A trust is a legal document that enables an individual, known as the grantor, to assign specific assets to the care of a trustee who manages them on behalf of the individual’s beneficiaries. Trusts can be generally classified as either revocable or irrevocable: A revocable trust is a trust that can still be changed or terminated by the person who created it, the grantor. This type of trust gives the grantor a great deal of control over the trust assets and their use. They can remove beneficiaries, appoint new ones, change trustees and update the terms governing the management of the trust's assets. This option is suitable for people who want flexibility in managing their estate and whose circumstances may change over time. An irrevocable trust is much more restrictive than a revocable one. Once it is created, it cannot be easily changed or terminated by the grantor or any other party. Assets placed in an irrevocable trust become the trust's property and cannot be retrieved by the grantor. They cannot alter the trustees and beneficiaries, nor can they make any changes to the terms of the trust. This type of trust is best used for estate planning and tax purposes, as assets in an irrevocable trust are not subject to estate or income taxes. Using a revocable trust as an estate planning tool has some advantages. However, it also comes with some disadvantages. The following are the advantages of choosing a revocable trust: The probate process is expensive and time-consuming. With a revocable trust, the grantor's assets are transferred into the trust before death, avoiding the need for probate court proceedings. Unlike wills or other assets that pass through the probate process, the assets mentioned in revocable trusts are not accessible to the general public. This implies that the terms of the trusts and information about the beneficiaries are kept private. Grantors can alter the terms of a revocable trust anytime and as often as needed during their lifetime. This makes revocable trusts ideal for those with ever-changing family conditions or who wish to explore alternative estate planning choices. Challenges to a revocable trust are much more complicated than those of a will. This provides an additional layer of protection for the grantor's assets, ensuring that the estate is handled according to their wishes. If the grantor becomes mentally or physically incapable, a revocable trust can ensure that its assets will continue to be used for the grantor's benefit. Under this option, grantors can outline instructions for the trustee to follow if such an event occurs. Revocable trusts also come with the following disadvantages: Setting up a revocable trust involves legal fees. There are also additional costs for the ongoing maintenance of the trust, particularly when the grantor wishes to make any changes. Since revocable trusts can be altered, grantors may choose to transfer more assets into it as time goes on. Unfortunately, they may need to monitor the assets in their trust regularly and consciously remember to make the necessary changes. Money placed in a revocable trust is still subject to taxes. Revocable trusts do not reduce either income taxes or estate taxes. The property under a revocable trust is regulated for tax purposes as if it were the grantor's own property. Revocable trusts are not ideal for those who wish to protect their assets from creditors. This is because the assets in a revocable trust remain part of the grantor's estate and can thus be subject to creditors' claims. All assets in a revocable trust must be re-titled in the name of the trust. This is a complicated process and requires assistance from an attorney or accountant. It can also take time for all assets to be re-titled correctly. Below is a summary of some of the advantages and disadvantages grantors face when establishing a revocable trust. As an alternative to revocable trusts, irrevocable trusts also have their own advantages and disadvantages. Some of the advantages of an irrevocable trust include the following: Assets maintained in an irrevocable trust are excluded from the grantor's taxable estate. This decreases the grantor's tax liability. Grantors can utilize an irrevocable trust to protect assets from creditors and potential litigation. Once an asset is transferred into the trust, it is no longer regarded as part of the grantor's estate and cannot be seized by creditors or other parties. The fact that assets in an irrevocable trust are no longer tied to the grantor might facilitate Medicaid eligibility. This allows them to hold fewer assets in their name