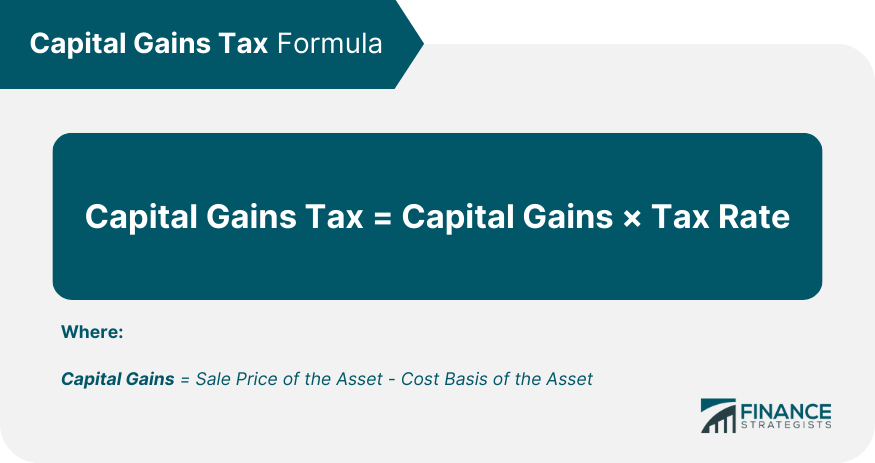

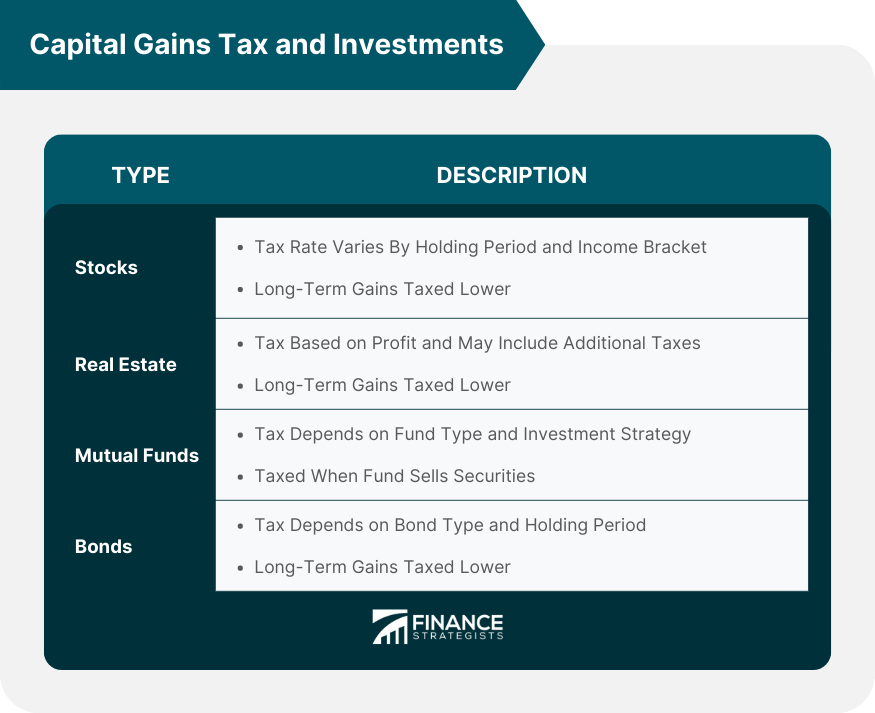

Capital gains tax is a tax on the profit made from the sale of a capital asset. The tax rate for capital gains varies depending on the asset's holding period and the taxpayer's income bracket. In general, short-term capital gains, or gains from assets held for one year or less, are taxed at the taxpayer's ordinary income tax rate, while long-term capital gains, or gains from assets held for more than one year, are taxed at a lower rate. Capital losses, or losses incurred from the sale of a capital asset, can be used to offset capital gains and reduce the overall capital gains tax liability. Calculating capital gains tax involves determining the profit made from the sale of a capital asset and then applying the appropriate tax rate. The formula for calculating capital gains tax is: The cost basis of an asset is typically the original purchase price, adjusted for any improvements or adjustments made over time. A number of factors can affect the calculation of capital gains tax, including the type of asset sold, the holding period of the asset, and the taxpayer's income bracket. Capital gains tax can significantly impact investment returns, as it reduces the overall profit made from the sale of an asset. Understanding the impact of capital gains tax on different types of investments can help individuals and businesses make informed investment decisions. The capital gains tax rate on stocks varies depending on the stock's holding period and the taxpayer's income bracket. In general, long-term capital gains from stock sales are taxed lower than short-term capital gains. The capital gains tax on real estate sales can be significant, as it is based on the profit made from the sale and may be subject to additional taxes, such as state and local taxes. The holding period of the real estate also affects the capital gains tax rate, with long-term gains being taxed at a lower rate than short-term gains. Capital gains tax on mutual fund investments can be complex, as it depends on the type of mutual fund and the individual's investment strategy. Generally, mutual fund investments are subject to capital gains tax when the fund sells securities, and the capital gains are passed on to individual investors. Capital gains tax on bond investments depends on the type of bond and the holding period of the bond. In general, long-term capital gains from bond investments are taxed at a lower rate than short-term gains. There are several exclusions and deductions that can reduce the overall capital gains tax liability. These include an exclusion for the sale of a primary residence, deductions for capital losses, and tax-free exchanges of investment property. Capital gains tax exclusions allow individuals to avoid paying tax on the profit made from the sale of certain assets, such as the sale of a primary residence. In order to qualify for this exclusion, the individual must have lived in the residence for at least two of the five years prior to the sale. Capital losses can be used to offset capital gains and reduce the overall capital gains tax liability. In addition, individuals may be able to claim deductions for certain expenses related to the sale of a capital asset, such as real estate commissions and legal fees. The sale of a primary residence can result in a significant capital gains tax liability, but some exclusions and deductions can help reduce this liability. For example, individuals may be able to exclude up to $250,000 of capital gains from the sale of their primary residence if they are single or up to $500,000 if they are married and filing jointly. Capital gains tax on retirement accounts can be deferred until the individual withdraws the funds. At this point, the funds are taxed as ordinary income. In addition, individuals may be able to avoid capital gains tax altogether by rolling over the funds from one retirement account to another. Capital gains tax can significantly impact investment returns, and individuals and businesses need to consider this impact when making investment decisions. Several strategies can be used to minimize capital gains tax, including tax-loss harvesting, holding onto investments for a long period of time, and investing in tax-efficient funds. Tax-loss harvesting