Medicaid is a vital healthcare program in the United States that provides healthcare coverage for millions of low-income individuals and families. Medicaid is a joint federal and state program that provides healthcare coverage to eligible low-income individuals and families. It aims to ensure that these individuals can access essential medical care and services without incurring heavy financial burdens. Established in 1965, Medicaid has since become an essential safety net for millions of Americans. Medicaid was enacted in 1965 under Title XIX of the Social Security Act, alongside Medicare. Initially designed to provide healthcare coverage to welfare recipients, it has since expanded to cover a wider range of low-income individuals. Over the years, numerous legislative changes have been made to refine and expand the program's reach. Eligibility for Medicaid is determined by a combination of income guidelines and categorical requirements, with some variations by state. In this section, we will discuss the federal poverty level, modified adjusted gross income, and categorical requirements for eligibility. Medicaid uses the federal poverty level (FPL) and modified adjusted gross income (MAGI) to determine eligibility. The FPL is an income threshold set by the government that varies by family size, while MAGI is an individual's or family's income adjusted for deductions. Medicaid coverage is generally available to children and pregnant women, elderly individuals, and individuals with disabilities who meet the income requirements. Specific eligibility criteria vary by state, but the program is designed to provide support for vulnerable populations who may struggle to afford private insurance. States have the option to expand Medicaid eligibility beyond federal guidelines. Additionally, states can apply for waivers or state plan amendments to modify their programs, leading to variations in eligibility and coverage across the country. Medicaid offers a wide range of healthcare services, including mandatory and optional benefits, as well as long-term care services. In this section, we will discuss the key benefits and services provided under the program. Mandatory benefits are services that every state Medicaid program must provide. These include inpatient and outpatient hospital services, physician services, and laboratory and x-ray services. These benefits ensure that Medicaid enrollees have access to basic medical care and essential diagnostic services. Optional benefits are services that states can choose to provide under their Medicaid programs. Examples include prescription drug coverage, dental care, and home and community-based services. States have discretion in determining which optional benefits to offer, leading to variations in coverage across the country. Medicaid is the largest payer of long-term care services in the United States, covering nursing facility services and home health services. These services provide essential support for elderly individuals and those with disabilities, helping them maintain their independence and quality of life. Despite its importance, Medicaid faces various challenges and controversies, including access to care, fraud and abuse, and program sustainability. In this section, we will briefly discuss these issues and their impact on the program. Access to care is a critical concern in Medicaid, with provider reimbursement rates and the availability of providers playing a significant role. Low reimbursement rates may deter some providers from accepting Medicaid patients, while a shortage of providers in certain areas can limit access to care for enrollees. Fraud and abuse in Medicaid can lead to financial losses and undermine program integrity. Detection and prevention efforts are essential to ensure that funds are used appropriately and that enrollees receive the care they need. With increasing enrollment and rising healthcare costs, the sustainability of Medicaid is a topic of ongoing debate. Policymakers and administrators must balance the need to provide essential healthcare services with the financial constraints faced by federal and state governments. Medicaid is jointly funded by the federal government and individual states, with costs shared through the Federal Medical Assistance Percentage (FMAP) and state contributions. Additionally, cost sharing and premiums are used to help offset expenses for both the program and enrollees. The FMAP is a formula that determines the federal government's share of Medicaid costs, with states covering the remaining expenses. The FMAP varies by state, taking into account each state's per capita income relative to the national average. This ensures that states with lower per capita incomes receive a higher federal matching rate, helping to balance the financial burden. Cost sharing refers to the portion of healthcare costs that Medicaid enrollees are responsible for, including copayments and deductibles. These amounts are typically minimal, ensuring that low-income individuals can still access care without excessive financial strain. Some states may also require premiums for certain populations, but these are generally modest and based on income. Medicaid is a significant portion of both federal and state budgets, with expenditures continually rising due to factors such as increasing enrollment and rising healthcare costs. Policymakers and administrators continue to seek ways to control costs while maintaining quality care for enrollees. Managed care is a healthcare delivery system that aims to improve efficiency and control costs, and it is widely adopted in Medicaid programs. In this section, we will discuss the types of managed care organizations and the benefits of managed care for Medicaid. Health Maintenance Organizations (HMOs) and Preferred Provider Organizations (PPOs) are the two primary types of managed care organizations utilized in Medicaid. HMOs offer a network of healthcare providers, while PPOs allow enrollees to choose from a broader range of providers, often at a higher cost. Managed care can lead to cost savings and quality improvement for Medicaid programs. By coordinating care and emphasizing preventive services, managed care organizations can help reduce unnecessary medical expenses and improve health outcomes for enrollees. Medicaid is a critical component of the U.S. healthcare system, providing healthcare coverage for millions of low-income individuals and families. As policymakers and administrators grapple with the challenges and controversies surrounding the program, it remains a vital safety net for some of the nation's most vulnerable populations. Ongoing policy debates and reforms will continue to shape the future of Medicaid and its role in ensuring access to quality healthcare for those in need.What Is Medicaid?

Eligibility Criteria of Medicaid

Income Guidelines

Categorical Requirements

State Variations in Eligibility

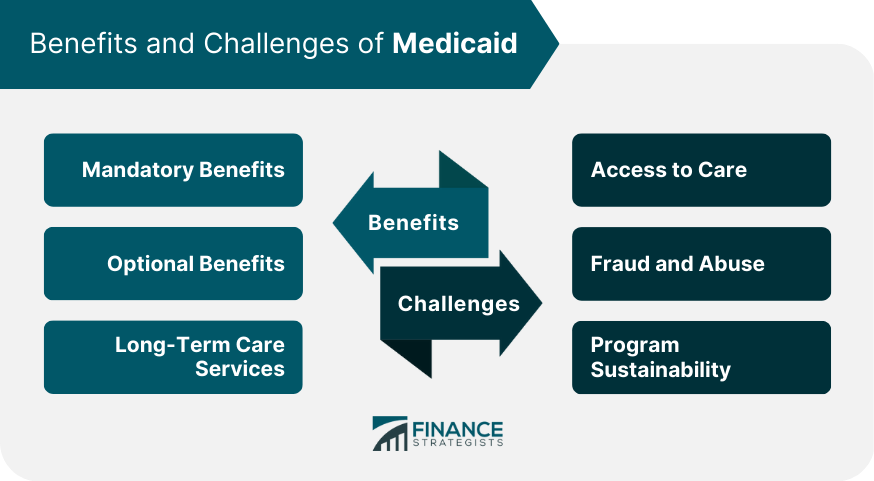

Benefits of Medicaid

Mandatory Benefits

Optional Benefits

Long-Term Care Services

Challenges and Controversies

Access to Care

Fraud and Abuse

Program Sustainability

Medicaid Financing

Federal and State Funding

Cost Sharing and Premiums

Medicaid Expenditure Trends

Medicaid Managed Care

Types of Managed Care Organizations

Benefits of Managed Care

Conclusion

Medicaid FAQs

Medicaid is a federal and state health insurance program that provides coverage to low-income individuals, families, pregnant women, children, and people with disabilities.

Eligibility for Medicaid varies by state, but generally, individuals with limited income and resources, including pregnant women, children, seniors, and people with disabilities, may be eligible.

Medicaid covers a range of benefits, including doctor visits, hospital stays, prescription drugs, preventive care, and long-term care services.

Medicaid is financed by both the federal and state governments. The federal government provides a matching payment to states based on their per capita income, while states contribute a portion of their own funds.

You can apply for Medicaid through your state's Medicaid agency. Eligibility requirements and application processes vary by state, but many states allow you to apply online, by mail, or in person.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.