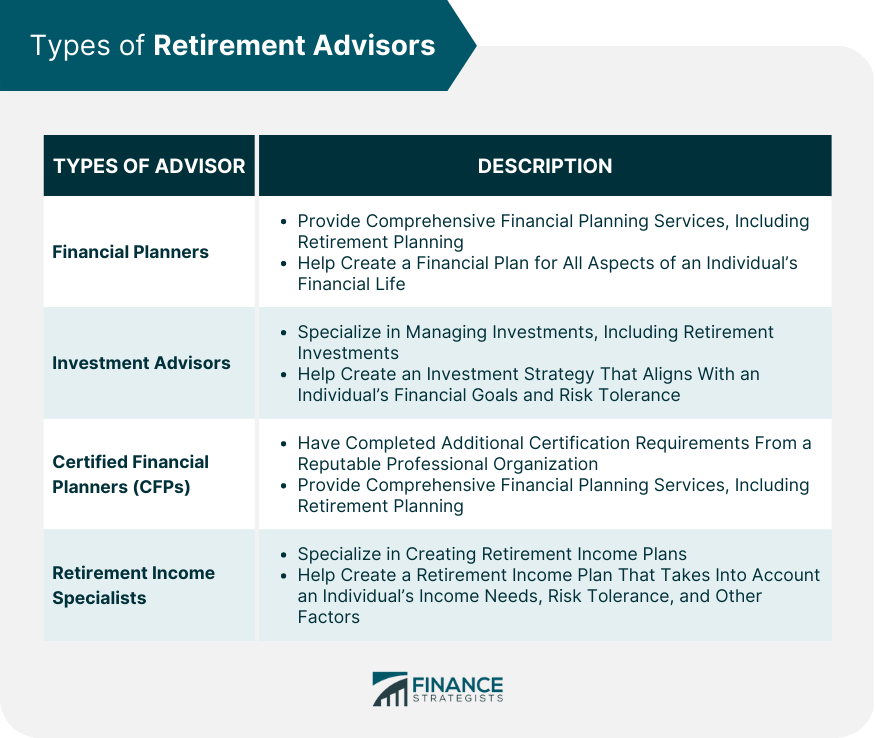

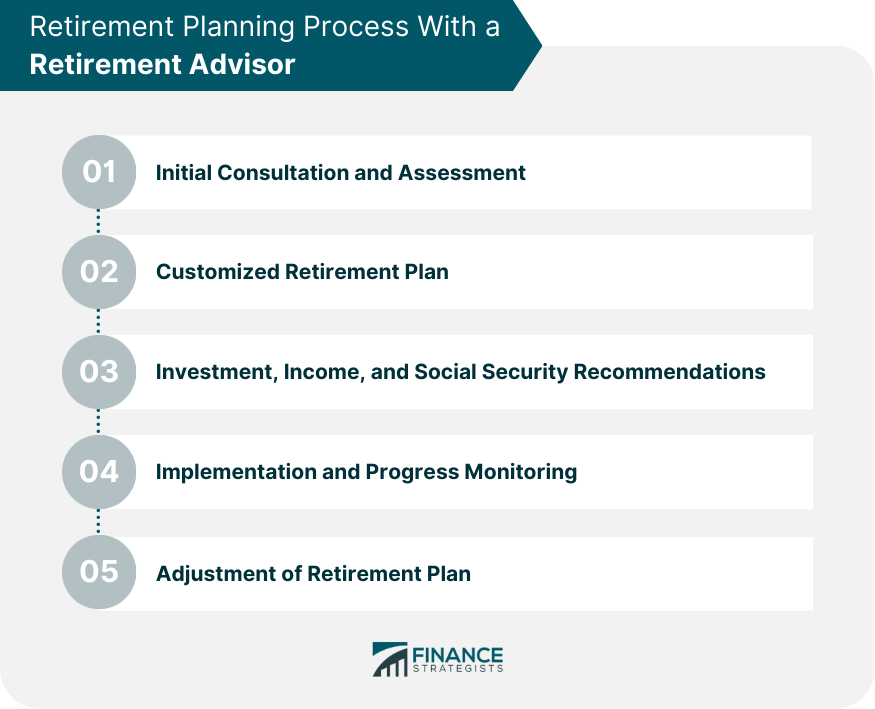

A retirement advisor is a professional who specializes in retirement planning and can help individuals make informed decisions about their finances during retirement. They advise on investment strategies, social security maximization, and personalized retirement plan creation. Have a question for a Retirement Advisor? Click here. Retirement planning is vital for anyone who wants to ensure financial security during their retirement years. Retirement planning can be crucial for these individuals as they may need more time or expertise to create and manage a comprehensive retirement plan. Retirement can be a time of uncertainty, especially when it comes to finances. Retirees can benefit from a retirement advisor who can help them navigate the complexities of retirement planning and ensure they make informed decisions about their financial future. Retirement planning can be complex and challenging to keep up with changing regulations and market trends. A retirement advisor can provide the necessary expertise and knowledge to create a comprehensive retirement plan that meets an individual's specific needs and goals. There are several types of retirement advisors, each with areas of expertise. It is important to consider the areas of expertise of each type of retirement advisor when choosing the right one for your needs and goals. Financial Planners. They provide comprehensive financial planning services, including retirement planning. Investment Advisors. They specialize in managing investments, including retirement investments. They can help individuals create an investment strategy that aligns with their risk tolerance and financial goals. Certified Financial Planners (CFPs). They are financial planners who have completed additional certification requirements from the CFP Board. Retirement Income Specialists. They specialize in creating retirement income plans. They can help individuals create a retirement income plan that takes into account their income needs, risk tolerance, and other factors. There are many benefits to hiring a retirement advisor. Expertise and Knowledge. Retirement advisors have specialized training in retirement planning and keep themselves up-to-date with the latest regulations, market trends, and investment strategies. Personalized Retirement Plan. Retirement advisors can create a customized retirement plan that takes into account an individual's income, expenses, retirement goals, and risk tolerance. Investment Guidance. Retirement advisors can guide investment strategies to help maximize an individual's retirement income while protecting their savings. Maximizing Social Security Benefits. Retirement advisors can help maximize social security benefits by guiding when to claim social security benefits, how to maximize those benefits, and how to coordinate them with other sources of retirement income. Peace of Mind and Financial Security. Hiring a retirement advisor can provide reassurance that an individual's retirement finances are in good hands, thereby reducing stress and overwhelming feelings. When hiring a retirement advisor, there are several factors to consider. It is essential to consider the advisor's qualifications and credentials, including their minimum bachelor's degree in finance, economics or a related field, specialized training in retirement planning, and certification from a reputable organization. Experience working with individuals at different stages of retirement is crucial when choosing a retirement advisor. This experience can ensure that an individual's retirement plan is comprehensive and meets their specific needs and goals. Working with a retirement advisor with a good reputation and positive references from past clients is important. It is also recommended to verify an advisor's reputation by checking their credentials with a reputable professional organization. Understanding how retirement advisors charge for their services and ensuring their fee structure is transparent and fair is important. Retirement advisors can charge fees in several ways, including hourly rates, percentage of assets under management, or a flat fee. The retirement planning process with an advisor typically begins with an initial consultation and assessment. During this consultation, the advisor will gather information about an individual's financial situation, retirement goals, and risk tolerance. Based on this information, the advisor will create a customized retirement plan that meets the individual's needs and goals. The retirement plan will include recommendations for investment strategies, income planning, and social