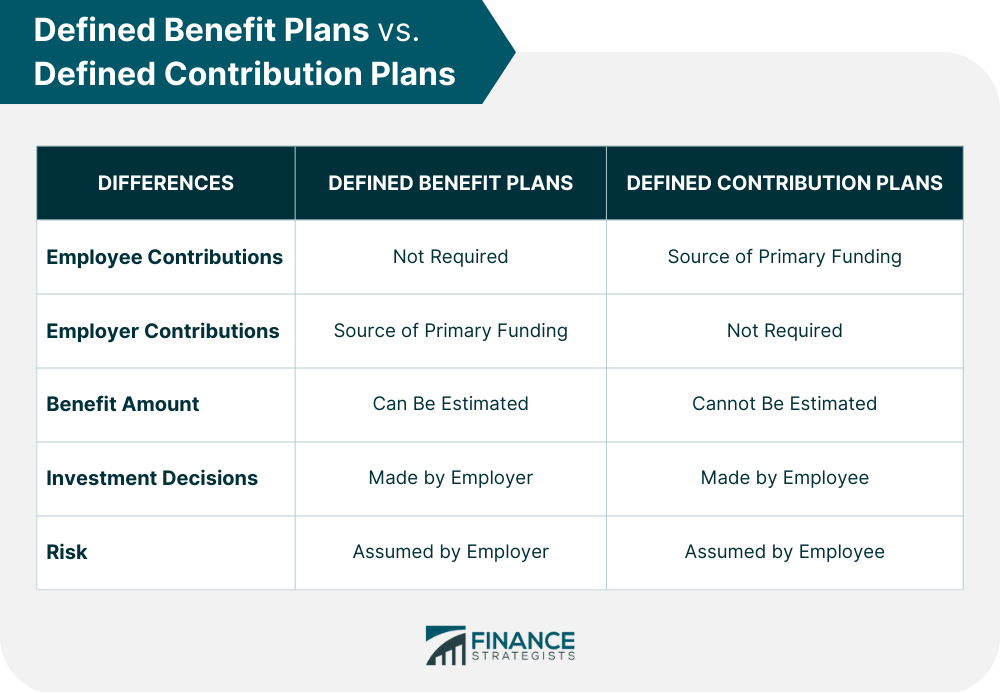

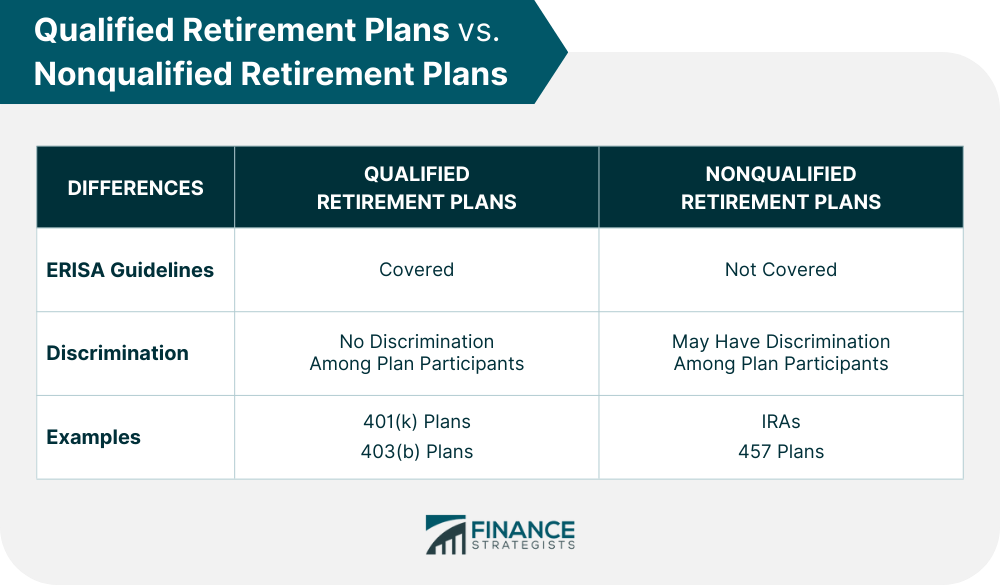

A qualified retirement plan is an employer-sponsored savings plan indicated in Section 401(a) of the Internal Revenue Code (IRC). These types of plans must adhere to Internal Revenue Service (IRS) guidelines on matters such as vesting, minimum compensation levels, and funding limits. A retirement plan is also qualified if it meets certain requirements mandated by the Employee Retirement Income Security Act (ERISA). This law specifies basic rules for most voluntary retirement plans in the private sector to safeguard plan participants. Qualified retirement plans provide tax advantages to both employees and employers because any money contributed to a plan is excluded from an individual’s taxable income. As such, it is worth considering these types of plans when planning for retirement. Qualified retirement plans generally come in the following forms: Defined benefit plans are a type of retirement plan in which employees receive a predetermined sum of money upon retirement. This amount is often based on their years of service, salary level, and other factors following a formula set by the employer. The freedom of making investment decisions, along with managing associated risks, lies in the hands of the employer, who must make sufficient contributions to the plan to ensure it is fully funded. A pension with a conventional annuity structure is an example of a defined benefit plan. Defined contribution plans are a type of retirement plan in which employees contribute money, often through salary deferral. Employers might also match contributions or contribute separately. However, this is not required. Under this setup, employees can decide how their money will be invested. However, the risk associated with the investment is shouldered solely by the employee. An example of a defined contribution plan is a 401(k). Below are several other examples of qualified retirement plans that employers can choose from: Some of the most important requirements for qualified retirement plans include the following: Employees must fulfill the minimum age and service criteria requirements before they are eligible to participate in a qualified retirement plan. For instance, they must be at least 21 years of age. They must also complete at least one year of service with the sponsoring company. Employers may require that workers stay with the company for a certain amount of time before the funds in the plan become fully vested or considered their own. Regardless of the specific details, all employees must be 100% vested by the time they reach normal retirement age. A qualified plan must follow IRS rules and regulations. It must be operated for the exclusive benefit of employees, and the same employee benefits provided must be aligned with those mentioned in the plan document. The employer must guarantee that all employees are treated equally when it comes to their plan benefits. For instance, employer matching requirements must be the same regardless of salary level. Employers should comply with the IRS reporting and disclosure process. This means they must periodically submit the appropriate tax forms, account balance statements, and distribution records. Generally, employees must begin receiving distributions from their qualified retirement plan when they reach 72 years of age. Alternatively, they may begin withdrawing funds starting the year they retire, provided they do not own at least a 5% share of the company. Elective deferrals are contributed by employees to their plans and are subject to yearly limits set by the IRS. Employees can contribute a maximum of $23,000 as of 2024 ($23,500 in 2025). Those 50 or older may contribute an extra $7,500 as of 2024 and 2025. Employers must also follow IRS’ annual contribution limits. The limit for a defined benefit plan is $280,000 as of 2025 (up from $275,000 in 2024). Meanwhile, the maximum combined employer and employee contribution to a defined contribution plan is $70,000 as of 2025 (up from $69,000 in 2024). The maximum yearly salary that can be considered for each employee who participates in a qualified retirement plan cannot exceed $350,000 for the year 2025 ($345,000 in 2024). Qualified retirement plans offer tax benefits such as the following: