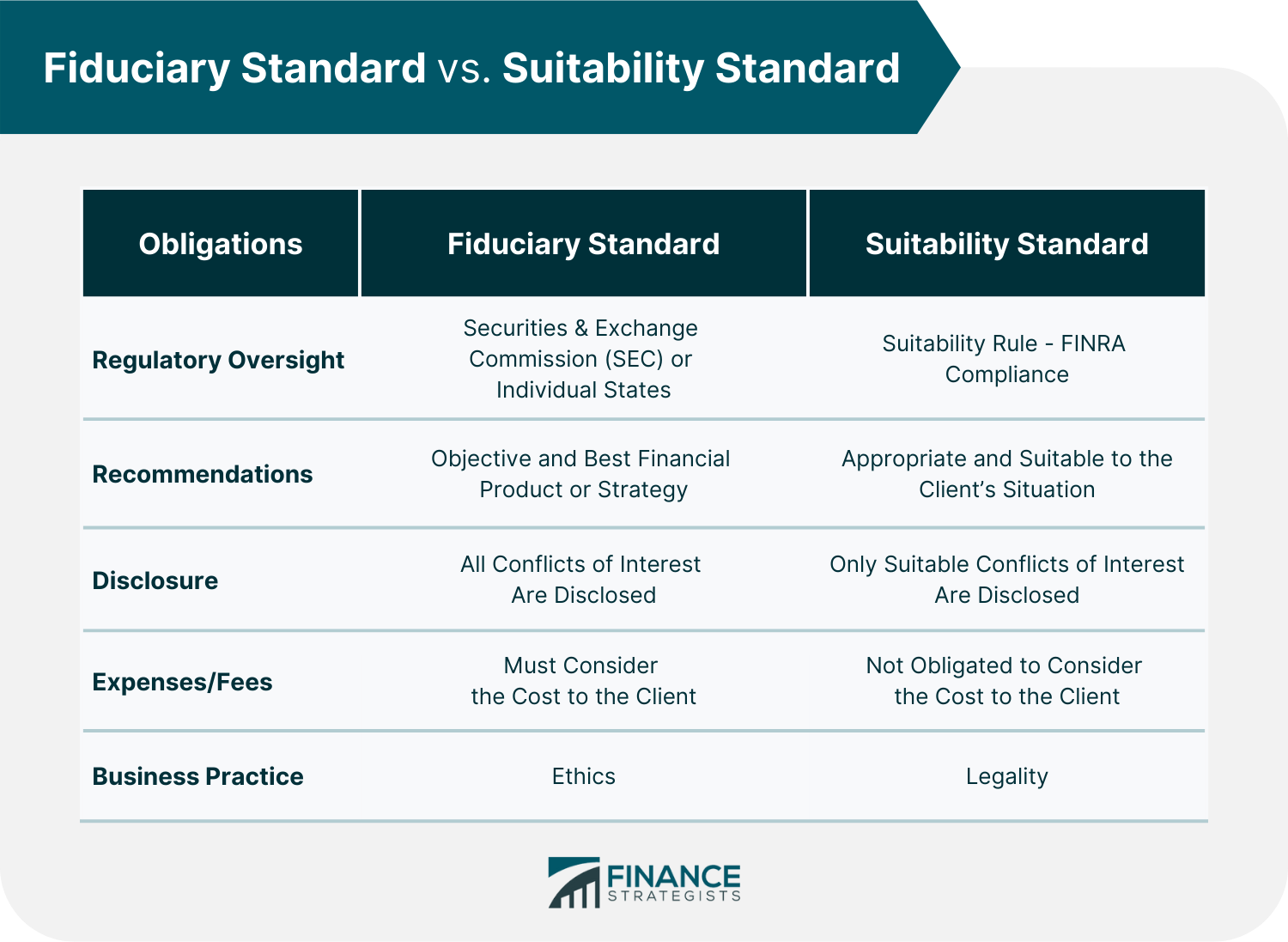

A fiduciary financial advisor is a professional legally bound to act in their client's best interests. This means that they must always put their client's needs first, ahead of their own. Financial advisors, attorneys, estate executors, and real estate brokers are examples of these experts. Fiduciaries can only offer financial solutions that benefit a given client's economic circumstance entirely since they operate in their customers' best interests and must disclose any conflicts of interest to their clients, such as benefitting at the expense of a client. Fiduciary financial advisors have two primary duties: duty of care and duty of loyalty. Duty of care means they are obligated to make informed business judgments by analyzing all available information about the client's financial situation before making suggestions or plans under this provision. Duty of loyalty demands that a fiduciary should not use their position to satisfy their own interests, such as offering recommendations for financial products on which they may get a commission but may not necessarily be in the best interest of the client. Professionals in the financial industry abide by two standards: suitability and fiduciary standards. The fiduciary standard is the highest legal obligation that one can have to another person. It obligates the fiduciary to always act in the best interests of the person they represent. This duty supersedes any other duty, including the fiduciary's self-interest. The suitability standard, in contrast, requires financial professionals to only offer products and services suitable for their clients. This standard is inferior to the fiduciary standard because it does not consider the client's best interests but merely whether or not a particular financial product is appropriate for the client's situation. Financial advisors who uphold the suitability standard offer products and services to clients that help them earn a fee and a commission. This usually means it is more expensive for clients. Professionals who adhere to the fiduciary standard go further than what is suitable and make an oath to provide recommendations with the client's best interest in mind and disclose all possible conflicts of interest that may arise. The table below summarizes the key differences between the two: Not all financial advisors have a fiduciary duty to their clients. In fact, most do not. They may have a legal duty to provide suitable advice, but they are not bound to act in their client's best interests. While it is not imperative, hiring a financial advisor with a fiduciary duty, such as one connected to an SEC-registered business or a Registered Investment Advisor (RIA), can provide peace of mind. Knowing that your advisor is legally obligated always to put your interests first can be helpful. Robo-advisors are computer algorithms that provide recommendations for investments with limited human interaction. Robo-advisors registered with the SEC are naturally fiduciaries. ERISA's fiduciary rules should likewise be observed for Robo-advisors that offer advice on 401(k) plans. However, some Robo-advisors may not wholly adhere to these fiduciary duties due to minimal human supervision. For example, a Robo-advisor may have an algorithm that fails to take into account a client's investment objectives and risk tolerance. Hence, this may hinder the Robo-advisor from creating specific and customized client plans. Nevertheless, Robo-advisors should still err on the side of caution and observe fiduciary duty to the fullest extent. A fiduciary breach can occur when a fiduciary financial advisor fails to act in their client's best interests, puts their own interests ahead of their clients, or does not disclose any potential conflicts of interest. This might imply the advisor did something as serious as exchanging investments without their client's permission, or it could mean something as basic as neglecting to declare any conflicts of interest linked with investments. Breaches can also occur when a customer account is used to make excessive transactions to collect fees or when a client account is used to purchase stocks for oneself. When financial advisors break their fiduciary duty, they can be subject to civil liability and professional disciplinary sanctions like suspension or barred from the industry. The penalty for a fiduciary breach involves compensatory damage to make up for the loss the clients experienced due to the violation. Additionally, punitive