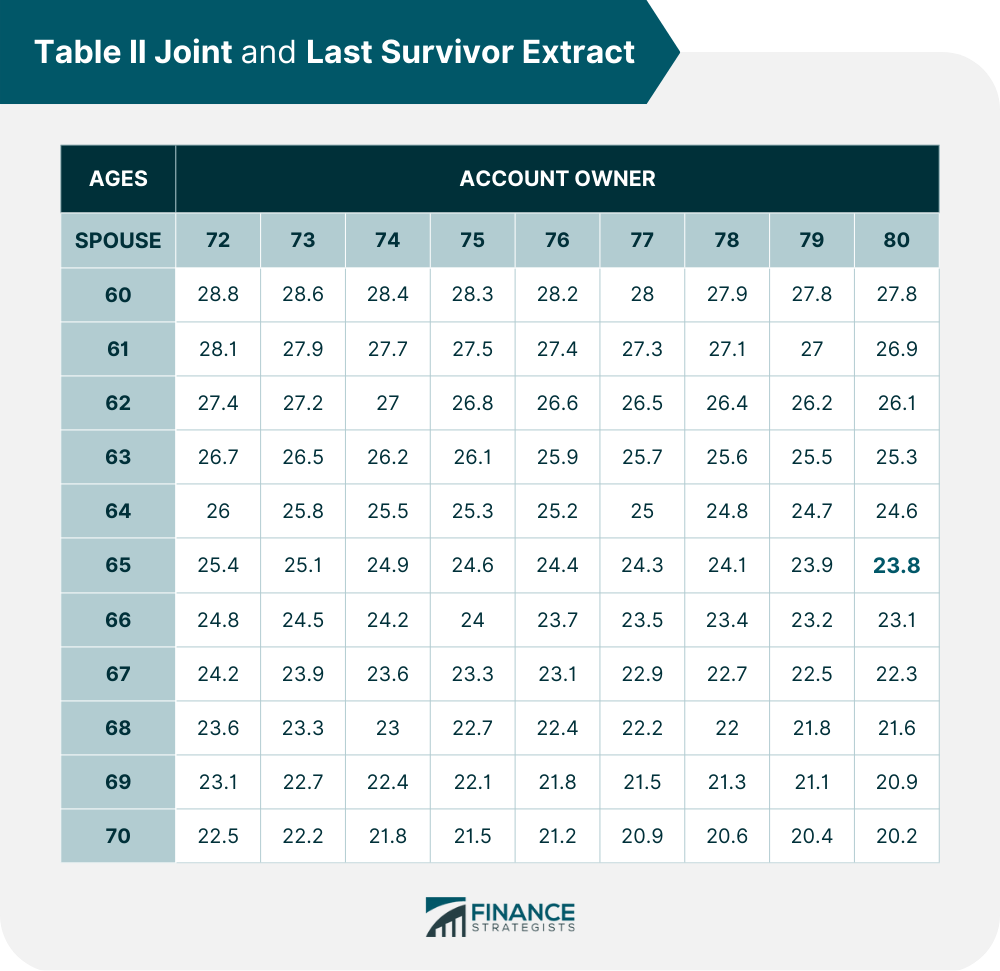

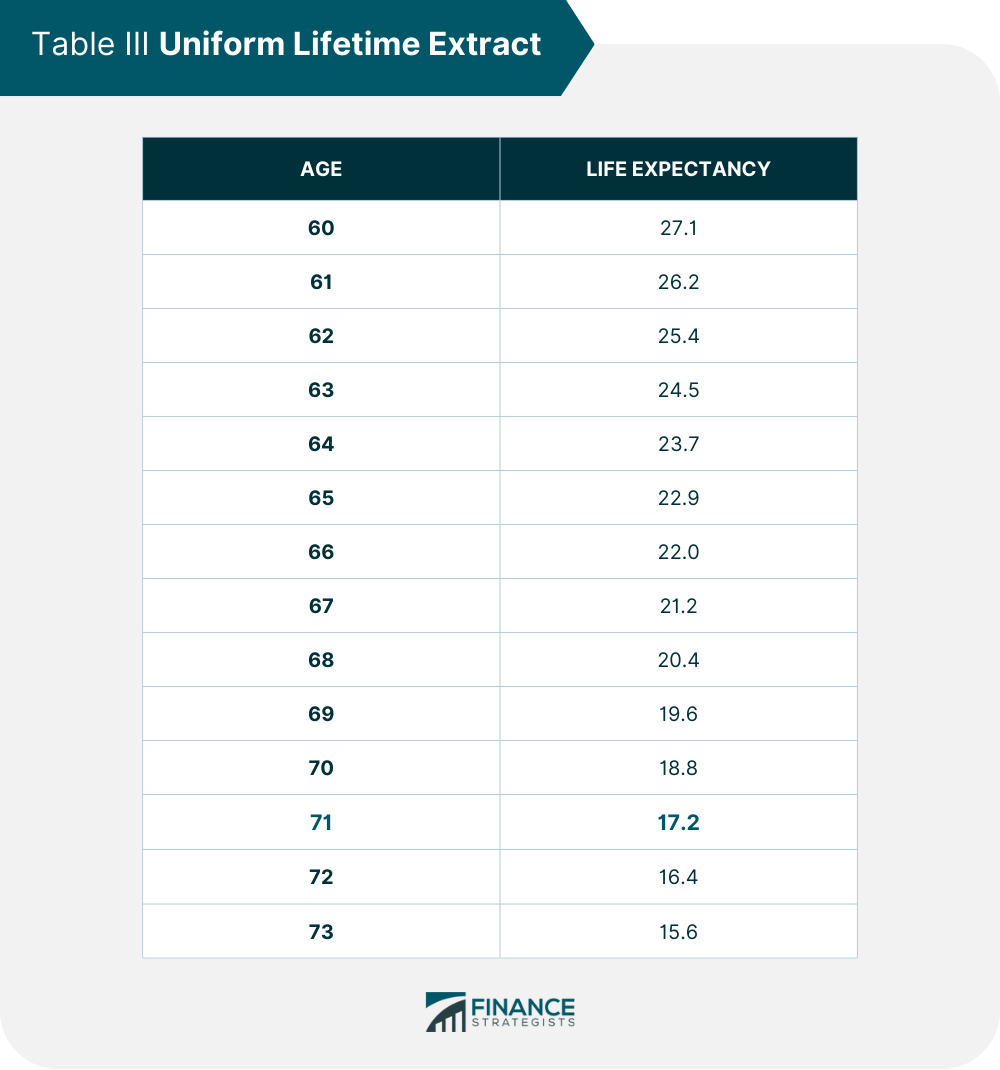

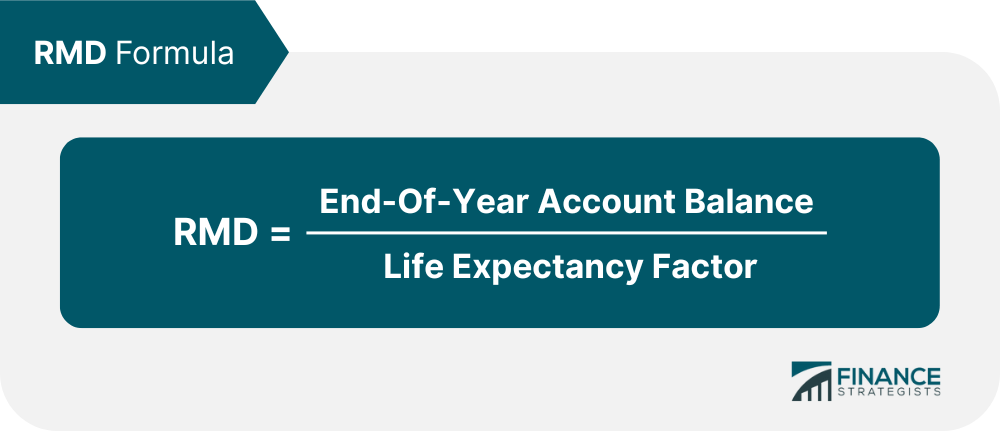

A required minimum distribution (RMD) is a yearly amount of money required by the Internal Revenue Service (IRS) to be withdrawn from traditional IRAs or employer-sponsored retirement accounts. RMDs must be withdrawn from tax-deferred retirement accounts, such as traditional, rollover, SIMPLE, and SEP IRAs, as well as the majority of 457(b), 401(k), and 403(b) plans. Roth IRAs have no RMDs unless they are inherited. The funds withdrawn are subject to taxation according to the same rules as other retirement account distributions. Planning ahead of time may help lower taxes and expand reinvestment opportunities. The RMD rules guarantee that individuals do not simply accumulate retirement accounts, avoid taxation, and leave their retirement savings as an inheritance. If you have been putting money down in an IRA, 401(k), or another tax-advantaged retirement plan, you have not paid income tax on those funds. The government allows you to postpone paying taxes, yet RMDs are how the government ensures you will be taxed ultimately. RMDs are calculated by dividing the balance of an IRA or retirement plan account as of December 31 of the previous year by a life expectancy factor published by the IRS. Three life expectancy tables are used to calculate RMDs and apply them under different situations. The Single Life Expectancy Table is used for beneficiaries of an inherited IRA or retirement plan. The beneficiary's age will be used to determine the life expectancy factor. The RMD amount is calculated by dividing the account balance by the factor corresponding to their age in the table. The life expectancy factor for a 68-year-old beneficiary is 20.4. Life expectancy values from this table are used if an individual is married, the spouse is the only beneficiary and is more than 10 years younger than the owner. For the Joint and Last Survivor Table, the account owner's and beneficiary's ages will be used to determine the life expectancy factor. The ending account balance of the owner is divided by the corresponding life expectancy factor determined from the table below, where the age of the owner and the spouse intercepts. For an 80-year-old