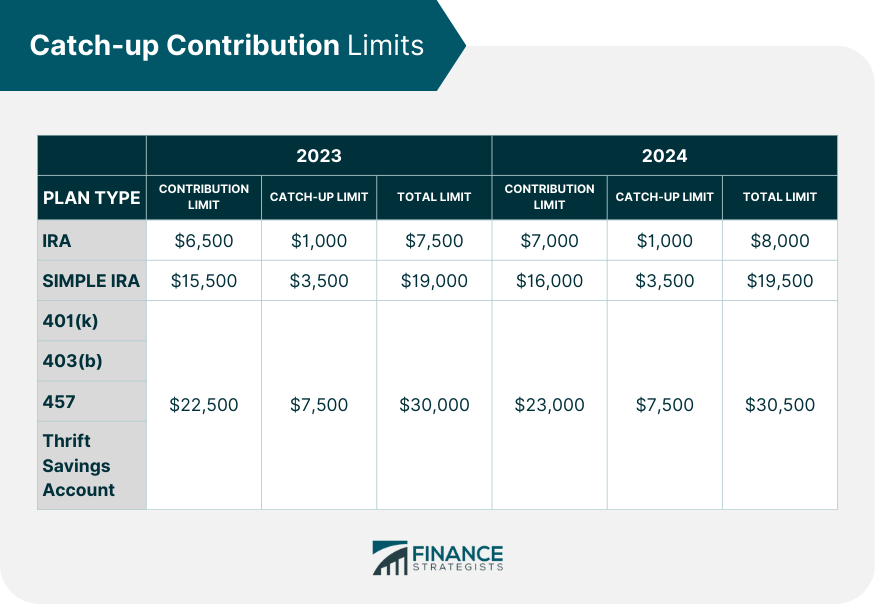

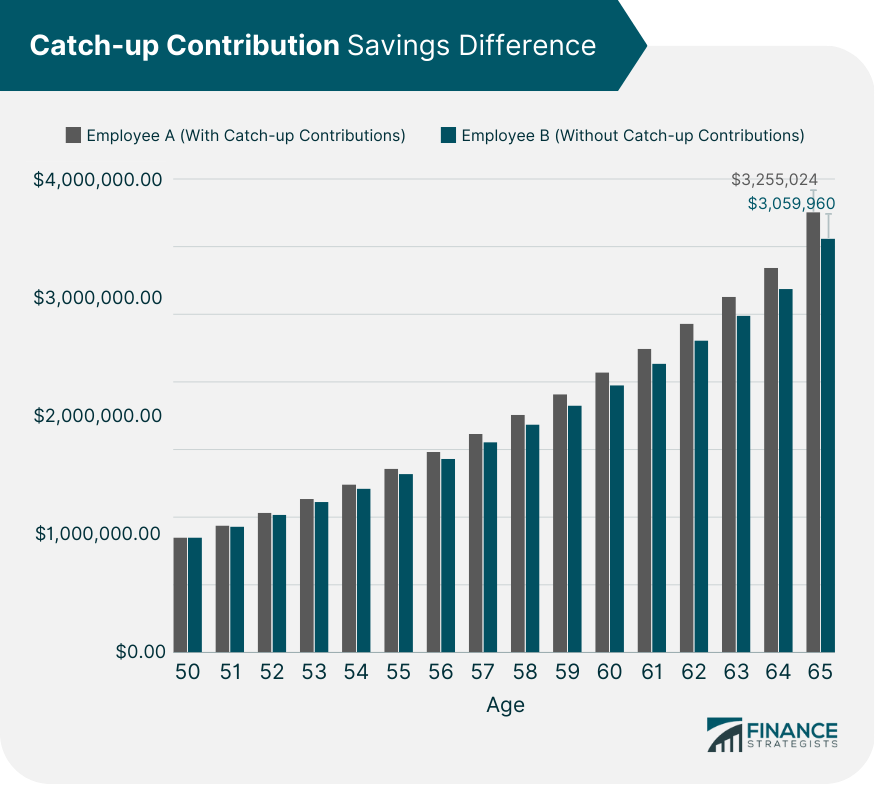

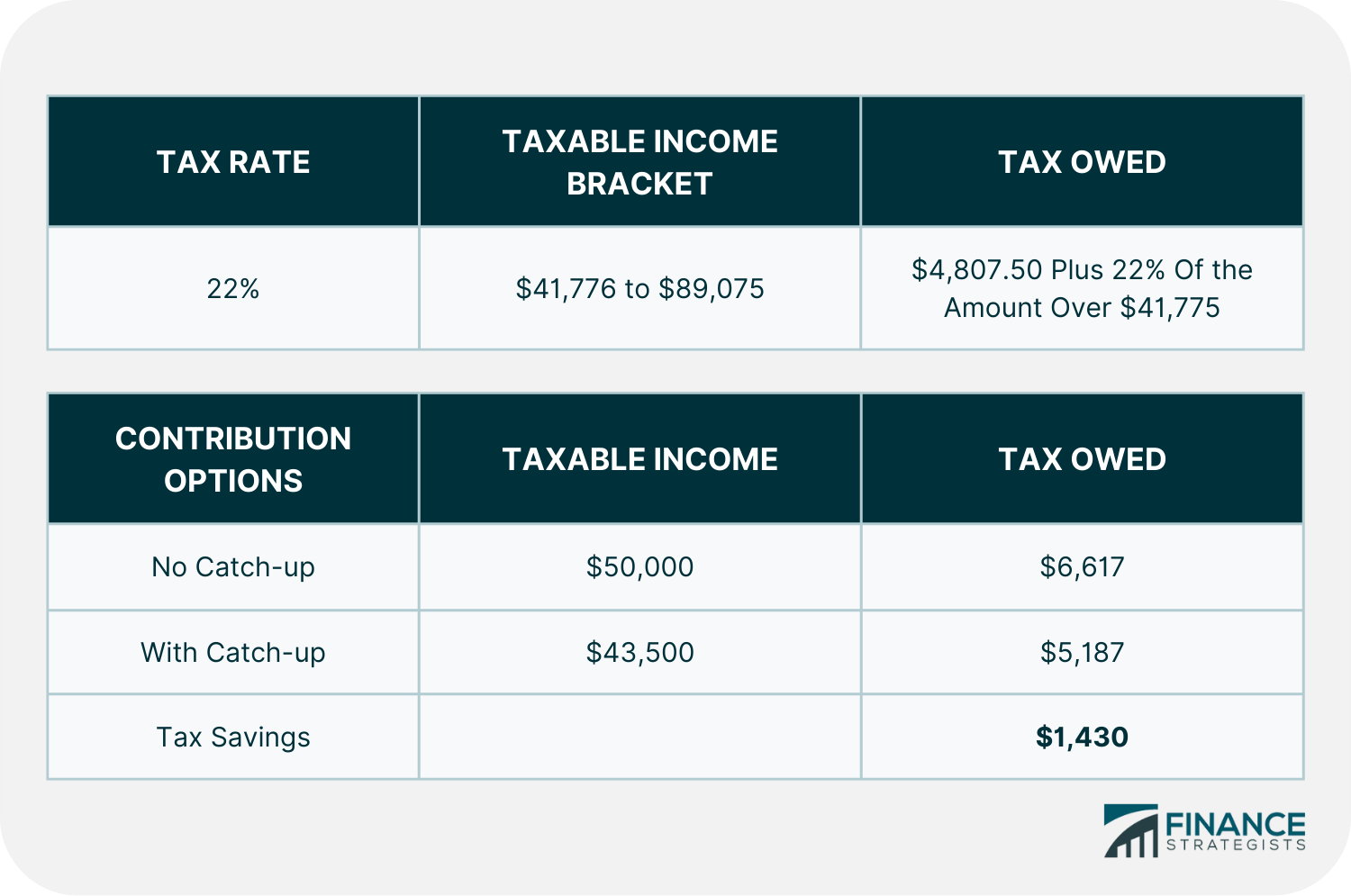

A catch-up contribution is a type of saving strategy that allows people aged 50 or older to contribute extra money to their retirement accounts. The purpose of this is to help you keep up with your retirement savings if you were unable to save as much as you needed. You can contribute more to your retirement accounts than how much the Internal Revenue Service (IRS) mandated as the annual contribution limit. Thus, growing your retirement savings significantly. It is a good idea to consider this strategy to make up for lost time and start on the path to a comfortable retirement. If you have been contributing to a retirement plan since beginning your employment, you have complied with the IRS-imposed yearly contribution limits. This cap is raised by catch-up contributions, giving you more room for tax-advantaged growth as your retirement draws near. Individuals can make catch-up payments to various retirement plans, including the well-known 401(k) plan. Individuals who make their contributions on their own can select between a traditional IRA and a Roth IRA, which have different contribution limits. The IRS reviews and adjusts contribution limits every year, primarily considering inflation. A prerequisite to catch-up contributions is reaching your plan's contribution limit. The contribution limits for 2024 and 2025 are shown in the following table: The most significant eligibility factor for catch-up contributions is age. You are eligible to make the annual catch-up payments if you are 50 or older before the end of the calendar year. There are conditions on the yearly catch-up contributions: There can be additional eligibility requirements for some plans. For a 403(b) plan, 15 years of employment from an eligible employer such as a government institution, public school system, healthcare agency, or church association is an example. Consider making catch-up contributions, as it could significantly impact your savings efforts. Whether you are just starting to save up for retirement or need to beef up your funds, this can be a prudent option. A hypothetical illustration of the savings difference is shown below. It does not reflect past or guarantee the future performance of retirement investments. You need to factor in fees, expenses, inflation, and applicable taxes if withdrawn earlier than the plan allows. For example, Employee A and Employee B both have an investment of $850,000 at age 50. Employee A maxes out contributions to their 401(k) plan in 2024, making a