A warranty deed is a document that protects a person who is purchasing a property from any mortgages, liens, or encumbrances that might impede the transfer of ownership. Essentially, a warranty deed attests to the grantee (buyer) that the grantor (seller) holds the title to the property and has the legal capacity to sell it. This ensures that no unauthorized entity will attempt to seize possession of a property after it has been bought, giving buyers peace of mind. The warranty deed protects the grantee against any possible encumbrances in taking over the property. If such circumstances arise, it is the responsibility of the grantor to resolve or handle them. So prior to providing the warranty agreement, the grantor must exercise due diligence and seek the help of a title company. The title company searches for any problems or concerns that may have affected ownership of the title in the past. In a warranty deed, the grantor is held accountable for any breach following the title search, even if it happened without their knowledge or prior to their ownership of the property. During the completion of the sale, the grantee receives the warranty deed. The warranty deed contains an exact description of the property being transferred, a statement that the property is being transferred to the buyer, and mentions the purchase price. It is also signed and witnessed in accordance with state laws. After being notarized, the deed is sent to the relevant government authority for official recording. There are two primary types of warranty deeds: general warranty deeds and special warranty deeds. A general warranty deed verifies the current owner of the title as well as the whole title history of the property. It ensures that the buyer will not come across any claims, tax liens, or other encumbrances from any point in the ownership of the property. The buyer is given the most protection possible under a general warranty deed. Even if it happened without their knowledge or at a time when they did not own the property, the seller is liable for any breaches of the general warranty deed. A special warranty deed functions similarly to a regular warranty deed, with the exception that it only covers a specific period of time. The special warranty deed guarantees that the current seller is the owner of the property and that no claims were made against it while they were the owners. It does not cover claims made before the seller obtained the title. Whether using a general or special warranty deed, a title company must conduct due diligence and thorough investigation prior to the final sale. This will ensure there are no potential breaches before the property is passed to the buyer. The procedure for obtaining a warranty deed may vary depending on where you live. You might be able to utilize an online tool to create this document on your own. Official websites like the U.S. Securities and Exchange Commission (SEC) offer templates and other resources helpful in creating deeds. Alternatively, real estate agents or closing lawyers may assist with this process as well. The requirements for a warranty deed may also be governed by state regulations surrounding real estate transfers. Regardless, a warranty deed must always indicate: The warranty deed should be signed by the grantee, the grantor, and several witnesses. The deed also needs to be notarized and filed with the local register of deeds. Although the procedure is quite straightforward, you may want to speak with a real estate lawyer to ensure that your warranty deed is compliant with the law. If you are a buyer, you can demand a warranty deed before the sale can proceed. Obtaining a warranty deed is especially recommended if: If there are any problems with the property title after the sale has been completed, the grantor is liable for resolving them. The grantee could take legal action against the grantor to enforce this responsibility if necessary. Grounds for the dispute may include: If a subsequent claim is made by another party to the property, title disputes may also arise. As an illustration, let us imagine you purchase a house from a seller who offers a warranty deed. Assuming there are no claims against the property, you buy the house. Unknown to you, the seller had initially specified in their will that one of their children would inherit the house. After the seller's death, the child then comes forward to contest the deed's legality. A warranty deed will typically take precedence over a will's provisions. However, a dispute over the title to the property can result in monetary and legal difficulties that you do not want to deal with. Again, discussing any potential disputes with your real estate agent or attorney might help prevent them from occurring