and may increase their likelihood of qualification. Below are the major disadvantages of an irrevocable trust: The grantor can no longer control the assets once they are in the trust. Assets become part of the trust and are no longer connected to the grantor. If the grantor experiences a change in circumstances, they may not be able to access the assets or transfer them out of the trust. Irrevocable trusts are limited in flexibility. The grantor must ensure that their wishes are accurately and thoroughly expressed in the trust document, as it will be challenging to make changes later on without court approval. Here is a recap of some of the advantages and disadvantages that come with establishing an irrevocable trust. Revocable and irrevocable trusts can be distinguished from each other in the following ways: In irrevocable trusts, the grantor transfers property to the trust and relinquishes all future rights to the transferred assets. A third party, the trustee, oversees the trust by adhering to the terms and conditions outlined by the grantor. With a revocable trust, the grantor owns and controls the trust assets and can make whatever changes he thinks are necessary. Usually, the trustee administers the trust only in the event of the grantor's mental or physical incapacity. The ownership of the irrevocable trust no longer lies with the grantor. The trustee is in charge of the assets and will take care of them, following the guidelines in the trust document. Grantors of a revocable trust retain ownership of all assets placed into the trust during their lifetime. Assets will only be distributed to the designated beneficiaries upon the grantor's death. Assets placed in an irrevocable trust are protected from creditors and potential lawsuits. The grantor is no longer considered the owner of these assets, so they cannot be taken by creditors or other parties. A revocable trust does not offer creditor protection because the grantor retains ownership of all assets placed in the trust. A revocable trust can be terminated or changed at any point, so assets placed in the trust are vulnerable. An irrevocable trust is regarded as a separate entity and must submit its own annual tax returns under its own tax ID number. Therefore, an irrevocable trust is ineligible for several deductions and exemptions that an individual may claim. The assets held in the name of a revocable trust are deemed the grantor's property, and the income received from these assets is reported with the grantor's other income. Individuals can choose between the two types of trusts by deciding on the level of control they prefer over the assets they wish to put into the trust. A revocable trust is better for individuals who prefer flexible arrangements. With this option, they can retain control over how the assets in the trust are used during their lifetime. On the other hand, an irrevocable trust is best for individuals who want to protect their assets from creditors and lawsuits but who have no problem forfeiting control of their assets. The value of the assets to be transferred also influences which type of trust is more appropriate. An irrevocable trust is often used for estates worth more than the federal estate tax exemption limit because it protects assets and comes with tax savings. In contrast, a revocable trust may be more favorable when the estate's worth is less than the federal estate tax exemption limit since these assets are already exempted from estate taxes. A trust is a legal document that enables an individual, known as the grantor, to assign specific assets to the care of a trustee who manages them on behalf of the individual’s beneficiaries. Trusts are estate planning tools that can be classified as either revocable or irrevocable. Choosing the right type of trust will depend on individual needs and goals. A revocable trust gives the grantor a great deal of control over the trust assets and their use. Meanwhile, an irrevocable trust requires a grantor to give up control and ownership of assets transferred into the trust. The significant advantage of revocable trusts lies in their flexibility which may be favorable to the changing circumstances of the grantor. On the other hand, irrevocable trusts make up for the lack of control over their assets by offering protection from creditors and estate taxes. Given all of these factors, it is essential to consult a qualified financial professional who can help individuals make an informed choice about which type of trust would be best suited to their particular needs.Revocable Trust vs. Irrevocable Trust: An Overview

