A defined benefit plan is a retirement plan wherein employers give employees guaranteed retirement benefits based on a predetermined formula. Defined benefits provide better protection than other retirement plans even if investments do not perform well because employers pay out predetermined benefits regardless. These plans have become increasingly rare in recent decades in the private sector due to a preference for 401(k) – a defined contribution plan. Although, some employers still offer defined benefits in the public sector. A defined benefit plan is an employer-sponsored pension program that guarantees participants a fixed income at retirement. Employers calculate the benefits allocated to each worker based on salary, age, and length of employment. This retirement plan rewards loyalty to those who stay long-term within the same company. In addition to providing guaranteed income security, these plans also offer tax advantages such as tax-deferred growth and deductions for employer contributions. Unlike other retirement plans like 401(k)s, where employees almost entirely fund contributions, employers typically cover all costs associated with a defined benefit plan. Although in exceptional cases, employees may contribute as well. Therefore, companies offering these programs are more attractive to potential job seekers since they provide them with long-term security and peace of mind once they retire. The two most common types of defined benefit plans are pensions and cash balance plans. A pension is a guaranteed monthly benefit beginning at retirement based on a formula that considers how long a worker stayed with a company and how much they earned. Employees must usually stay with a company for a particular duration to receive pension benefits. An employee is considered vested after accumulating the required tenure. Pension plans may have different vesting requirements. For example, an employee may be 50% vested after five years with a company, granting them retirement payments equal to 50% of a full pension. Cash balance plans are defined benefit plans that give employees a set account balance at retirement or when they leave the company rather than regular payments. It is calculated based on two factors: the amount an employer deposits into the account each year plus the annual interest rate accrued. Although employers still bear the risk of retirement funds management, cash balance plans often offer fewer benefits than pension plans. They are calculated using the entire working years with the company instead of an employee’s highest earning period. Participants can receive their balance as a lump sum or as an annuity that will pay out regular payments over time. Defined benefit plans offer many advantages to employers and employees. Some of them are: With this type of retirement plan, individuals can rest assured that they will receive exactly how much money their former employer promised them. This allows for better financial planning for individuals who can budget and calculate exact amounts for their costs. Changes in the marketplace will not affect the guaranteed income upon retirement. Such provides stability to those participating in this plan, allowing them to accrue the pre-established benefits without fear of fluctuating asset prices and returns. Contributions are tax-deductible for those who fund the plan, providing added incentives and reduced taxes paid. Investments in the pool grow tax-deferred until withdrawals begin. Providing a guaranteed sum of money upon retirement as part of the pension program makes them more likely to remain with the employer long-term. Employees can expect more secure financial support, increasing job satisfaction and loyalty. Many organizations widely use defined benefit plans as employee benefits. However, using such plans has various drawbacks that can negatively impact the employer or the employee. This type of plan is run by the employer, who decides where and how to invest your money. While most management teams act responsibly and look for the best possible return, in some cases, losses occur due to bad decisions and management errors. It often takes several years of continuous service for workers to get the full benefit from a pension plan or other defined benefit plan. Depending on the plan, it may take up to five years before an employee becomes fully vested and is thus eligible for full benefits from the company. These plans' value is tied directly to the length of service. Leaving the company before the vesting period can result in forfeiting much of that value. Employees may have to think twice before considering an offer with another company. The plan's amount of money at retirement is predetermined. It will not benefit from investments or the stock market rising. Regardless of these changes, a retiree will receive their agreed-upon income when they retire. Employers are responsible for contributing to the plan and managing investments, paying out benefits, and managing other administrative tasks. The cost associated with these activities can quickly add up, which can be detrimental to their bottom line. The employer also assumes all investment risk. Suppose there is a poor return on investments or increased life expectancy of participants. In that case, those costs must be absorbed by the employer. When receiving payments from defined benefit plans, employees typically have two options as follows: Annuities provide financial security for those who need to be more cautious with their money, as the payout consists of regular amounts over a set period. Since annuities grow tax-deferred, you only have to pay income taxes on the money once you withdraw it or start receiving payments. If the annuity were purchased with pre-tax funds, the money would be taxed as income when you withdraw it. In comparison, you would only pay tax on the earnings if purchased with after-tax funds. Taking out a lump sum may seem more attractive initially. Over time, the cash flow generated from an annuity will generally add up to a more considerable cumulative amount. A lump-sum payment setup is one in which the entirety of the contract value is distributed at one time. This can benefit those who want to invest this amount into a potentially more profitable venture, such as stocks, bonds, or mutual funds. Lump-sum payments give you more flexibility since they give you the freedom to spend or invest your money in any way you see appropriate such as paying off large debt or giving it off as an inheritance. It is important to note that this immediate transfer of large sums may cause the individual to move into a higher tax bracket. Thus, leading to increased taxes owed at year-end. On the other hand, taking this payment could also offer some tax-related advantages due to discounts given for structured plans and other considerations when dealing with more significant amounts of money like these. A defined benefit plan is a type of retirement plan that promises a set payment at a regular frequency after the employee retires. Employers calculate the benefits allocated to each worker based on salary, age, and length of employment. The advantages of defined benefit plans are fixed payout, protection from market fluctuations, tax benefits, and increased employee retention. The disadvantages include the limited potential for growth of investments, vesting period, and employer cost. Employees can choose between an annuity or a lump-sum payment when receiving payments from defined benefit plans. These plans carry significant risks for both employers and employees. Suppose investments do not perform well or more employees than expected retire and take their benefits. In that case, the employer can be left struggling to maintain benefits, and employees lose out on payouts. When it comes to managing and maximizing retirement savings, seeking the help of an experienced financial advisor can help you choose the right strategies for a seamless retirement planning.What Is a Defined Benefit Plan?

