Automobile insurance is essentially an agreement between you and your insurance provider. You agree to pay premiums, and in return, the company covers certain losses and damages to your vehicle. This might include repairs from accidents, replacement after theft, or fixes following vandalism. The details of your coverage, including the cost of your premiums, can vary based on several factors such as your driving record, the type of car you drive, and your specific insurance needs. Insurance companies take these demographic details into account because statistics show different risk levels for each group. Typically, younger and single male drivers face higher premiums due to a perceived higher risk. A driver's record and experience significantly impact insurance premiums. A history free of accidents and traffic violations can lower your premiums, whereas past incidents indicate a higher risk, bumping up costs. Where you live affects your premiums too. Urban areas, with their dense traffic and higher crime rates, usually see higher insurance costs compared to quieter rural areas. Weather conditions in your area can also play a part. The type, model, and age of your vehicle can significantly influence insurance costs. Luxury and high-performance cars generally come with higher premiums because they are costlier to repair. Conversely, older cars might cost less to insure due to their lower value. Believe it or not, your financial stability matters. Many insurers consider a good credit score as an indicator of responsibility, often rewarding it with lower premiums. The more comprehensive your insurance coverage, the higher your premiums. Opting for additional features or higher coverage limits will cost you more, but provide better protection. Bodily injury liability covers the cost of injuries sustained by others in an accident where the policyholder is at fault. This coverage includes medical expenses, lost wages, and legal fees. Property damage liability covers the cost of damages to another person's property in an accident where the policyholder is at fault. This typically includes repair or replacement of the other party's vehicle and other damaged property. Uninsured/underinsured motorist coverage protects policyholders when involved in an accident with a driver who has insufficient or no insurance. This coverage helps pay for medical expenses and property damage. Collision coverage covers the cost of repairs or replacement of the policyholder's vehicle after an accident, regardless of fault. Comprehensive coverage protects against non-collision events such as theft, vandalism, fire, or natural disasters. This coverage pays for repairs or replacement of the policyholder's vehicle in these situations. MedPay or PIP covers medical expenses for the policyholder and passengers in their vehicle, regardless of fault. PIP may also cover lost wages and other related expenses. Gap insurance covers the difference between the outstanding loan balance on a vehicle and its actual cash value in the event of a total loss. Rental reimbursement and towing coverage provide financial assistance for rental cars or towing services in the event of a breakdown or accident. Start by evaluating what you need from an insurance policy. Think about your car’s value, your driving habits, and how much coverage you feel comfortable with. This will help you narrow down your choices to find a policy that fits both your needs and your budget. Don’t settle for the first quote you get. Shop around and compare offers from several insurance providers. This is easier than ever with online comparison tools, or you can consult with an insurance broker for a more personalized service. Take a close look at the insurance company’s reputation and customer service. Read up on customer reviews, ask friends and family for recommendations, and check the insurer’s financial stability. These factors are crucial for ensuring that you have a good experience, especially when you need to make a claim. Make sure you thoroughly