A pension plan is a favored kind of retirement plan by employees in which employers commit to paying a defined benefit or fixed amount of money upon retirement. Pension plans are a popular incentive to retain employees because of the perks of getting a steady stream of checks that lasts the length of their retirement. However, traditional pension plans are becoming less common, particularly in the private sector. These plans have been substituted with defined-contribution plans such as the 401(k) because they are cost-efficient and easier to manage for employers. Have questions about pensions? Click here. Pension plans are essential for employees considering their future, so it is crucial to know their basics. Private and public employees are both eligible for pension plans. Federal, state, and local government bodies provide public pensions. The majority of civilian employees of the U.S. government, including postal service workers, are covered by retirement systems. Established private companies offer pensions, but recently there has been a decreasing rate of new employees eligible to receive them. For example, someone who just started working for a manufacturing company that has been in business for over 50 years is more likely to have a pension plan than someone who just started working at a tech startup. Employers and employees can contribute to a pension plan. Employer contributions are mandatory, while employee contributions are voluntary. Employees who want to ensure they receive the maximum benefits from their pension plan should contribute as much as possible. Employees with pension plans are not involved in administrating those funds. This tends to relieve employees since financial matters are often complex. However, the absence of oversight implies that employees cannot guarantee that their pension accounts are adequately funded or that the benefits will last throughout their retirement. There have been instances where companies have declared bankruptcy, and employees lost a significant portion of their pension funds. Employees also do not have control over how their funds are invested. The investment decision lies with the employers who manage the pension fund. Generally, investments are made to minimize the risk while still providing good returns. This often means the funds are invested in a mix of stocks, bonds, and other securities. Pensions are often paid monthly for the rest of the retiree’s life or in a lump sum upon retirement. In most cases, pension income is calculated as a proportion of an employee’s earnings throughout his working years. This proportion is determined by the employer’s terms and the employee’s length of service. For example, a worker who has been with a firm or government service for decades may be able to retire with 75% of their pay. Someone with a shorter tenure or working for a less rewarding employer may only earn 40%. Depending on the arrangement, such pension benefits may also be inherited by a surviving spouse or qualified dependent in the event of the retiree’s death. Vesting is a process that determines when an employee has the right to employer-provided benefits. For an employee to be vested, he or she must typically work for the company for a certain number of years, usually between 3 and 5 years. Once employees are vested, they are entitled to the benefits even if they leave the company before retirement. Employees who leave the company before they are vested forfeit all rights to the pension benefits. Vesting schedules can be classified into two types: cliff and graded. Cliff vesting means that the employee does not have a claim to any contributions until a particular time. Graded vesting, however, means that an employee gradually earns the right to benefits over time. Employees who are covered by pension plans receive guaranteed benefits at retirement, while defined-contribution plans do not offer this same guarantee. In the unfortunate event of bankruptcy, employees with pension plans may still receive some level of benefits as they are typically given preferential treatment in the case of liquidation. Pension Benefit Guaranty Corporation (PBGC), a federally chartered corporation, would take over the plan and pay employees benefits if the employer cannot do so. However, this guarantee is not without limits, as there is a cap on the benefits the PBGC would pay out. Pension plans have a tax-advantaged status for both employers and employees. Because contributions made by employees are taken out of gross income, they reduce the taxes the employee has to pay. In addition, any earnings on the investments are not subject to taxation until they are distributed to employees. When employees eventually receive their pension benefits, those payments are taxed as ordinary income. Employer contributions are also tax-deductible. Pensions offer many benefits to employees. Pension plans offer employees security in retirement by providing a guaranteed income stream, giving retirees a sense of financial security and peace of mind knowing they will have the resources to cover basic living expenses. This security can be especially beneficial for employees who do not have other sources of funds. Pension plans also offer the benefit of inheritance. In most cases, a surviving spouse or a qualified dependent can inherit a portion of the pension benefits. This feature can provide financial security