security claiming strategies. The advisor will work with the individual to implement the retirement plan and monitor its progress. The advisor will adjust the retirement plan if necessary to meet the individual's changing needs and goals. Choosing the right retirement advisor is crucial for anyone who wants to ensure financial security during retirement. Here are some essential questions to ask when evaluating potential retirement advisors What are your qualifications and experience in retirement planning? Working with a retirement advisor with the knowledge and expertise to create a comprehensive retirement plan is essential. Ask about their education, credentials, and experience working with individuals at different stages of retirement. How do you charge for your services? Retirement advisors can charge fees in several ways, including hourly rates, percentage of assets under management, or a flat fee. Understanding how an advisor charges for their services and ensuring that their fee structure is transparent and fair is essential. How do you approach retirement planning for your clients? Individuals' retirement plans should be unique and tailored to their specific needs and goals. Ask the retirement advisor how they approach retirement planning and what strategies they use to create customized plans for their clients. Can you provide references or client testimonials? A retirement advisor's reputation and track record are essential considerations when choosing an advisor. Ask for references or client testimonials and contact them to learn about their experiences working with the advisor. Retirement planning is essential for anyone who wants to ensure financial security during their retirement years. Hiring a retirement advisor for retirement planning can provide the necessary guidance and support to help individuals make informed decisions about their retirement finances. When choosing a retirement advisor, it is essential to consider their qualifications, experience, reputation, and fee structure. With the right retirement advisor, individuals can create a comprehensive retirement plan that meets their specific needs and goals and provides peace of mind and financial security during their retirement years.What Is a Retirement Advisor?

Who Needs a Retirement Advisor?

Individuals Approaching Retirement Age or Recently Retired

Retirees Seeking Financial Guidance

Anyone Looking for Professional Retirement Planning Advice

Types of Retirement Advisors

They can help individuals create a financial plan that addresses all aspects of their financial life, including investments, taxes, insurance, estate planning, and retirement planning.

They have the knowledge and skills to provide comprehensive financial planning services, including retirement planning.

Benefits of Hiring a Retirement Advisor

What to Look for in a Retirement Advisor

Qualifications and Credentials

Experience in Retirement Planning

Reputation and References

Fee Structure and Transparency

Retirement Planning Process With an Advisor

Questions to Ask a Retirement Advisor

Conclusion

Retirement Advisor FAQs

A retirement advisor is a professional who can help individuals make informed decisions about their finances during retirement. They specialize in retirement planning, investment strategies, and maximizing social security benefits.

Retirement planning is important for anyone who wants to ensure financial security during their retirement years. Individuals approaching retirement age, retirees seeking financial guidance, and anyone looking for professional retirement planning advice can benefit from hiring a retirement advisor.

Hiring a retirement advisor provides expertise and knowledge in retirement planning, personalized retirement plan creation, investment guidance, social security maximization strategies, and peace of mind.

When choosing a retirement advisor, one must consider their qualifications, experience, reputation, and fee structure. They should have a minimum of a bachelor's degree in finance, economics, or a related field, specialized training in retirement planning, and certification from a reputable organization.

The retirement planning process with a retirement advisor typically begins with an initial consultation and assessment. The advisor gathers information about an individual's financial situation, retirement goals, and risk tolerance. Based on this information, the advisor creates a customized retirement plan that meets the individual's specific needs and goals. The advisor will work with the individual to implement the retirement plan and monitor its progress over time.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.