total annual contribution of $30,500, including catch-up contributions. On the other hand, Employee B does not make any catch-up contributions, making their total annual contribution equal to $23,000. Using 7% as the annual rate of return, Employee A will accumulate $7,763.00 more than Employee B at age 51. At 65, Employee A will earn $195,064 more than Employee B. Catch-up contributions offer significant tax benefits. When you make one, you typically lower your taxable income for the year and are still liable for taxes on your retirement withdrawals. For example, let us compare the tax liability when an employee who earns $50,000 annually chooses to make catch-up contributions to his 401(k) plan or not. Applying the calculation for income tax, if he does not make catch-up contributions, he will owe $6,617 in taxes. If he adds $6,500 catch-up to his 401(k) contributions, he will only owe $5,187 in taxes. This means that an employee in the 22% tax bracket who maxes out a 401(k) plan would save $1,430 more in taxes than those who will not make a catch-up contribution. Catch-up contributions may be a sensible idea for various reasons. Fundamentally, it can assist you in compensating for lost time if you have not been able to save as much as you had hoped. You can save more money compared to what is in the IRS's mandated annual contribution limits. By doing this, you may be able to reach your retirement savings goals and ensure that you have a comfortable retirement. Making a catch-up contribution has potential drawbacks, including the chance of adding to your debt load, which is problematic if you already have financial difficulties. A few extra steps in the setup and maintenance have to be taken to gain from this savings plan. But given the benefits it is anticipated to offer, it might be worthwhile. If you are interested in making a catch-up contribution, there are a few steps you will need to take. Check with the plan administrator or IRA custodian to see if there are specific rules or limitations on catch-up contributions within your plan. You can ask them how to get started with a catch-up contribution. For workplace retirement programs, you can approach your human resources or benefits department and provide the necessary authorization to make a catch-up contribution. Calculate how much you can contribute. Check the IRS-designated annual contribution limits for each type of retirement account. You can adjust the amount you choose to pay each period or paycheck to achieve your savings goal for the year. Contributions to 401(k) plans can be made at any time during the calendar year