account owner with a 65-year-old beneficiary, the life expectancy factor is 23.8. The table is used for unmarried individuals and married individuals whose spouses are not more than 10 years younger and are not the sole beneficiary of the account. Using the Uniform Lifetime Table, the year-end account balance of the owner is divided by the factor indicated on the table based on their age. The life expectancy factor for an 83-year-old is 17.7. RMD calculation is based on the end-of-year balance of the last tax year and the life expectancy factor based on their situation and the corresponding table that will be used. An individual inherits a retirement account with a $250,000 balance as of December 31st, and the Single Life Expectancy Table is used. For a 73-year-old beneficiary, the life expectancy factor is 15.6. Using the formula above, $250,000 divided by 15.6 is $16,025. The same formula applies to other RMD calculations; you only need to choose the most appropriate expectancy table for your circumstances. Currently, required minimum distributions from eligible retirement funds must begin at age 73. Before 2023, the RMD age was 72. Prior to that, it was 70 ½ until 2020. It is important to note that account owners are not required to take an RMD immediately when they become 73. They have until April 1 of the year after their birthday. After that, they must withdraw their RMD by December 31st annually. Employer-sponsored plans, like 401(k)s, may allow delaying taking RMDs for a more extended period. Having multiple retirement accounts requires computing RMD for each one separately. Multiple IRAs can be combined and withdrawn from a single account. A traditional or Roth IRA that is inherited is an individual retirement account you inherit upon the death of the former owner. Because an IRA is a tax-advantaged account, the IRS has established RMD withdrawal guidelines. Beneficiaries may previously spread RMDs across their lifetime. However, modifications were made in the 2019 Setting Every Community Up for Retirement Enhancement Act (SECURE Act). The stretch option was eliminated for most non-spouse IRA beneficiaries in 2020. They must withdraw the whole amount of an inherited IRA within 10 years, with certain exceptions. The SECURE Act requires no yearly