Revocable Trust

Irrevocable Trust

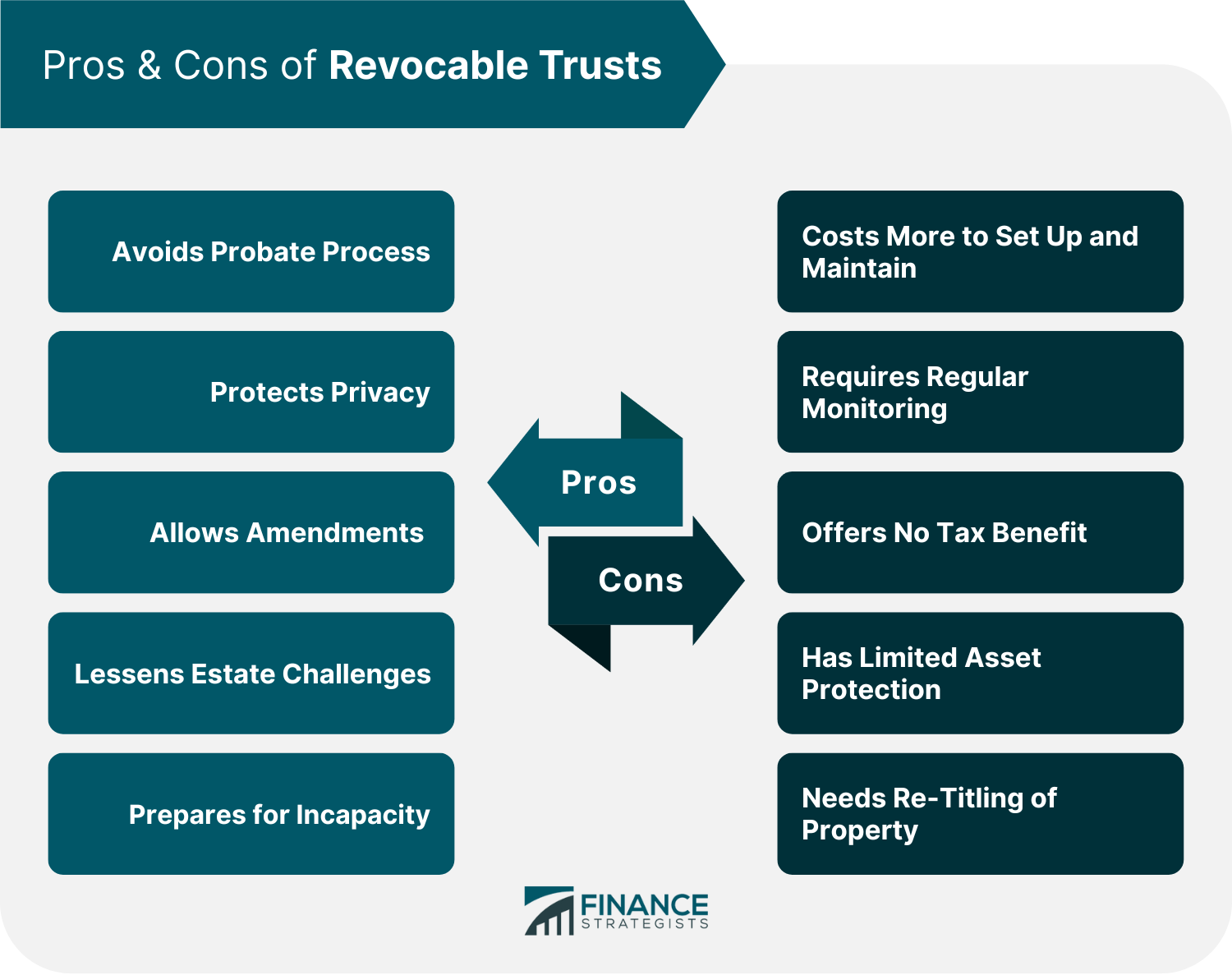

Revocable Trust: Pros and Cons

Revocable Trust Pros

Avoids Probate Process

Protects Privacy

Allow Amendments

Lessens Estate Challenges

Prepares for Incapacity

Revocable Trust Cons

Costs More to Set Up and Maintain

Requires Regular Monitoring