understand the terms and exclusions of your policy. Read the fine print and don’t hesitate to ask for clarification on anything that seems unclear. Knowing exactly what your policy covers—and what it doesn’t—can save you a lot of hassle later on. See if you qualify for any discounts, such as those for safe driving or having anti-theft devices installed in your vehicle. Also, consider bundling your auto insurance with other policies like home insurance for additional savings. Life changes, and so should your insurance. Make it a point to review your policy regularly and update it as necessary, especially after significant life events like buying a new car or moving. This ensures your coverage always matches your current needs. Following an accident, ensure the safety of all involved, exchange contact and insurance information, document the scene with photos, and report the accident to the authorities, if required. Contact the insurance company to report the accident and initiate the claims process. Provide necessary documentation and follow the insurer's guidelines throughout the process. Familiarize yourself with the claims process and expected timeline. Claims can involve inspections, estimates, negotiations, and repair authorizations before reaching a settlement. Insurance premiums may increase after filing a claim. To mitigate premium increases, consider reviewing coverage options, exploring discounts, or shopping for new policies. If unsatisfied with a claim decision, policyholders can dispute the outcome with the insurance company or seek legal advice from an attorney specializing in insurance law. As vehicles equipped with autonomous technology, like Tesla's Autopilot or Google's Waymo, become more common, the insurance industry will face a paradigm shift. Liability may increasingly fall on manufacturers rather than drivers, prompting insurers to create new types of policies that focus more on software and hardware faults than human error. Usage-based insurance (UBI) is gaining traction, driven by technologies like Allstate's Drivewise or Progressive's Snapshot. These programs use telematics to monitor driving habits such as speed, braking behavior, and time of day driven, allowing insurers to tailor premiums directly to individual risk profiles. AI is revolutionizing claims handling by automating tasks such as damage assessment and fraud detection. For example, companies like Lemonade use AI to process claims quickly—sometimes within minutes—improving efficiency and customer satisfaction by reducing the wait times typically associated with claim processing As the landscape of automobile insurance transforms with technological advancements, regulatory bodies will need to keep pace. Changes might include new standards for vehicle technology compliance, privacy laws concerning data collected by UBI programs, and rules governing liability in accidents involving autonomous vehicles. Electronic Vehicle Health Checks (EVHC) can indirectly benefit your auto insurance premiums by promoting proactive maintenance and potentially providing valuable vehicle data. However, insurers currently focus more on EV-specific risks, such as repair costs and battery health, when determining rates. The direct impact of EVHC on premiums will likely increase as reporting becomes standardized and insurers incorporate this data into their risk models. Maintaining adequate automobile insurance is essential for financial protection and legal compliance. Regularly review and update coverage to ensure it aligns with personal needs and circumstances. Stay informed about changes and trends in the automobile insurance industry to make informed decisions and ensure adequate coverage as new technologies and regulations emerge. As personal circumstances, vehicle ownership, and driving habits change, it's crucial to review and update coverage accordingly. This practice will help ensure that insurance policies continue to provide appropriate protection and meet legal requirements.What Is Automobile Insurance?

