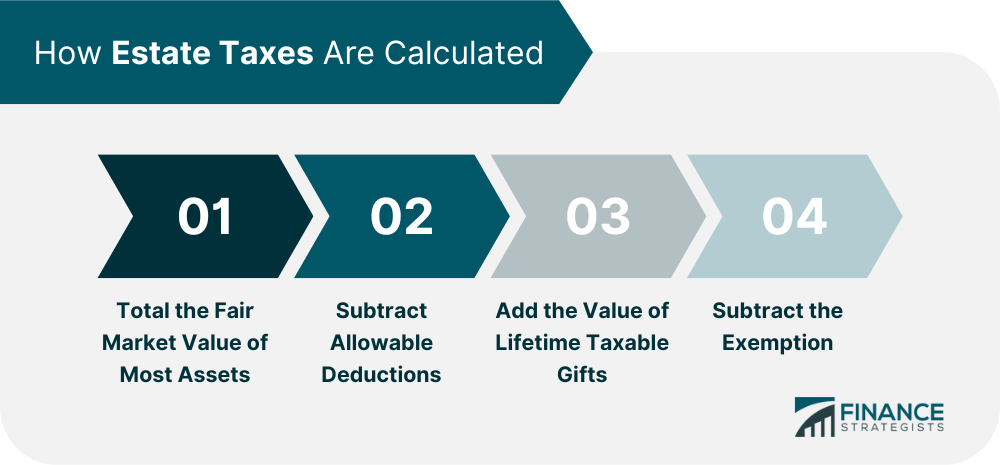

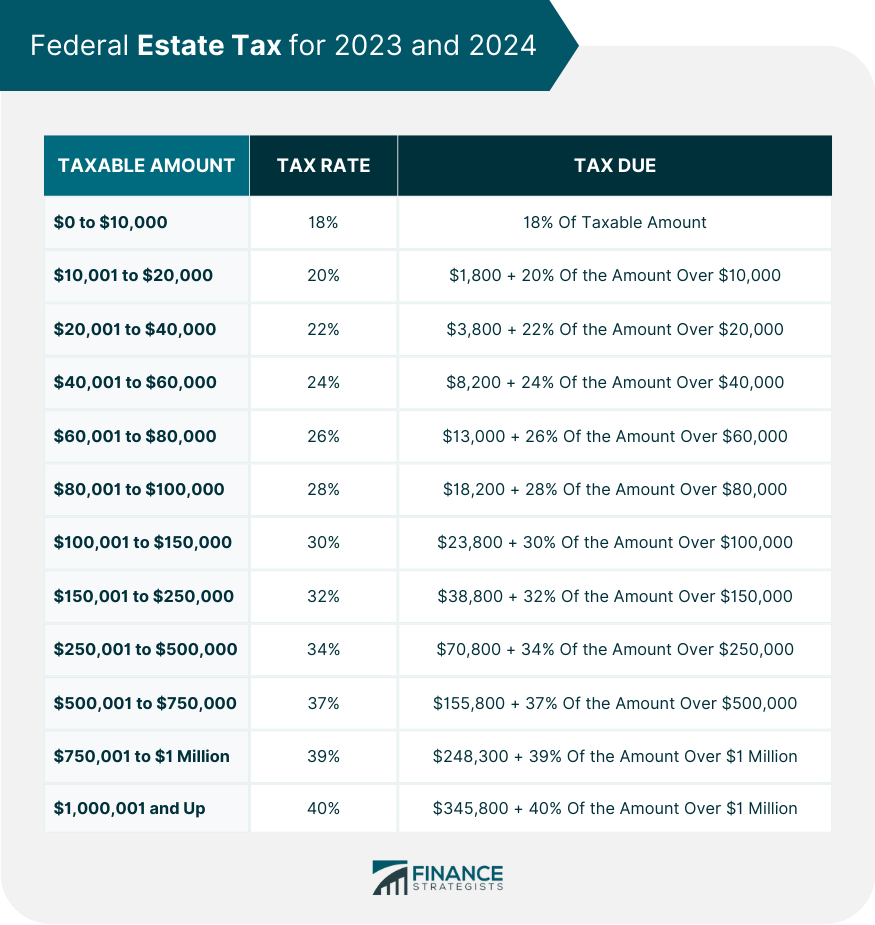

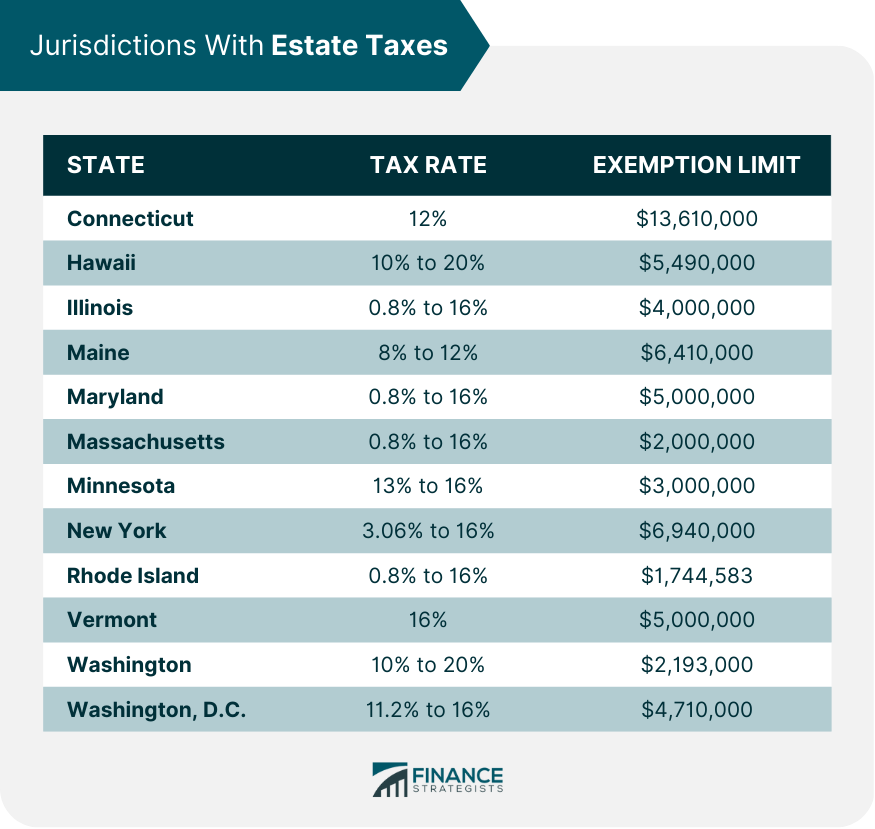

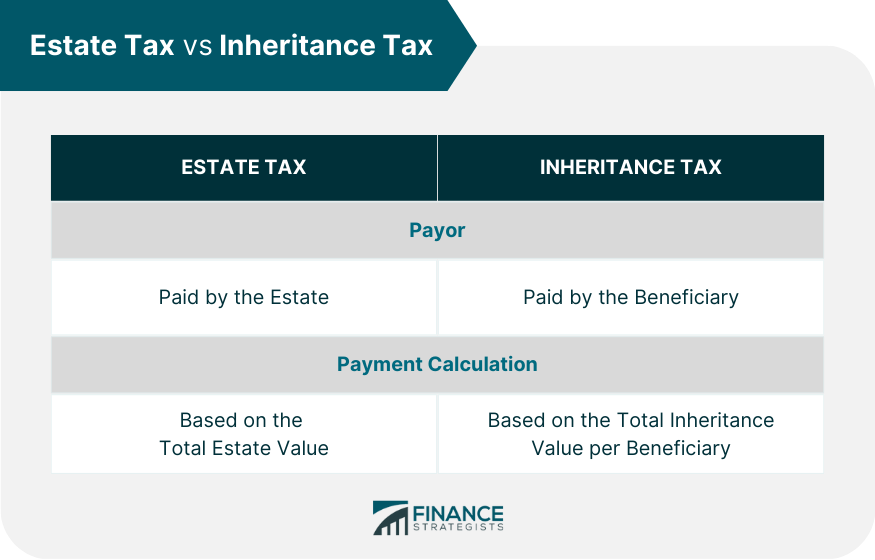

An estate tax is collected on the transfer of assets from a deceased individual's estate to their heirs or beneficiaries. Estate tax is based on the total value of the assets transferred. It is paid by the estate before the distribution of assets to the heirs. It is enforced when the value of an estate surpasses a legally established exclusion threshold. Any amount above that minimum limit is the only portion subject to taxation. The primary purpose of the estate tax is to generate revenue for the government. The imposition of estate tax also attempts to address issues of wealth inequality. It aims to prevent the accumulation of wealth by a small percentage of the population, thereby promoting a more equal distribution of wealth in society. The estate tax is also a means of encouraging charitable giving. Under the tax code, individuals can make charitable donations that can reduce the size of their taxable estate. This provides an incentive for individuals to give to philanthropic causes. The process of calculating estate taxes involves several steps: Determine the total fair market value of most of the assets in the estate. This includes all real estate, stocks, bonds, and personal property, among other assets. Fair market value is the price at which the asset would be sold in a transaction between a willing buyer and a willing seller. After totaling the fair market value of the assets, subtract allowable deductions. These deductions may include any outstanding debts, funeral expenses, administrative costs, and other expenses related to settling the estate. The third step involves adding the value of lifetime taxable gifts. Lifetime gifts are those that were made by the deceased during their lifetime and are subject to gift tax. These gifts must be added to the estate's value to calculate the total taxable amount. Finally, the exemption amount is subtracted from the total taxable amount. The exemption amount is a predetermined amount set by the government that can be passed on to heirs tax-free. The remainder of the taxable amount is then subject to estate tax. As of 2024, the federal estate tax exemption is set at $13.61 million per individual. Individuals can leave an estate worth up to $13.61 million to their heirs without incurring any federal estate tax. An amount that exceeds this limit is subject to tax at a rate ranging from 18% to 40%. In 2025, the federal estate tax exemption was adjusted, and the new exemption amount is $13.99 million per individual. Any amounts above this threshold will be subject to tax at a rate of 18% to 40% depending on the total value that exceeds the exemption limit. Below is a table that shows the estate tax due depending on the rate applied to the taxable amount: In the United States, estate