Contributions to qualified retirement plans are tax-deductible, up to particular limitations. Contributions made by employers may be deducted from the company's taxable income, while employee contributions can also reduce their taxable income. Earnings on investments within retirement accounts are not taxed until they are distributed from the plan. This allows for tax-deferred growth. Any earnings can be reinvested and compounded without incurring a tax liability until distribution. Employers may choose to match part or all of their employee's contributions toward retirement plans. Employees can benefit more from employers' matching contributions if they maximize their contribution limit. Qualified retirement plans are those that meet the minimum requirements set by the IRS and are covered by the ERISA. Under these plans, there is no discrimination among plan participants, meaning eligible employees must receive the same treatment from their employers. In contrast, nonqualified retirement plans do not meet the standards set by the IRS and are not covered by the ERISA. Within this setup, employers can set more limits on which employees can avail of the plan. These plans may also not offer the same tax benefits as qualified plans. Qualified retirement plans are employer-sponsored retirement plans that meet the requirements of the IRS and are covered by the ERISA. They can fall into two categories: the defined benefit plan or the defined contribution plan. A defined benefit plan involves an employer setting a guaranteed retirement income for employees. In contrast, a defined contribution plan gives the employee more control over how much to contribute and invest in their own retirement. A retirement plan becomes qualified if it meets certain requirements, such as those related to participation, vesting, operation, discrimination, and distributions. Nonqualified retirement plans are not subject to the same conditions and may not offer the same tax advantages. The tax advantages of qualified retirement plans include tax-deductible contributions, tax-deferred growth of investments, and employer-matching contributions. Examples of qualified plans are 401(k) plans, 403(b) plans, cash balance plans, and profit-sharing plans.What Is a Qualified Retirement Plan?

Types of Qualified Retirement Plans

Defined Benefit Plans

Defined Contribution Plans

Examples of Qualified Retirement Plans

Requirements for Qualified Retirement Plans

Participation

Vesting

Operation

Nondiscrimination

Reporting and Disclosure

Distribution

Elective Deferral

Contribution Limits

Compensation

Tax Benefits of Qualified Retirement Plans

Tax-Deductible Contributions

Tax-Deferred Growth

Matching Contributions

Qualified Retirement Plans vs. Nonqualified Retirement Plans

The most common examples of qualified plans include 401(k) plans and 403(b) plans. Meanwhile, IRAs and 457 plans are common types of nonqualified retirement plans.

Final Thoughts

Whether you are planning to open a qualified or nonqualified retirement plan, it is important to consult a financial professional and get started on your retirement planning.

Qualified Retirement Plans FAQs

Your retirement plan is qualified if it meets the requirements of the IRC and ERISA. Usually, you have a qualified retirement plan if you have a 401(k) at work or if you are self-employed and have a solo 401(k).

Yes, a 401(k) is considered a qualified retirement plan. It meets the requirements of the IRC and ERISA for tax-deferred growth of investments and employer-matching contributions.

A qualified retirement plan is a retirement plan that meets the requirements of the IRC and ERISA on factors such as participation, vesting, operation, and discrimination. Examples include 401(k)s, 403(b)s, cash balance plans, and profit-sharing plans.

Both employers and employees benefit from a qualified retirement plan. For instance, employers can take advantage of tax deductions due to their contributions, while employees can defer taxes on their contributions and investment gains until they start withdrawing funds.

The advantages of a qualified retirement plan include employer-matching contributions, tax-deductible contributions for employers and employees, and tax-deferred growth of investments.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.