This tailored approach ensures that your coverage matches your unique situation.Factors Affecting Automobile Insurance Premiums

Driver's Age, Gender, and Marital Status

Driving Record and Experience

Location and Geographic Factors

Vehicle Make, Model, and Age

Credit Score and History

Insurance Coverage Options Selected

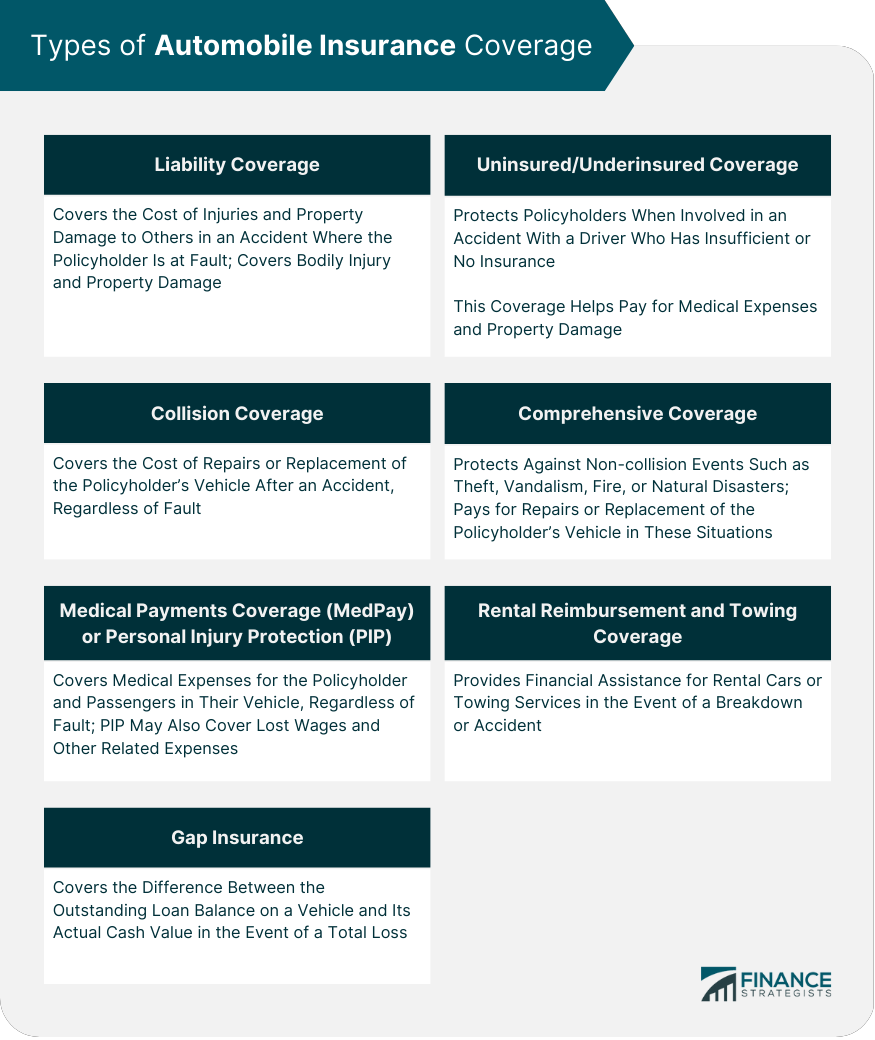

Types of Automobile Insurance Coverage

Liability Coverage

Bodily Injury Liability

Property Damage Liability

Uninsured/Underinsured Motorist Coverage

Collision Coverage

Comprehensive Coverage

Medical Payments Coverage (MedPay) or Personal Injury Protection (PIP)

Gap Insurance

Rental Reimbursement and Towing Coverage

How to Choose the Right Automobile Insurance Policy

Assessing Individual Needs and Budget

Comparing Quotes From Multiple Providers

Evaluating Customer Service and Company Reputation

Understanding Policy Terms and Exclusions

Utilizing Discounts and Bundling Options

Periodically Reviewing and Updating Coverage

Filing a Claim and Managing Automobile Insurance

Steps to Take After an Accident

Filing a Claim With the Insurance Company

Understanding the Claims Process and Timeline

Managing Premium Increases After a Claim

Disputing a Claim Decision or Seeking Legal Advice

Future Trends in Automobile Insurance

The Impact of Autonomous Vehicles

Usage-Based Insurance and Telematics

The Role of Artificial Intelligence in Claim Processing

Evolving Legal Frameworks and Regulations

Environmental Factors and Electric Vehicles

Conclusion

Automobile Insurance FAQs

Automobile insurance is a type of insurance that provides financial protection to the owner of a vehicle against losses resulting from accidents, theft, or damage to the vehicle.

Automobile insurance can cover various aspects such as liability coverage which covers injuries and property damage that you may cause to other people in an accident, collision coverage which covers damage to your vehicle in an accident, comprehensive coverage which covers damage to your vehicle from non-collision events such as theft or natural disasters, and uninsured/underinsured motorist coverage which covers you if you're involved in an accident with an uninsured or underinsured driver.

Automobile insurance is required by law in most states in the US. It provides financial protection in the event of an accident, which can be costly to repair or replace a vehicle, as well as medical expenses for injuries sustained by yourself or others.

The amount of coverage you need will depend on various factors such as the value of your vehicle, your driving history, and the level of risk you are willing to assume. In general, it is recommended that you carry enough coverage to protect your assets in case of an accident.

Yes, you can change your automobile insurance policy at any time. You may want to consider changing your policy if your circumstances have changed, such as if you've purchased a new vehicle, moved to a new location, or had a significant life event such as marriage or divorce.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.