taxes are enforced at the federal and state levels. Below is a list of jurisdictions that have estate taxes, including their respective exemption limits and tax rate range: Below are tips and strategies for reducing the amount of estate taxes owed: One effective strategy for reducing estate taxes is to set up an Intentionally Defective Grantor Trust. This trust allows the grantor to transfer assets into the trust while still maintaining control over them, thereby reducing the value of the grantor's estate. The IDGT is considered a separate entity for income tax purposes, allowing the grantor to pay income tax on the trust's income and further reduce the value of their estate. Another strategy is to own a life insurance policy. A life insurance policy's death benefit can provide liquidity to the estate, allowing heirs to pay estate taxes without having to sell assets at a disadvantageous price. Life insurance proceeds are generally income tax-free. If structured correctly, such policies may provide tax benefits, such as reducing tax liability on any estate taxes due. The Irrevocable Life Insurance Trust is a trust specifically designed to hold life insurance policies, thereby removing the policies from the estate and reducing the estate's value. By doing so, the policy's death benefit is excluded from the estate and not subject to estate taxes. Individuals should start by compiling a comprehensive list of all of their assets, including real estate, investments, and personal property. It is important to determine the fair market value of each asset, as this will be used to calculate the estate's total value. Identify any allowable deductions that can be used to reduce the estate's value, such as charitable donations or business expenses. Another step in preparing for the estate tax is to review and update any estate planning documents. Preparing an estate tax can be a daunting task, but the key is to plan and consult with an estate planning lawyer who can provide the necessary guidance and advice to individuals who are looking to reduce their estate tax liability. Estate tax is applied to the estate of a person who has recently passed away before the funds are distributed to their designated heirs. On the other hand, the inheritance tax is charged to the heirs after they have already received the assets or funds. One of the main differences between estate and inheritance tax is the entity responsible for paying the tax. The deceased person's estate generally pays the estate tax before the property is distributed to beneficiaries. Inheritance tax is typically paid by the person who receives the property from the estate. Another key difference is how the tax is calculated. The estate tax is calculated based on the total value of the deceased person's estate. In contrast, inheritance tax is computed based on the total inheritance value per beneficiary. In some cases, inheritance tax may