Freddie Mac, officially the Federal Home Loan Mortgage Corporation, is a government-sponsored enterprise (GSE) created to provide stability and affordability to the US housing market by purchasing mortgages from banks and other lenders. Freddie Mac does not provide loans directly to homebuyers. Instead, it shifts the risk of loans it bought from private investors and enables them to free up capital for more lending. Over its history, Freddie Mac has become one of America’s most significant sources of home mortgage financing. It provides funding for millions of Americans looking to purchase or refinance a home. Freddie Mac was established in 1970 by Congress under the Federal Home Loan Mortgage Corporation Act as a counterbalance to prevent the dominance of Fannie Mae (Federal National Mortgage Association) in the housing market. Freddie Mac was reorganized in 1989 under the Financial Institutions Reform, Recovery, and Enforcement Act (FIRREA). It became a publicly traded company, with stock trading on the New York Stock Exchange (NYSE). In 2003, it was discovered that top executives had manipulated financial reports to conceal billions of dollars in losses, resulting in a $125 million fine and criminal charges against some of Freddie Mac's former executives. Furthermore, as a result of the scandal, Freddie Mac had to restate its earnings from 2000 to 2002 and pay an additional $5 billion in previously undisclosed losses. Freddie Mac also played a role in the 2008 financial crisis due to its involvement in the subprime mortgage market, along with Fannie Mae. The companies purchased large amounts of these mortgages from lenders and then packaged them as securities to be sold on the open market. Freddie Mac and Fannie Mae helped fuel the housing bubble, leading to record foreclosures and an economy-wide collapse when it burst. In September 2008, the Federal Housing Finance Agency placed the companies into conservatorship. This move allowed the government to restructure Freddie Mac and Fannie Mae's debts and provide them additional capital to remain solvent. Since then, Freddie Mac has been working to rebuild its reputation and increase homeownership opportunities for families across the US. Freddie Mac is tasked with preserving stability and affordability in the US housing market and correctly responding to the private capital market. It helps create a secondary market by purchasing mortgages from banks, credit unions, and other loan originators and selling them as mortgage-backed securities. With this, it provides market liquidity, allowing institutions to free up capital for more lending opportunities. Freddie Mac also works with lenders to originate loans, redesigning and adjusting mortgage products to make them more attractive to potential buyers. It sets standards for the industry regarding underwriting and loan origination and guides managing risk. Freddie Mac primarily performs its roles through its two business segments: Single-Family and Multifamily. This area helps first-time buyers, people with low to moderate income, and live in underserved markets purchase a home. It focuses on conventional, conforming mortgages for one- to four-unit houses, condominiums, and manufactured homes. Through its Single-Family business segment, Freddie Mac ensures homeowners have access to competitively priced mortgage products and services. The company works with lenders across the US to provide loans that best fit the needs of borrowers. It gives lenders confidence in providing extended and fixed-rate loans, making homeownership more affordable. Freddie Mac also assists homeowners in avoiding or processing foreclosures by working closely with lending institutions. This area focuses on helping people access affordable rents on apartment homes. Freddie Mac buys loans from specialized lenders for multifamily properties, like conventional, subsidized, senior, and student housing across the US. This segment provides long-term financing to owners of multifamily rental housing and promotes affordable housing investments. Freddie Mac works with lenders to offer funding for developers who rent out homes to low-to-moderate-income people. Freddie Mac helps ensure people in all parts of the country can access safe and decent rental homes at reasonable prices. The company aims to create stable communities by boosting local economies, creating jobs, and supporting public safety initiatives. Freddie Mac offers a variety of mortgage programs that aim to help people access and maintain homeownership. These include: It is a mortgage option for first-time homebuyers that offer as low as a 3% downpayment. It allows a 97% loan-to-value (LTV) ratio or a 105% total loan-to-value (TLTV) with Affordable Seconds and other secondary financing schemes. It offers more flexible credit requirements. Borrowers only need a usable credit score or a minimum of 620 and an "Accept" grade from Freddie Mac's Loan Product Advisor tool. To be considered a first-time homebuyer, the borrower must not have owned a house within three years