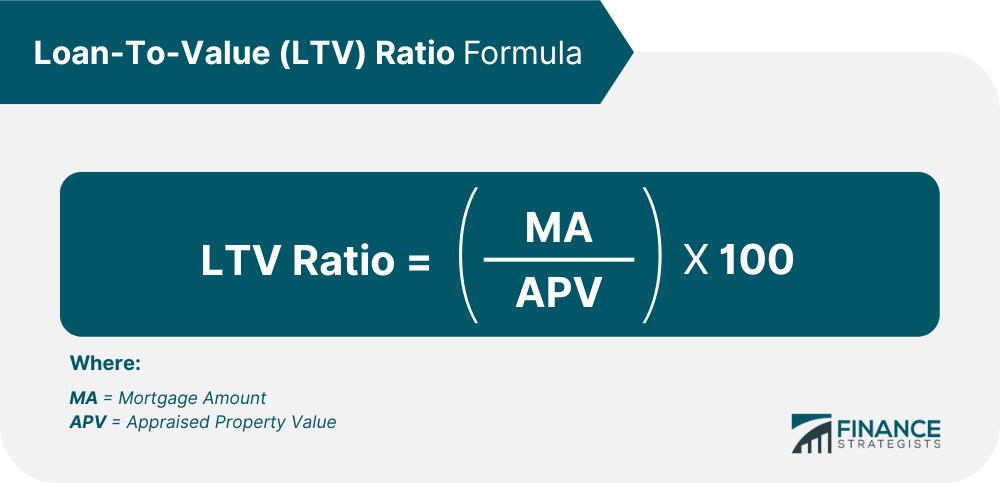

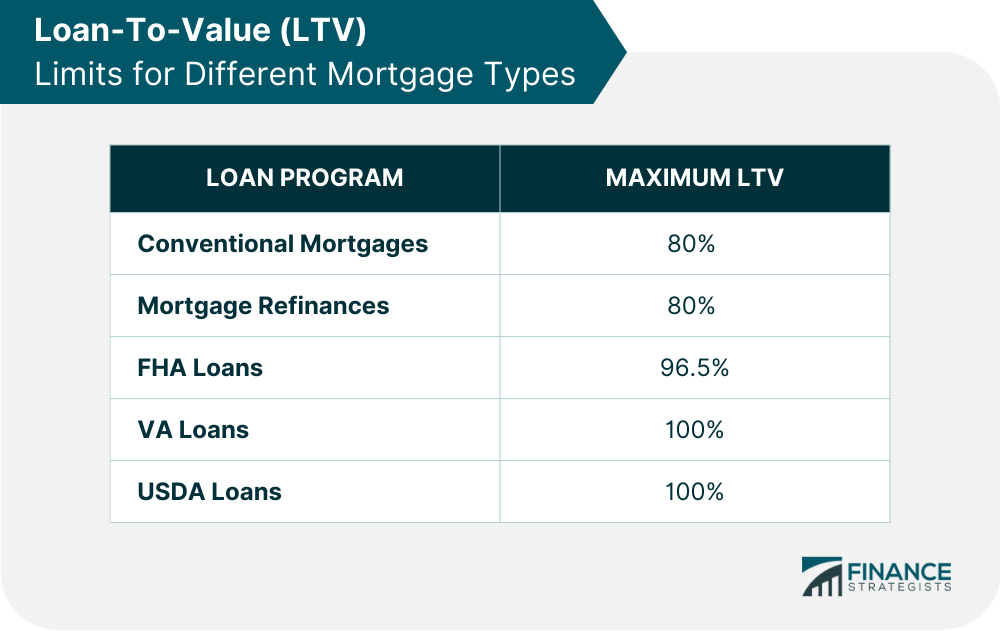

The Loan-To-Value (LTV) ratio is used by banks, mortgage lenders, and other financial institutions to compare the amount of debt financing needed to purchase a home with its appraised value. The LTV ratio is one of the tools that lenders use to assess risk when offering loans. It also helps them determine the amount they are willing to loan an individual or business. Each lender requires different LTV ratios, so borrowers should research before selecting one. Loan-to-value ratios may also affect the approval of a loan, so borrowers need to be aware of this concept and use it to their advantage. The loan-to-value ratio is essential for both the lender and the borrower. This measurement helps lenders manage risk when issuing home or property loans. Different LTV ratios signify different levels of risk for lenders, influencing which loans they approve. On the other hand, knowing their LTV ratio can help borrowers optimize their loan application to ensure it is approved. For instance, to get approved for a mortgage loan, they can increase the amount of their down payment or lower their requested loan to meet the LTV criteria of a particular lender. Different lenders have different LTV ratio criteria, which prospective borrowers may or may not be able to meet. Thus, the LTV ratio also helps borrowers determine which lender is the most appropriate one for them. The loan-to-value ratio is calculated by dividing the loan or mortgage amount by the property's appraised value. The resulting amount is then multiplied by 100. For example, if a borrower took out a $200,000 loan for a home valued at $250,000, their LTV ratio would be calculated as follows: LTV Ratio = 200,000/250,000 x 100 This means that the borrower's loan-to-value ratio would be 80%. Different mortgage types have various loan-to-value ratio limits. Conventional mortgages are loans that follow the guidelines set by government-sponsored enterprises (GSEs) such as Fannie Mae or Freddie Mac. Generally, these loans have a maximum LTV ratio of 80%, meaning that the loan is typically no more than 80% of a property’s appraised value. LTVs for this type may vary based on the kind of property refinanced, whether the mortgage is fixed or adjustable and whether a homeowner is doing a standard refinance or cash out. However, mortgage refinancing generally requires a maximum LTV ratio of around 80% of the property's appraised value. The Federal Housing Administration (FHA) also has specific guidelines for loan-to-value ratios. Generally, the maximum LTV ratio is 96.5%, meaning that a borrower can finance up to 96.5% of the appraised value of their property with an FHA loan. However, borrowers must note that no matter how much their down payment is, they will still be required to pay for mortgage insurance when they take out an FHA loan. Generally, Veterans Affairs (VA) loans have a maximum LTV ratio of 100%. This means that veterans can finance up to 100% of the value of their property with a VA loan. However, unlike FHA loans, VA loans do not require borrowers to purchase mortgage insurance as part of the loan program. This can be a significant advantage for some borrowers looking to save money on their monthly payments. The U.S. Department of Agriculture's (USDA) LTV ratio for home loans is typically 100%, meaning borrowers can finance up to the total value of their home with a USDA loan. USDA loans are available to eligible borrowers who live in rural areas or have limited access to traditional home mortgage loans. However, additional requirements may need to be met, including income limits. The ideal LTV ratio for most lending institutions is 80%, meaning the loan amount should be, at most, only 80% of a property's appraised value. It is to the borrower's advantage to aim for a lower LTV by increasing their down payment and lowering their loan amount. Lower LTVs can signify to lenders that borrowers have invested considerable equity in the property in the form of a higher downpayment. Thus, the borrower is less likely to default on their financial obligations. Borrowers with lower LTVs are perceived to be less risky since they request a smaller loan amount. A lower