How Defined Benefit Plans Work

Types of Defined Benefit Plans

Pensions

Cash Balance Plans

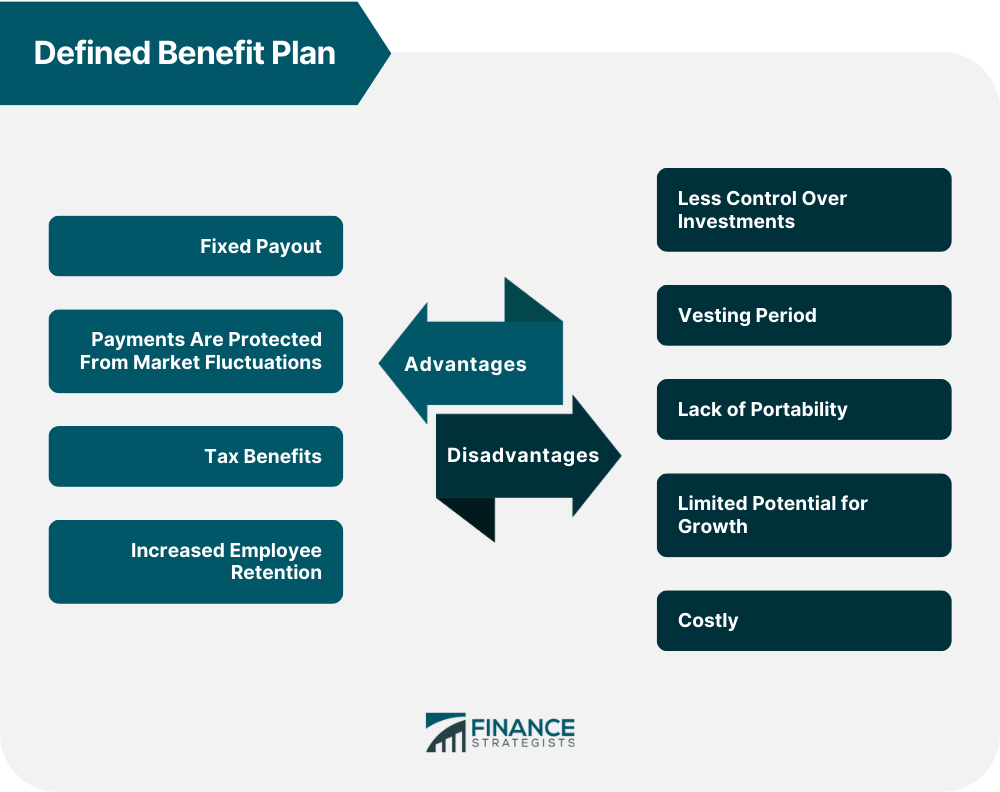

Advantages of Defined Benefit Plan

Fixed Payout

Payments are Protected from Market Fluctuations

Tax Benefits

Increased Employee Retention

Disadvantages of Defined Benefit Plan

Less Control Over Investments

Vesting Period

Lack of Portability

Limited Potential for Growth

Costly

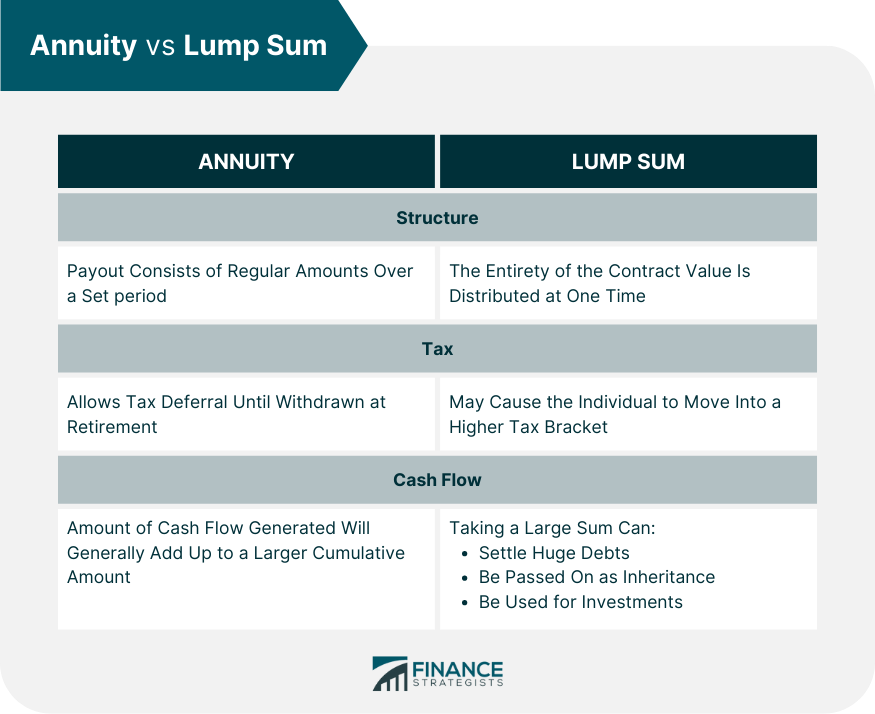

Defined Benefit Plan Payment Options

Annuity Payments

Lump-Sum Payments

Final Thoughts

Defined Benefit Plan FAQs

A Defined Benefit Plan is a retirement plan that provides employees with a predetermined monthly income after they retire.

There are many benefits to having a DBP. Some benefits include: a guaranteed monthly income in retirement, attracting and retaining top talent, and employers are not responsible for all payouts if an employee leaves before retirement.

Some drawbacks include: employees are often stuck in their job until they reach the payout age, employees must make sure to start early and contribute consistently in order to save enough for retirement.

It offers security in knowing exactly how much money will be received upon retirement, while also helping employers attract and retain talented employees.

Employees can contribute to their DBP by setting aside money from each paycheck. They can also contribute employer matching funds, which is free money that will double your contributions.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.