RMD in the ten-year period, only that the account will be empty by the tenth year following the original owner’s death. The IRS will take a 25% penalty tax on what is left if you fail to do so. If the deceased took RMDs but had not completed them in the year they died, the beneficiary must do so or face a 25% penalty. Once the deceased's RMD liability is resolved, a spouse has a few alternatives for acquiring management of the inherited IRA. Continue to Be an IRA Beneficiary. The account is an inherited IRA, with future RMDs based on the deceased original owner's age. Take Ownership of the IRA. Future RMDs are calculated based on the new owner's life expectancy and can commence at 73. Transfer the Funds to an Existing IRA. RMDs will subsequently be calculated based on the owner's age. The first step for non-spouses is to pay any RMD owed by the deceased in the year of death. After that, a non-spouse who inherits an IRA must transfer the funds to a particular inherited IRA. The standard rule for non-spouse beneficiaries is to take all funds from the account by December 31 of the tenth year following the original owner's death. The beneficiary is not obligated to take annual RMDs during the 10 years. You can withdraw all at once, staggered yearly, before the 10-year deadline. Some non-spouse beneficiaries are exempt from the new 10-year limit. Minor Children. Annual RMDs can be taken based on the child's age until they achieve the age of majority in their state. Disabled or Chronically Sick Individuals. Annual RMDs can be calculated based on the beneficiary's life expectancy. Individuals Within Ten-Year Gap With the Deceased. Withdrawals from an IRA can be made as annual RMDs based on the beneficiary's life expectancy. The rules for inherited RMDs may vary, be complex, and trigger penalties if not followed correctly. It is best to consult with a financial advisor for guidance in calculating RMDs for inherited accounts. Required minimum distribution is a compulsory withdrawal from retirement accounts such as employer-sponsored plans, profit-sharing plans, traditional IRAs, and IRA-based plans. RMDs are taken by April 1 of the year after the account holder's 73rd birthday. RMD forces those people to take money out of their accounts and pay taxes so that