damages can be imposed as punishment and discouragement from breaching their fiduciary duties in the future. Fiduciary financial advisors offer their clients the following advantages. Working with a fiduciary can provide peace of mind, knowing that your interests always come first. Clients can be assured that fiduciaries will provide objective recommendations and have their best interests in mind. A fiduciary will have fewer conflicts of interest because they are legally bound to disclose potential conflicts and create tailored and customized investment plans based on each client's needs and goals. Clients can be assured that fiduciaries will be transparent about their fees, commissions, and other sources of compensation. Fiduciaries are also transparent with their propositions and strategies. Fiduciaries guarantee clients that the solutions provided are needs-based as opposed to products-based. This means that the fiduciary will make recommendations based on what is best for the client rather than what earns them the most commission. When working with a fiduciary financial advisor, it is essential to consider the following factors: Fiduciaries usually charge in the same manner as most financial advisors do, depending on the services they will provide, their length of experience, memberships, credentials, and certifications. The 2022 data from the U.S. Bureau of Labor Statistics show that financial advisors' national mean hourly wage is $72.44. Financial advisors may also be paid a flat fee when creating a full financial plan for a client, typically costing around $3,000. Some financial advisors earn with the traditional Assets Under Management (AUM) model, which charges an average of 1% of the assets being handled annually. Fiduciaries often use the fee-only model, which means they will only earn income from the clients. This is to avoid any conflict of interest, and the fiduciary can stay true to having their client's best interest in mind. A client can directly ask a financial advisor if he or she is a fiduciary and verify their status. It is important to ask if the fiduciary is receiving any other compensation to clear out any conflict of interest. Ensure that the advisor is not selling any investment products and that the primary duty is to provide unbiased and objective advice. Verify the advisor's credentials if he or she is registered and check if their records are as declared on their memberships and certification. Requesting referrals from people you trust is one of the most excellent methods to discover a trustworthy financial advisor. Inquire with relatives and friends if they know somebody. The National Association of Personal Financial Advisors (NAPFA) is the fee-only financial advisors' most prominent professional association. All members of NAPFA adhere to a strict code of ethics. You may also look up the Certified Financial Planner Board website which lists down its members to be searched by city or state. CFP professionals must uphold the CFP Board's Standards of Professional Conduct, which requires them to act as fiduciaries when providing clients with financial planning services. The FINRA Broker Check is a free tool that allows users to check the professional background of FINRA-registered brokers and firms. To check on investment adviser firms registered with the SEC, browse through SEC's Investment Adviser Public Disclosure (IAPD)website. The site also has a search feature to allow investors to find an adviser firm based on specific criteria, such as location or type of services offered. When searching for a fiduciary, request at least three referrals and interview each. Make sure to ask about their experience, compensation, credentials, and whether or not they have any disciplinary history. Not all financial advisors are fiduciaries. When employing a financial advisor, be sure to clarify if they have a fiduciary duty. A fiduciary is subject to different requirements than someone solely obligated by the suitability principle. Employing the services of a fiduciary can provide many benefits, such as peace of mind, fewer conflicts of interest, and transparency. Fiduciaries must continuously operate in the best interests of their clients. When looking for a fiduciary financial advisor, be sure to consider the cost of their services and verify their credentials. Furthermore, when selecting someone to manage your money, choose someone you can trust and you are comfortable with.What Is a Fiduciary Financial Advisor?