throughout the property purchasing process. Warranty deeds offer a few key benefits: Warranty deeds prove that the grantor has a legal right to sell the property. A warranty deed guarantees that the title to the property is clear of any outstanding claims or liens. If there are any issues with the title, the grantor is responsible for resolving them. Commercial lenders typically require a warranty deed when extending loans for the purchase of commercial real estate. This is because they want to be certain that the property can be used as collateral in case of default. While warranty deeds offer some key benefits, there are also some limitations, such as: A special warranty deed only guarantees that the title is clear of any claims or encumbrances during the time that the grantor owned the property. The general warranty deed offers more protection because it guarantees that the title is clear of any claims or encumbrances at any point in time. Creating and submitting warranty deeds involves additional costs for sellers. This is just one of the costs associated with real estate transactions, along with title fees, escrow fees, and transfer taxes. Even general warranty deed holders are encouraged to acquire title insurance to protect themselves from any potential claims made against their ownership in the future. In addition, homeowners may be forced to obtain title insurance as a condition when making a mortgage loan, even if they possess a general warranty deed. While warranty deeds are the most common type of deed, there are a few other types: A deed in lieu of foreclosure is when a homeowner signs over their title to the lender in exchange for debt relief. This type of deed is often used as an alternative to going through the more lengthy or costly formal foreclosure process. The quitclaim deed is a legal document that transfers property from one person to another without a sale. It is typically done between relatives or following a divorce. A quitclaim deed restricts the previous owner from holding any additional interests in the property in the future. During legal procedures, a special purpose deed is used to allow authorized representatives to transfer property without subjecting themselves to personal liability. The title of a property can be transferred from one person to another via a warranty deed or a deed of trust. However, a major difference between the two involves the person who is being protected by each contract. A warranty deed offers the grantee or buyer protection from inheriting any liens or future claims made against the property. If there are problems with the property's title after the sale has been completed, the warranty deed holds the grantor or seller liable for resolving them. In contrast, a trust deed protects the beneficiary or lender from the possibility of the borrower or trustor defaulting on their loan. A deed of trust involves a trustor (the borrower), the beneficiary (the lender), and the trustee (an unbiased third party). The borrower, sometimes referred to as the trustor, is the individual whose assets are held in the trust. The beneficiary's investment interest is the one being safeguarded. While the borrower's debt is being repaid, the trustee is the owner of the property in law. The trustee dissolves the trust and returns ownership of the property to the borrower after the debt is repaid. A warranty deed offers the greatest amount of protection to the buyer. For this reason, it is the most common type of deed used to transfer property ownership. When you purchase a home, you will likely sign a warranty deed that guarantees you full and clear ownership of the property. Should any issues arise with the title in the future, you will be protected from legal action. While a deed of trust also offers protection, it is typically used in situations where the buyer is borrowing money from a lender. In this case, the lender is protected by the deed of trust until the debt has been repaid in full. Other types of deeds exist, but they are not as commonly used as warranty deeds and deeds of trust. These include quitclaim deeds, deeds in lieu, and special purpose deeds. You can get a warranty deed if you are buying or selling a property. The deed will be signed by the grantor and notarized to make it legally binding. You may also be required to pay a small recording fee to have the deed filed in your local county registrar's office. Warranty deeds offer many benefits, but there are also some limitations to be aware of. Understanding how they work can help you make the best decision for your needs. Be sure to consult with an experienced real estate attorney if you have any questions about property deeds or are involved in a legal dispute. What Is a Warranty Deed?