for loved ones in the event of the death of the pension plan participant. Pensions offer a tax advantage for employees who choose to contribute because contributions are made with pre-tax dollars, reducing the amount of taxes the employee has to pay. In addition, any earnings on the investments are not subject to taxation until they are distributed to employees. Pensions also have some drawbacks that employees should be aware of. Pension plans are subject to insolvency risk if the employer cannot make the required contributions. This risk can happen for various reasons, such as poor investment performance, changes in the business environment, or financial difficulties. If this happens, employees may not receive all the benefits they are entitled to. Pension plans often have restrictions on when an employee can vest and become eligible for benefits. This means that employees who leave the company before they are vested may not receive any benefits from the pension plan. In addition, pension plans often have eligibility requirements that employees must meet to receive benefits. For example, an employee may need to work for the company for a certain number of years or reach a certain age before they are eligible to receive benefits. Employees have no influence over how the money in their pension fund is invested, which can be a drawback if the investments do not perform well. In addition, employees cannot access their pension benefits until they retire, which means they cannot use the money for other purposes if they experience financial difficulties before retirement. Pension plans are often governed by labor agreements, meaning the plan’s terms can change if the agreement is renegotiated. For example, the employer may decide to terminate the pension plan or change the eligibility requirements. Maximizing Pension at Retirement There are specific steps employees can take to maximize pension at retirement. If an employee wants to maximize his pension, increasing his contribution as much as possible is essential. More contributions now would mean having more money in retirement. Another option is enrolling in a 401(k) plan, allowing employees to save even more money for retirement. The potential risk of pension plans going bankrupt can be avoided if an employee takes a lump sum and the considerable money can be invested. The downside is that there is no guaranteed lifetime income. It is their responsibility to make money last. On the other hand, annuity payments provide a guaranteed income stream for life but are unfavorable when inflation, employee death, and possible company bankruptcy are considered. According to the U.S. Census Bureau, the 2019 average annual retirement income is $84,153 for ages 65 to 74. Using this data, let us say that an employee was offered a $400,000 lump sum payment or $84,153 per year. Lump sum payment value: $400,000 Annuity value in 5 years: $84,153 x 5 = $420,765 A direct comparison would lead employees to believe that the annuity is better. However, the $420,765 value is not the present value and must be discounted to its present value to enable a practical comparison. A present value calculator can help, or the formula below can be used: Present Value = Future Value / (1 + r)^n = $420,765 / (1 + 0.063)^5 = $310,008.27 If the estimated discount rate is at 6.3%, the annuity value would be worth $310,008.27 after five years. Comparing this amount to the lump sum payment value of $400,000, we can conclude that it is wiser to choose the lump sum option over the annuity payments. If an employee wants to make sure that they are taking the best steps to maximize their pension, it is best to seek professional advice to understand options and make the best decisions for retirement. These experienced professionals have helped hundreds of clients and are experts in offering services to assist in planning and making the most of their pensions. A 401(k) is a defined-contribution plan that some employers offer. Like a pension plan, employees can make pre-tax contributions to their 401(k) account. The money in the account grows tax-deferred and can be withdrawn after retirement. Both employers and employees can contribute to a pension plan and a 401(k). In a pension plan, contributions are mandatory for employers but voluntary for employees. In a 401(k), employees can also contribute, while employers may match those contributions. A key difference between the two is that with a pension plan, the benefit paid to the employee in retirement is typically based on years of service and salary history. With a 401(k), the benefit paid in retirement depends on the account balance at retirement. Pension plans favor those who want a guaranteed income stream in retirement. However, 401(k)s can be a good option for those who want more control over their retirement savings and the ability to withdraw their money earlier. Below is a summary of the two plans’ key features: A pension plan is a retirement savings account that provides employees with a guaranteed income stream for life. Depending on their tenure and income, employees receive benefits when they retire with the company pension fund. Before making any decisions, it is crucial to understand all the options and terms associated with a pension plan. Employees should also seek professional advice to ensure they make the best choices for their retirement.What Is a Pension?