What Is the Fiduciary Standard?

Do All Financial Advisors Have a Fiduciary Duty?

Are Robo-Advisors Functioning Under Fiduciary Duty?

When Fiduciary Duty Is Breached

Importance of Fiduciary Financial Advisors

Peace of Mind

Fewer Conflicts of Interest

Transparency

Needs-Based Solutions

Working With a Fiduciary Financial Advisor

Cost

What to Look For

How to Find One

The Bottom Line

Fiduciary Financial Advisor FAQs

No, not all non-fiduciary financial advisors are bad. Even though they do not have a fiduciary duty and may only be obligated by the suitability principle, these professionals may still have your best interest at heart. The key is to do your due diligence when looking for a financial advisor. Make sure to interview several candidates, ask about their experience and credentials, and most importantly, inquire about how they are compensated. This will help you determine if a conflict of interest may influence the advice given.

A client can directly ask a financial advisor if he or she is a fiduciary and verify their response. It is important to ask if the fiduciary is receiving any other compensation to clear out any conflict of interest. Ensure that the advisor is not selling any investment products and that the primary duty is to provide unbiased and objective advice.

Fiduciaries usually charge in the same manner as most financial advisors do, depending on the services they will provide, their length of experience, memberships, credentials, and certifications.

The main difference is that fiduciaries are required to always act in the best interests of their clients, while the suitability principle only obligates regular financial advisors. This means that they are not required to always act in the best interests of their clients but only in what suits them.

It depends on your needs and preferences. If you value some peace of mind in knowing that your financial advisor is legally bound always to act and operate in your best interest, then you should choose a fiduciary financial advisor.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.