you turn 50, even if you have not yet reached that age. For IRA catch-up contributions, the deadline is the same as the tax return filing. Catch-up contributions allow people aged 50 or older to contribute more than the annual IRS-mandated contribution limits to their 401(k)s and IRAs. These contributions can help you reach your retirement savings goals. The amount you are allowed to contribute varies depending on the type of retirement plan that applies to your case. It is a great way to boost your retirement income. Still, sometimes it may not be enough to compensate for lost time and cover the difference in your desired retirement savings. To make a catch-up contribution, you will need to check with the appropriate personnel, calculate how much you can afford to contribute for the time being and adjust accordingly. Speak with a financial advisor to help create a retirement plan that meets your goals.What Is a Catch-up Contribution?

How Catch-up Contributions Work

Catch-up Contribution Limits 2024 & 2025

Catch-up Contribution Differences

Savings Difference

Income Tax Difference

Pros & Cons of Making a Catch-up Contribution

How to Make a Catch-up Contribution

Final Thoughts

Catch-up Contribution FAQs

Employers are not required to match catch-up contributions. However, some choose to do so. It depends on the conditions of your employer's plan.

Catch-up contribution allows people aged 50 or older to contribute more than the annual IRS-mandated retirement contribution limits. The amount you are allowed to contribute varies depending on the type of retirement plan.

It might benefit middle-aged individuals who are just starting to save for retirement or need to boost their retirement savings. If you have not been able to save as much as you would have liked or were not able to save ahead of time, it can help you make up for that. It could have a significant effect on your attempts to save money.

The catch-up contribution for IRAs is $1,000 in 2024 and 2025, compared to $7,500 for plans like 401(k)s, 403(b)s, most 457s, and the government's Thrift Savings Plan (TSP). The Catch-up contribution is $3,000 for SIMPLE IRAs.

Check with the appropriate personnel, plan administrator, or human resource staff to see if there are any specific rules or limitations on catch-up contributions within your plan. Calculate how much you can contribute. Check the IRS-designated annual contribution limits for each type of retirement account. Adjust the amount you choose to pay each period or paycheck to achieve your savings goal for the year.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.