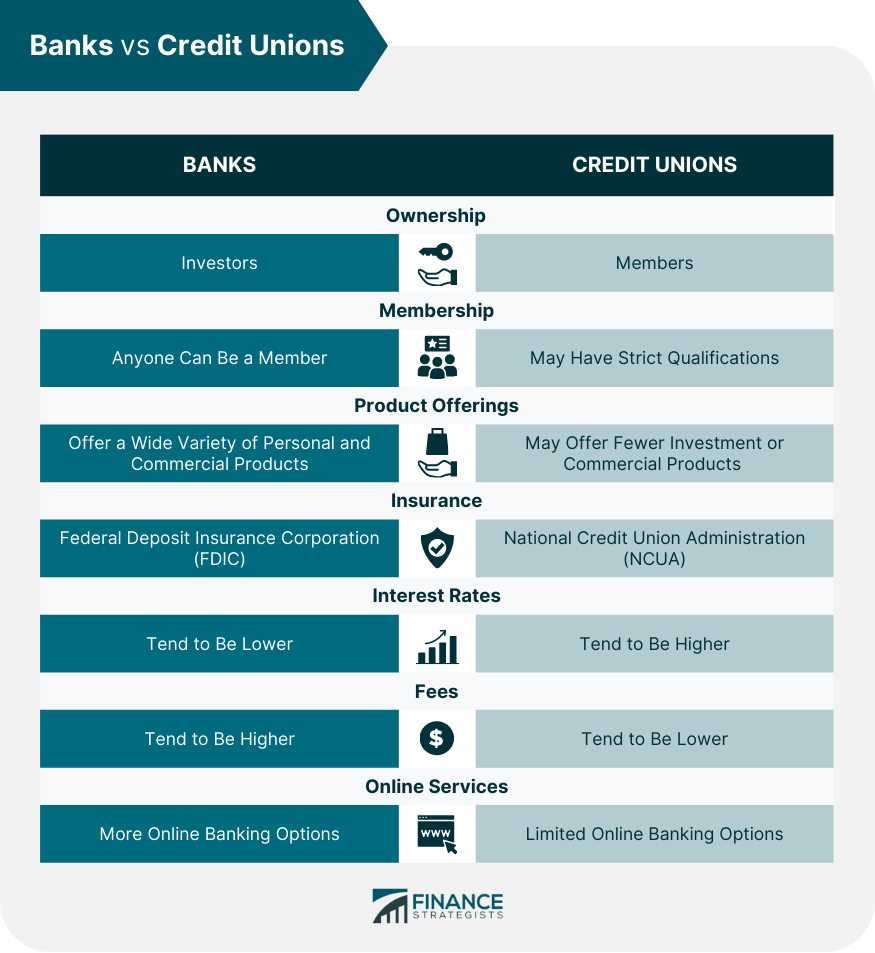

People can choose between banks and credit unions to manage their financial needs. These financial institutions can provide similar services, but there are key differences that should be taken into account before making a decision. Banks are big, licensed businesses that accept deposits, grant loans, and offer other financial services like investments and foreign exchange. Banks are generally for-profit businesses. They exist to make money for their shareholders. On the other hand, credit unions are nonprofit, co-operative-owned institutions that offer similar services to banks. Credit unions provide services to members who share a common bond, such as belonging to the same organization or company or living in the same community. Both banks and credit unions provide essential financial services, so it helps to understand what they both have to offer. Knowing the strengths and weaknesses of each will help individuals make an informed choice when choosing a financial institution. Banks are large financial institutions that provide a wide range of services to individuals, businesses, and other organizations. Most banks have branches all over the country, so customers can easily get help with transactions or obtain advice on financial matters. Banks accept deposits from customers and then use those funds to give out loans, offer investments, and facilitate money transfers. They also provide credit cards, checking accounts, and other related services. Banks operate primarily to generate profits for their shareholders. However, since they have access to more resources, they can offer their clients a wider range of investment products and more varied loan terms. Credit unions are nonprofit financial cooperatives that are operated and owned by their members. They provide many of the same services as banks, such as accepting deposits and giving loans. Credit unions typically serve a specific group or community with something in common. For example, they could cater to employees of an organization or residents of a particular region. They generally have fewer branches than traditional banks. The profits earned by a credit union are put back into the organization for the benefit of its members. Thus, they can offer higher interest rates on deposits and lower interest rates on loans. Banks and credit unions differ in terms of the following criteria: Banks are for-profit institutions owned by shareholders interested in making a profit. Anyone can be a bank's customer regardless of geographic location or affiliation. However, they do not have the right to vote or be part of any bank's decision-making process. Credit unions are nonprofit, member-owned cooperatives. Those who own accounts can vote for board members and get a say in major decisions. However, membership qualifications may be strict. Banks and credit unions can offer similar services, such as savings accounts, loans, and credit cards. However, banks generally offer a wider variety of personal and commercial products. They also have more investment options available for their clients. On the other hand, credit unions may cater primarily to individuals and small businesses since they have fewer investment options or commercial products. There is a difference in the governing body that provides insurance for deposits. The Federal Deposit Insurance Corporation (FDIC) insures banks, while the National Credit Union Administration (NCUA) insures credit unions. Both organizations offer up to $250,000 in insurance coverage per account holder. So even if an institution fails, deposited funds will be protected up to that limit. Not all institutions are covered by these organizations, so it is essential to check before opening an account. Banks typically offer lower interest rates on savings accounts and higher loan rates. Credit unions can offer slightly higher interest on savings accounts due to their nonprofit status. They also tend to have lower loan rates since they are not required to generate a profit for shareholders. The business model of credit unions also allows them to return profits to their members in the form of higher interest rates for deposits and lower loan rates. Banks do not have this option, as their earnings are paid to shareholders. There are more fees associated with banks because they are for-profit organizations. Banks often charge fees for services such as overdraft protection, monthly maintenance fees, ATM fees, and more. Credit unions typically have fewer and cheaper fees and may even waive specific fees. Additionally, they are more likely than banks to disclose all expenses associated with their services and products. Both banks and credit unions may provide online banking services. However, banks usually have more robust offerings, such as mobile banking apps and computerized money management tools. Credit unions tend to offer basic features for accessing accounts. However, they may not provide the same level of sophistication as banks. They also often lack cutting-edge online banking security protocols, which can put members at risk if their accounts are hacked or compromised. Banks typically offer a wider selection of mortgage and home equity loan products. This includes fixed-rate mortgages, adjustable-rate mortgages (ARMs), jumbo loans, and government-backed home loans such as Federal Housing Administration (FHA) or Veterans