of the loan. Borrowers must also commit to living in the property as a primary residence and undergo homeowner education from Freddie Mac. A 35% mortgage insurance is also required for an LTV ratio above 95%. HomeOne covers 1-unit homes, condominiums, and planned unit developments (PUDs). It does not include manufactured homes. Lastly, HomeOne has no income or geographic limits. This program is designed for very-low- and low-income borrowers with a minimum down payment of 3%. It allows 97% LTV and up to 105% TLTV for Affordable Seconds. For 1-unit properties, the program also allows a 97% high total loan to value (HTLTV). Borrowers qualify if they earn less than 80% of the area median (AMI) and have a minimum credit score of 660 or higher. Home Possible is also available to first-time homebuyers. It covers 1- to 4-unit homes, condominiums, PUD, and eligible manufactured homes. No occupancy or ownership restrictions exist, but first-time homebuyers must take homeowner education. Home Possible requires 16% mortgage insurance from borrowers with an LTV ratio of 90-95%, which decreases accordingly. Insurance requirements may be waived for borrowers with an LTV ratio below 80%. This program is designed for borrowers who want to combine construction conversion with low-down-payment mortgage programs for permanent financing flexibility. They can select from 2 different loan options: Construction Conversion Mortgage (CCM) and Renovation Mortgage (RM). Funds are released after an appraisal of the value of the completed renovation. CCM allows borrowers to purchase a property that needs significant repairs. The borrower will get the money in draws throughout the renovation process. RM provides funds upfront so borrowers can buy and remodel an existing property. CCM and RM have no income restrictions unless paired with HomeOne and Home Possible. The program caters to primary residences, second homes, and investment properties. Borrowers are required to have at least a 660 credit score. Property types include 1- to 4-unit homes, condominiums, and PUD, while loans for the permanent installation of manufactured homes are also covered. LTV ratios, insurance, and other requirements depend on underlying mortgage programs like HomeOne or Home Possible. This program helps low- to moderate-income borrowers buy or refinance manufactured homes designed for permanent placement on a lot or leased land. Besides providing financing, Freddie Mac offers guidance on setting up the house and securing it to the ground. The Manufactured Home Mortgage is available in 1-unit configurations. Minimum credit score requirements are not specified by Freddie Mac, while income, insurance, LTV ratio, and homeowner education requirements follow underlying mortgage programs. Loans are allowed for primary or secondary homes but not investment properties. These programs are for borrowers who wish to refinance their existing mortgage due to financial hardship or a decline in home value. Relief Refinance and HARP allow refinancing with an original LTV ratio of 80%. There are no upper limits for fixed-rate mortgages. The programs require a minimum credit score of 660 for 1- to 4-unit primary residences and no income limits. Insurance coverage follows the original requirements for the mortgage being refinanced. Property types include single-family 1- to 4-unit homes, PUDs, condominiums, and manufactured homes. These programs can be applied to primary residences, investment properties, and 1-unit secondary homes. Freddie Mac and Fannie Mae are GSEs that play an essential role in the US mortgage industry. They both help provide liquidity and stability to the housing market by purchasing mortgages from lenders, allowing them to make more loans available to consumers. Fannie Mae is older as it was established in 1938 as part of Roosevelt's New Deal. Freddie Mac was created later to expand the secondary mortgage market Fannie Mae initiated. These GSEs also differ in mortgage sourcing. Freddie Mac typically buys loans from smaller lenders and credit unions, while Fannie Mae usually works with large commercial banks. Fannie Mae offers mortgage programs like HomeReady, Standard 97% LTV, HomeStyle Renovation, Standard Manufactured Housing, MH Advantage, and RefiPlus/HARP, which have different requirements and specifications compared to Freddie Mac's programs listed above. Freddie Mac has been a significant mortgage industry force for over 50 years. Its mission of providing liquidity and stability to the mortgage market has made it a critical player in the US housing system, along with Fannie Mae. Freddie Mac has helped millions of Americans access affordable home financing over the years, making homeownership possible for many who may not have otherwise been able to obtain funding. It has two main areas: Single-Family and Multifamily Business Segments. Its programs range from home buying to refinancing mortgages. Work with a mortgage broker to learn more about Freddie Mac and how it can help you get the financing you need.What Is Freddie Mac?

