACH Network

Low Cost

Fast Processing Time

Security

Convenience

Open to Anyone

Risks of ACH Network

ACH Credit Risk

ACH Debit Risk

Operational Risk

Fraud Risk

Preventing Fraud on ACH Systems

Encryption

Authentication

Authorization

Wire Transfer vs. ACH Transfer

Alternatives to ACH Transfers

Final Thoughts

Automated Clearing House (ACH) FAQs

ACH transfers usually take a few days to process. Direct payments may be processed and sent within the same or in one to two business days, while direct deposits are often processed the next business day.

ACH transactions are generally safe. The Automated Clearing House network is regulated by the NACHA (The National Automated Clearing House Association) and the Federal Reserve. However, there are still risks associated with ACH transactions such as operational and systemic risks.

ACH transactions hasten the process of receiving and making payments. They are also very convenient to use and are inexpensive.

Yes, but you will have to coordinate this with your bank. They may do so depending on certain circumstances and it may come with reversal fees. Recurring ACH payments may also be canceled but it has to be done at least three business days prior to the due date. Contact the bank and the company you are paying for and inform them about revoking access to your account.

ACH payments are often used for recurring payments, like monthly bills or loan repayments. They can also be used for one-time payments. ACH transfers are a popular choice because they are efficient and usually cheaper than other methods, like wire transfers.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.