How Warranty Deeds Work

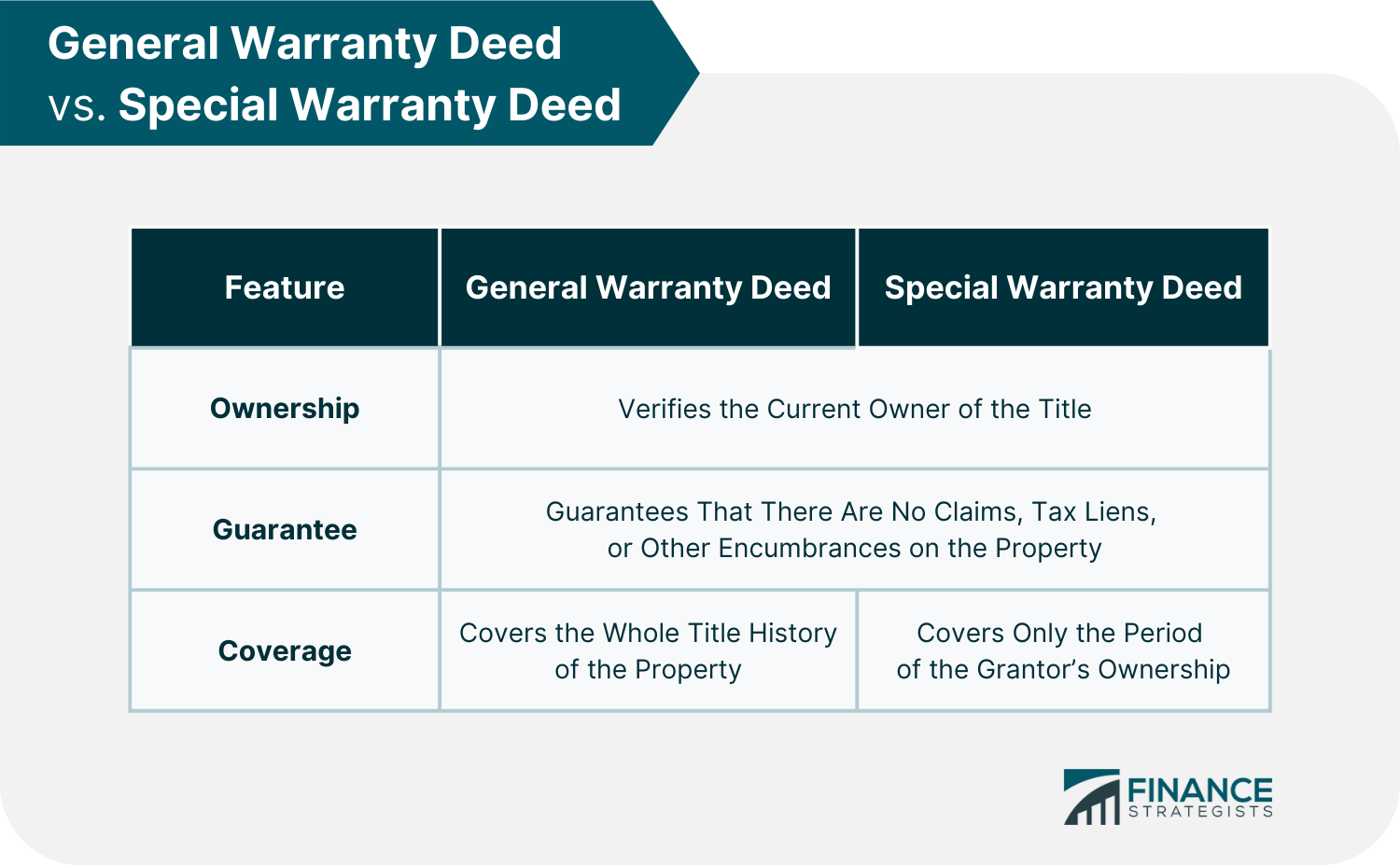

Types of Warranty Deeds

General Warranty Deed

Special Warranty Deed

How to Get a Warranty Deed

Who Should Get a Warranty Deed?