Affairs (VA) loans. Credit unions can provide similar loan types, but their offerings may be more limited than banks. However, they can offer competitive rates for members who qualify. They also provide personalized service, which can be helpful for those looking to buy or refinance a home. Banks are very common financial institutions, and it is good to consider their pros and cons: Listed below are the primary advantages of banks: Banks typically have more physical branches and ATMs, making them more accessible. Additionally, they offer mobile banking apps and money management software with cutting-edge security protocols. Anyone can be a customer of a bank. They can join a bank with proper identification, regardless of geographic location or employment status. Banking services are available to a majority of the population. Customers have more options when choosing a banking institution. Banks offer a wide range of products and services, from savings accounts, loans, and credit cards to mortgages and services such as international banking, which comes with advanced tools and features. Banks also have some disadvantages to be considered: Banks charge more fees for basic services, such as overdraft protection fees, ATM fees, and monthly maintenance charges. Some transactions may even incur additional costs depending on the type and amount. Choosing a bank can be costly for those looking to borrow money for mortgages or other types of loans. Banks generally offer high loan rates since profits are paid out to shareholders. Banks often offer low-interest rates for savings accounts, meaning customers may not earn as much from their deposits as credit unions. Credit unions have become an alternative to banks, and it is reasonable to evaluate their pros and cons: The following are the primary advantages of credit unions: Credit unions typically have lower fees for services such as ATM use, overdraft protection, monthly maintenance, and loan origination. They also tend to disclose all expenses associated with their products and services before deducting them. Members own the credit union, and profits earned are returned to them through higher interest rates on savings and lower loan rates. This makes credit unions appealing to customers looking to maximize their earnings or borrow money at a reasonable rate. Credit unions offer personalized service and often have fewer customers, so they can provide faster service when members need assistance. When marketing products and services, they might use a more consultative approach. The following are drawbacks associated with credit unions: Most credit unions require applicants to meet certain conditions, such as living in a specific geographic area or working in a particular profession. This limits access to their services if an individual does not qualify for membership. Credit unions have few physical locations, which can make them harder to access. Some credit unions also lack mobile and computerized banking, making them inconvenient for clients, while others may only offer simple online banking services and mobile apps. Customers who need specialized options such as international banking, currency exchange, or wire transfers may not find those services available at a credit union. Additionally, they may have lower lending limits than banks and other financial institutions. The choice between a bank and a credit union should depend on your needs. These financial institutions differ in membership, products, services, interest rates, and fees. If you want convenience, banks tend to have more locations, better digital tools, and a wide range of services. However, they also have higher fees and loan interest rates. Consider credit unions if you prioritize lower fees, higher interest rates on your savings, and better customer service. Take note you must meet the membership requirements before you can open an account at a credit union. When choosing between a bank or a credit union, think about your current financial goals and if your chosen financial institution can help you achieve them. Ultimately, it is essential to compare your local banks and credit unions so you can select the option that meets your needs. People can choose between banks and credit unions to manage their financial needs. Banks and credit unions differ in ownership, membership, product offerings, insurance, fees, interest rates, and accessibility. Banks are big, licensed businesses that generate profit for the shareholders who own them. Meanwhile, credit unions are nonprofit institutions owned and operated by their members. Before selecting one, one must be aware of each option's advantages and disadvantages. Credit unions have the advantage of having fewer fees and competitive interest rates on savings products and loans compared to banks. They also offer comparable services to banks, but their scope is more limited. Banks have the upper hand regarding the variety of products and services they offer, the convenience of their locations, and their digital banking capabilities. They also accept anyone who meets their guidelines. They do not require membership qualifications. When deciding between a bank or credit union, it is important to compare all the important factors and choose the option that meets your individual needs. Doing so can save you time and money and help you reach your financial goals faster.Banks vs Credit Unions: Overview