the IRS can generate revenue and ensure equal distribution of retirement funds. The formula used to calculate the RMDs is the account balance as of December 31 of the previous year divided by a life expectancy factor. Three life expectancy tables are used to determine the factor: the joint life & last survivor expectancy, the uniform life expectancy, and the single life expectancy. Account owners should choose the table based on their circumstances. Presently, required minimum distributions from qualified retirement accounts must commence at age 73. Before 2023, the RMD age was 72. Prior to that, it was 70 ½ until 2020. Different rules and exceptions may apply for inherited accounts depending on the beneficiary's status as a surviving spouse, minor child, or disabled individual. It is best to consult a financial advisor to calculate RMDs, especially when they are inherited accounts.What Is a Required Minimum Distribution (RMD)?

Purpose of Required Minimum Distributions

How to Calculate Required Minimum Distributions

Table I Single Life Expectancy

Table II Joint and Last Survivor

Table III Uniform Lifetime

Example of a Required Minimum Distribution

When Should You Start Taking Your RMDs?

Rules for Inherited RMDs

Rules for Spouses

Rules for Non-Spouses

Final Thoughts

Required Minimum Distribution (RMD) FAQs

If you fail to take an RMD by the required deadline, you must pay a 25% penalty on the amount of RMD not taken. However, the penalty may be waived if you show that your failure was due to acceptable cause and not due to willful neglect.

Your required minimum distribution is calculated by dividing the balance in your retirement account as of December 31 of the previous year by a life expectancy factor indicated by IRS-provided tables based on your situation.

Yes, RMD distributions are taxable as ordinary income.

Roth IRAs do not have RMDs because contributions to Roth IRAs are after-tax, meaning all the taxes on these contributions have already been paid.

The purpose of required minimum distributions is to ensure that the federal government collects tax revenue on retirement savings over time. RMDs prevent money from remaining untouched in an account until the account owner's death.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.