Warranty Deed Legal Disputes

Benefits of Warranty Deeds

Limitations of Warranty Deeds

Other Types of Property Deeds

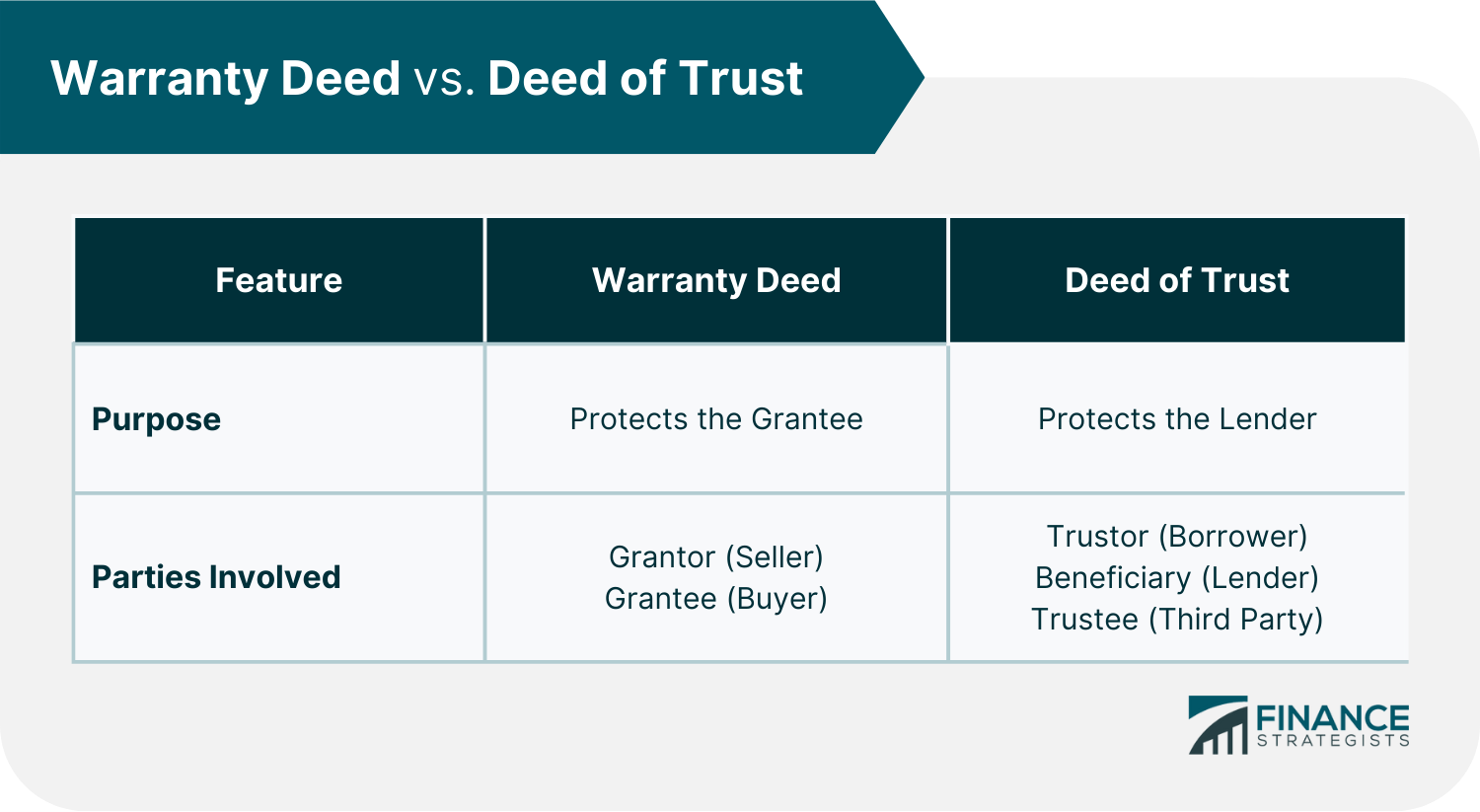

Warranty Deed vs Deed of Trust

Final Thoughts

Warranty Deed FAQs

A warranty deed is a legal document that is used to transfer ownership of real property from one person to another. The deed contains language that offers the grantee (buyer) certain protections, such as ensuring that the property does not have any outstanding liens or encumbrances.

A warranty deed does not establish a buyer's ownership of the property. Instead, it indicates that the seller is able to guarantee that no one else is the owner of the property or owes money to it. The property is not fully yours until the title is given to you.

A deed of trust is similar to a mortgage in that it establishes a legal relationship between a borrower and a lender. The property is held in trust by a third party until the debt has been repaid, at which point ownership is transferred to the borrower. Warranty deeds are typically used to transfer ownership of property outright without involving any debt.

You will need a warranty deed if you are a business owner looking to acquire or sell real estate, transferring the ownership of a property to a trust, desire to be protected against any legal claims that may arise from the ownership of the property, or if you are looking to get a loan and use the property as collateral.

A general warranty deed offers the greatest amount of protection to the buyer, as it guarantees that the title is free and clear of any liens or encumbrances at any point in time. A special warranty deed only protects against any claims or liens that were placed on the property during the time that the seller owned it.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.