What Are Banks?

What Are Credit Unions?

Key Differences Between Banks & Credit Unions

Ownership and Membership

Product Offerings

Insurance

Interest Rates

Fees

Online Services and Technology

Mortgages

Pros & Cons of Banks

Pros of Banks

Provide Greater Accessibility

Have Open Membership

Offer More Product Variety

Cons of Banks

Charge Higher Fees

Offer Higher Loan Interest Rates

Return Lower Savings Interest Rates

Pros & Cons of Credit Unions

Pros of Credit Unions

Charge Lower Fees

Offer Lower Loan Interest Rates

Can Have Better Customer Service

Cons of Credit Unions

May Have Strict Membership Qualifications

Can Be Less Accessible

Offer Fewer Products & Services

Banks vs Credit Unions: Which Is Right For You?

The Bottom Line

Banks vs Credit Unions FAQs

Both banks and credit unions are offered insurance by the FDIC or the NCUA. If your account is within the insurance limits, your money is safe in either a bank or a credit union.

Yes, credit unions are federally insured by the National Credit Union Administration. The NCUA provides up to $250,000 in insurance coverage per account.

If you decide to close an account, you should contact the bank or credit union directly. They will provide instructions on how to proceed and what documents must be submitted to close the account. The process may vary from one institution to another.

Credit unions generally offer lower fees than banks, but this may vary from one institution to another. It is essential to compare different credit unions in your area to determine which offers the best terms for their services and products.

Credit unions offer lower fees and competitive interest rates on savings products and loans. They provide personal service to their members and the opportunity to be a part owner of their institution. This gives them the right to participate in the decision-making process of the credit union.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.