History of Freddie Mac

What Does Freddie Mac Do?

Freddie Mac Business Segments

Single-Family Business Segment

Multifamily Business Segment

Freddie Mac Mortgage Programs

HomeOne

Home Possible

Construction Conversion and Renovation Mortgage

Manufactured Home Mortgage

Relief Refinance/Home Affordable Refinance Program (HARP)

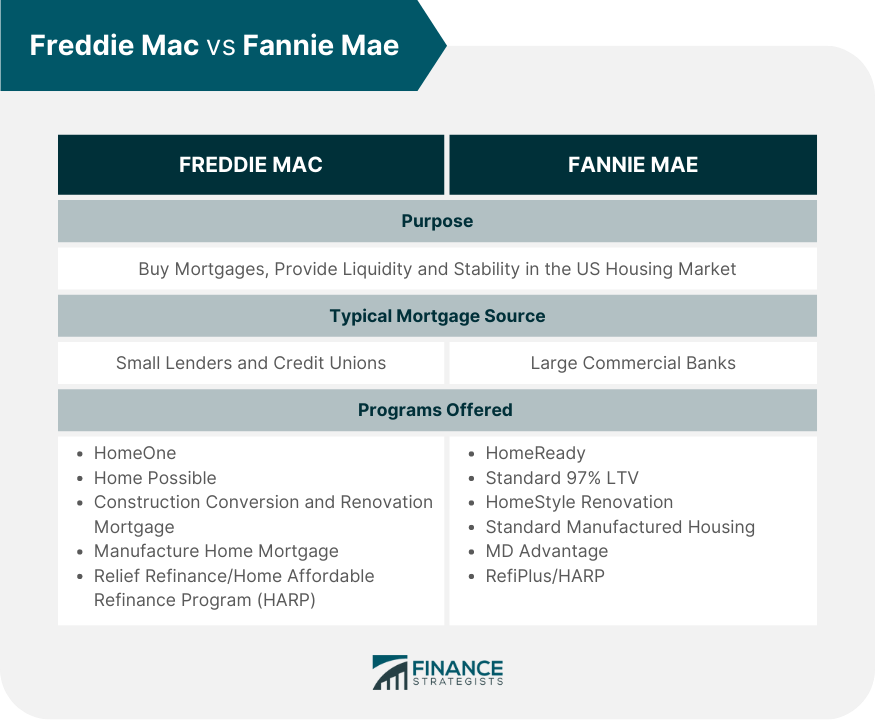

Freddie Mac vs Fannie Mae

Final Thoughts

Freddie Mac FAQs

Freddie Mac is a government-sponsored enterprise (GSE) created to support the secondary mortgage market and increase access to home ownership. By purchasing mortgages from lenders, Freddie Mac helps keep mortgage rates low and creates liquidity in the housing market.

The main difference is mortgage sourcing. Freddie Mac usually buys mortgages from smaller institutions, while Fannie Mae typically works with larger commercial banks. Their programs also differ in specifications and requirements.

Eligibility requirements depend on the specific mortgage program. For example, Home Possible sets income limits based on area median income (AMI), while HomeOne is open to all income classes.

In 2003, it was uncovered that top executives had manipulated financial reports to hide billions of dollars in losses. This led to investigations by both federal and state authorities and resulted in $125 million worth of fines against Freddie Mac and criminal charges against some of its former executives. Furthermore, the scandal caused Freddie Mac to restate its earnings from 2000-2002 and required it to pay an additional $5 billion in previously undisclosed losses.

Freddie Mac does not set a minimum loan amount for home buyers. It encourages lenders to make loans of any amount as part of its mission to expand access to mortgages.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.