How Pension Plans Work

Eligibility

Contributions

Fund Management

Payments at Retirement

Vesting

Guaranteed Benefits

Tax Consequences

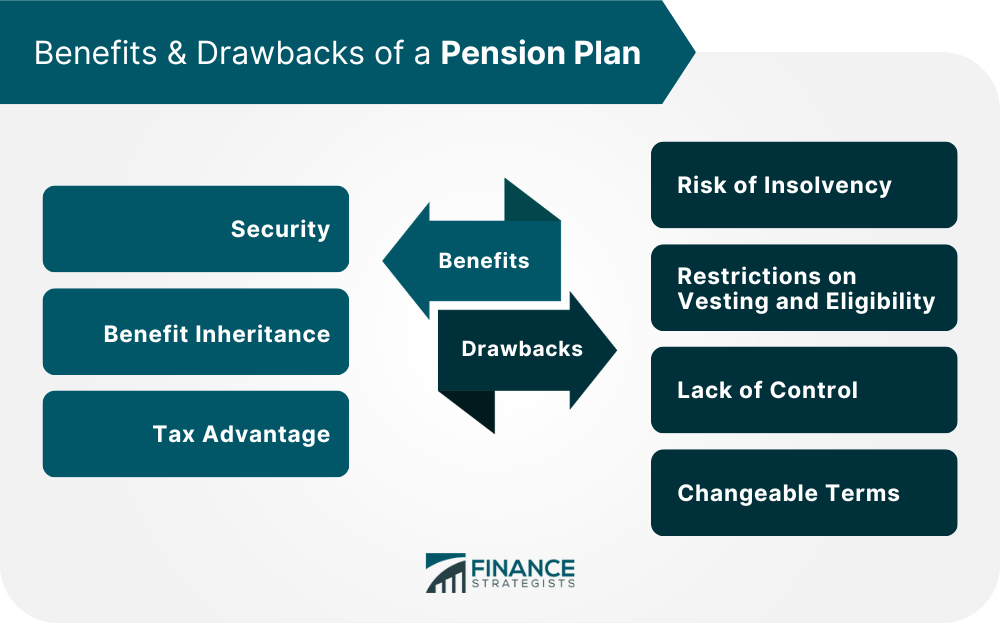

Benefits of a Pension Plan

Security

Benefit Inheritance

Tax Advantage

Drawbacks of a Pension Plan

Risk of Insolvency

Restrictions on Vesting and Eligibility

Lack of Control

Changeable Terms

Increase Contributions

Carefully Choose Between Lump Sum or Annuity

Tap on Professional Advice

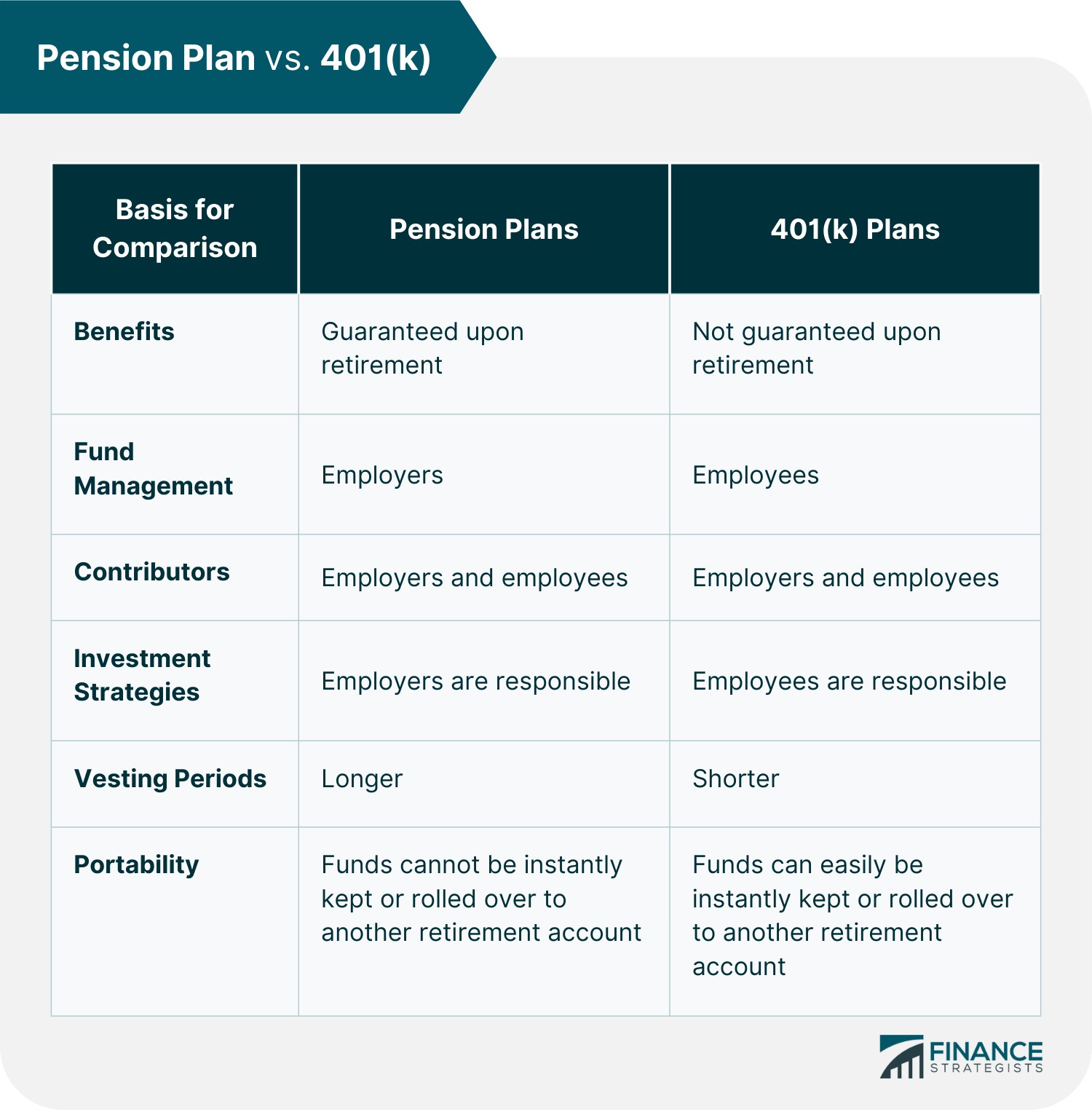

Pension Plan vs 401(k)

Final Thoughts

Pension FAQs

No. A key difference between the two is that pension plans are generally defined-benefit plans while 401(k) plans are defined-contribution plans.

Pension plans typically pay benefits for the lifetime of the retiree. In the event of the retiree's death, most pension plans will benefit the retiree's surviving spouse or qualified dependent.

If an employee resigns before the vesting period is complete, he will not be eligible to receive any benefits from the pension plan. If he leaves after the vesting period is complete, he is still entitled to receive his pension benefits when he reaches retirement age.

Pension plans have declined for the past few decades, but they are still considered a good retirement savings option because they provide guaranteed benefits. However, there are some risks to consider, such as the risk of insolvency of the employer, certain restrictions in vesting and eligibility, and lack of management control on the part of the employee.

A pension plan is a retirement savings account that provides employees with a guaranteed source of income for life. The company funds the pension plan, and employees receive retirement benefits. Depending on their years of service and income, employees may receive different benefits from the pension fund.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.