only apply to certain types of property or to beneficiaries who are not immediate family members. The rates for estate tax and inheritance tax differ based on the specific jurisdiction. In some areas, only one tax may be applicable, while in others, both taxes may be in place. The estate tax is a tax levied on the transfer of assets from a deceased individual's estate to their heirs or beneficiaries. Its primary purpose is to generate government revenue, address issues of wealth inequality, promote charitable giving, and serve as a form of fiscal policy. Calculating estate taxes involves totaling the fair market value of most assets, subtracting allowable deductions, adding the value of lifetime taxable gifts, and subtracting the exemption amount. Individuals can set up an IDGT, own a life insurance policy, or set up an ILIT to reduce their estate taxes. These strategies can be complex and require the guidance of a financial advisor to ensure that they are implemented properly and in compliance with all applicable regulations.What Is an Estate Tax?

How Estate Taxes Are Calculated

Total the Fair Market Value of Most Assets

Subtract Allowable Deductions

Add the Value of Lifetime Taxable Gifts

Subtract the Exemption

Federal Estate Tax for 2023 and 2024

Jurisdictions With Estate Taxes

How to Reduce Estate Taxes

Set up an Intentionally Defective Grantor Trust (IDGT)

Own a Life Insurance Policy

Set up an Irrevocable Life Insurance Trust (ILIT)

Preparing Your Estate Tax

Estate Tax vs Inheritance Tax

Final Thoughts

Estate Tax FAQs

Generally, the types of assets subject to estate tax include real estate, financial accounts such as stocks and bonds, business interests, life insurance policies, jewelry, and certain personal, tangible items such as artwork and cars.

Estate tax is imposed on a deceased individual's assets before the disbursement of funds to their intended heirs. In contrast, the inheritance tax is imposed on the heirs after they have already obtained the assets or funds.

In 2025, the federal estate tax exemption is $13.99 million ($13.61 million in 2024) per individual. Any amounts above this threshold will be subject to tax at a rate of 18% to 40% depending on the total value that exceeds the exemption limit. There may also be additional state-level taxes imposed in certain jurisdictions.

Strategies for reducing estate taxes include establishing an Intentionally Defective Grantor Trust (IDGT), owning a life insurance policy, and creating an Irrevocable Life Insurance Trust. These approaches can help transfer assets out of your estate and provide control over them while potentially reducing estate taxes.

The estate of a deceased person typically pays the U.S. estate tax before any assets are distributed to their heirs. The estate tax computation is based on the estate's value at the time of the person's death.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.