involves selling investments that have decreased in value to offset capital gains from other investments. Holding onto investments for a long period of time can also help minimize capital gains tax, as long-term capital gains are taxed at a lower rate than short-term gains. Capital gains tax can significantly impact an individual's estate, as it reduces the overall value of the estate and the amount that can be passed on to heirs. Several estate planning strategies can help minimize capital gains tax, including gifting assets to heirs, using trusts, and creating a charitable remainder trust. Capital gains tax can significantly impact retirement savings, as it reduces the overall value of the savings and the amount available for retirement expenses. Several retirement planning strategies can help minimize capital gains tax, including investing in tax-deferred retirement accounts, such as IRAs and 401(k)s, and using annuities. Capital gains tax can significantly impact investment returns, and individuals and businesses need to consider this impact when making investment decisions. Investment planning strategies, such as diversifying investments, investing in tax-efficient funds, and considering the overall tax impact of investments, can minimize capital gains tax and maximize investment returns. Capital gains tax is a tax on the profit made from the sale of a capital asset, with the tax rate varying based on the asset's holding period and the taxpayer's income bracket. Short-term capital gains are taxed at the taxpayer's ordinary income tax rate, while long-term capital gains are taxed at a lower rate. Capital losses can be used to offset capital gains and reduce the overall tax liability. Different types of investments are subject to specific capital gains tax rates. There are exclusions and deductions available to reduce the capital gains tax liability. Exclusions, such as the sale of a primary residence, can allow individuals to avoid paying taxes on certain assets. Deductions for capital losses and certain expenses related to the sale of a capital asset can also help reduce the overall tax liability. Considering the impact of capital gains tax is crucial in investment, retirement, estate, and tax planning. Overall, thoughtful investment planning, diversification, and considering the tax implications of investments can help individuals and businesses navigate capital gains tax and optimize their financial strategies.What Is Capital Gains Tax?

Capital Gains Tax Calculation

For example, a sale of real estate may be subject to additional taxes, such as state and local taxes, while a stock sale may be subject to different tax rates based on the taxpayer's income.Capital Gains Tax and Investments

Capital Gains Tax on Stocks

Capital Gains Tax on Real Estate

Capital Gains Tax on Mutual Funds

Capital Gains Tax on Bonds

Capital Gains Tax Exclusions and Deductions

Capital Gains Tax Exclusions

Capital Gains Tax Deductions

Capital Gains Tax and Home Sales

Capital Gains Tax and Retirement Accounts

Capital Gains Tax and Tax Planning

Strategies for Minimizing Capital Gains Tax

Capital Gains Tax and Estate Planning

Capital Gains Tax and Retirement Planning

Capital Gains Tax and Investment Planning

Conclusion

Capital Gains Tax FAQs

Capital Gains Tax is a tax imposed on the profit made from selling a capital asset, such as stocks, real estate, or bonds.

Short-term Capital Gains Tax applies to assets held for one year or less and is taxed at the taxpayer's ordinary income tax rate, while long-term Capital Gains Tax applies to assets held for more than one year and is taxed at a lower rate.

Yes, capital losses incurred from the sale of a capital asset can be used to offset capital gains and reduce the overall Capital Gains Tax liability.

Capital Gains Tax is calculated based on the profit made from the sale of a capital asset. It can be affected by factors such as the type of asset sold, the asset's holding period, and the taxpayer's income bracket.

Yes, there are exclusions, such as the sale of a primary residence, and deductions, such as capital losses, that can reduce the overall Capital Gains Tax liability. Proper tax planning and investment strategy can also help minimize the impact of Capital Gains Tax.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.