LTV increases borrowers' chances for approval, improves interest rates, and grants them the freedom to choose between lenders. One crucial metric that lenders examine when issuing loans is the Loan-To-Value ratio. The LTV ratio compares the loan amount vs. the value of the asset being acquired. For example, if a borrower took out a $250,000 loan to purchase a $300,000 home, their LTV would be 83%. Most lenders approve loans with an LTV ratio of at most 80%. Thus, it benefits the borrower to have a lower LTV when taking out a loan. However, there are times when two loans are used to secure one asset. In this case, lenders might look at the Combined Loan-To-Value (CLTV) Ratio instead. CLTV factors in multiple mortgages and other loans secured by the same property and divide that sum by its value. For instance, if someone has an existing mortgage worth $200,000 and then obtains a second mortgage for $50,000 on a $400,000 home, their Combined Loan-To-Value would be 62.5%. Lenders tend to require lower CLTV ratios since it is a more comprehensive risk measurement. Whether lenders use the LTV or CLTV to assess a loan’s risk, knowing about these key metrics can help prospective home buyers understand how much money they can borrow when purchasing a property. The loan-to-value ratio is a financial term used to represent the amount of money borrowed from a lender compared to the total value of the asset. It is calculated by dividing the loan amount by the asset's appraised value and multiplying the quotient by 100 to produce a percentage. Knowing the loan-to-value ratio is essential when purchasing high-value assets such as real estate or vehicles that require significant upfront financing. This number can determine how likely lenders are willing to finance these investments and at what interest rate. Different types of lenders can require various LTV ratios. However, regardless of the LTV ratio they require, lenders often limit their exposure to risk by requiring a low LTV ratio. This is because the higher the LTV ratio, the greater risk that the lender takes on by approving the loan. In general, loans with higher LTV ratios are associated with higher interest rates, while loans with lower LTV ratios tend to have more advantageous terms for borrowers. Knowing about this metric can help borrowers optimize their loan applications and obtain better terms. What Is the Loan-To-Value (LTV) Ratio?

Why Do LTVs Matter?

How to Calculate the Loan-To-Value (LTV) Ratio

= 80%Loan-To-Value (LTV) Limits for Different Mortgage Types

Conventional Mortgages

Mortgage Refinances

FHA Loans

VA Loans

USDA Loans

What Is a Good LTV?

LTV vs. Combined LTV

The Bottom Line

If you plan to place a loan to purchase property, you can consult with a mortgage loan officer and see how your loan-to-value ratio can influence your approval chances.

Loan-To-Value (LTV) Ratio FAQs

The Loan-to-Value ratio is calculated by dividing the loan amount by the property's appraised value. For example, if a borrower takes out a $250,000 loan to purchase a $300,000 home, their LTV would be 83%.

One of the main drawbacks of loan-to-value is that lenders view high LTV ratios as a greater risk. Thus, borrowers with higher LTV ratios may have to pay higher interest rates or may not qualify for financing. Borrowers with an LTV ratio above 80% may also be required to purchase private mortgage insurance, which can make their monthly payments more expensive.

Borrowers can lower their Loan-to-Value ratio by making a larger down payment on the property or reducing their overall loan. If borrowers do not have the financial capacity to do either on their own, they may raise money from friends or family.

Loan-to-Value ratios are affected by the borrower's down payment, property appraisal value, and overall loan amount. A larger down payment will result in a lower LTV ratio, whereas a higher loan amount or lower appraised value will lead to a higher LTV ratio.

The primary difference between Loan-to-Value (LTV) and Combined Loan-to-Value (CLTV) is the number of loans included in the calculation. LTV only considers the primary loan, while CLTV factors in multiple loans secured against one asset.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.