Offers No Tax Benefit

Has Limited Asset Protection

Needs Re-Titling of Property

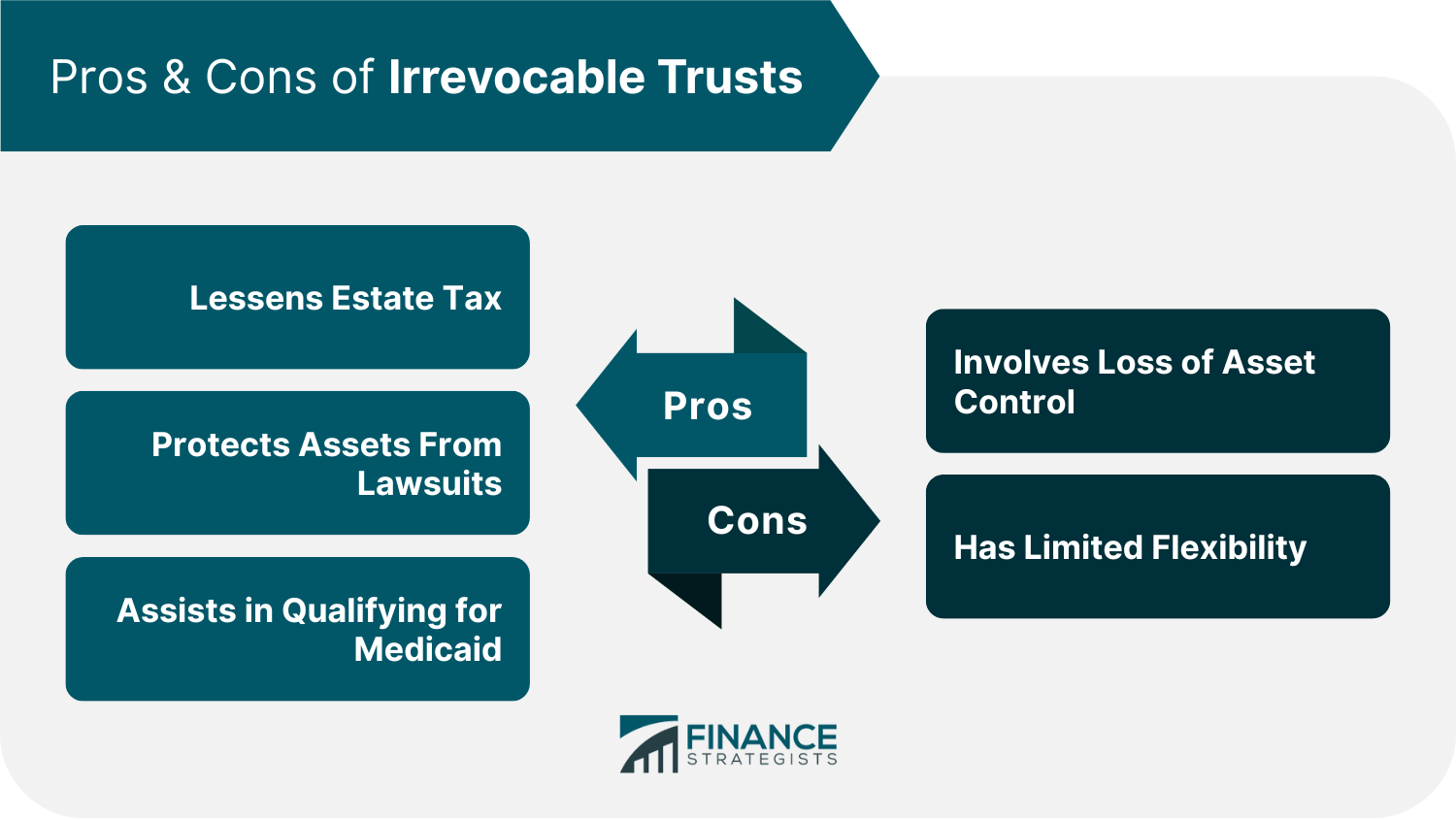

Irrevocable Trust: Pros and Cons

Irrevocable Trust Pros

Lessens Estate Tax

Protects Assets From Lawsuits

Assists in Qualifying for Medicaid

Irrevocable Trust Cons

Involves Loss of Asset Control

Has Limited Flexibility

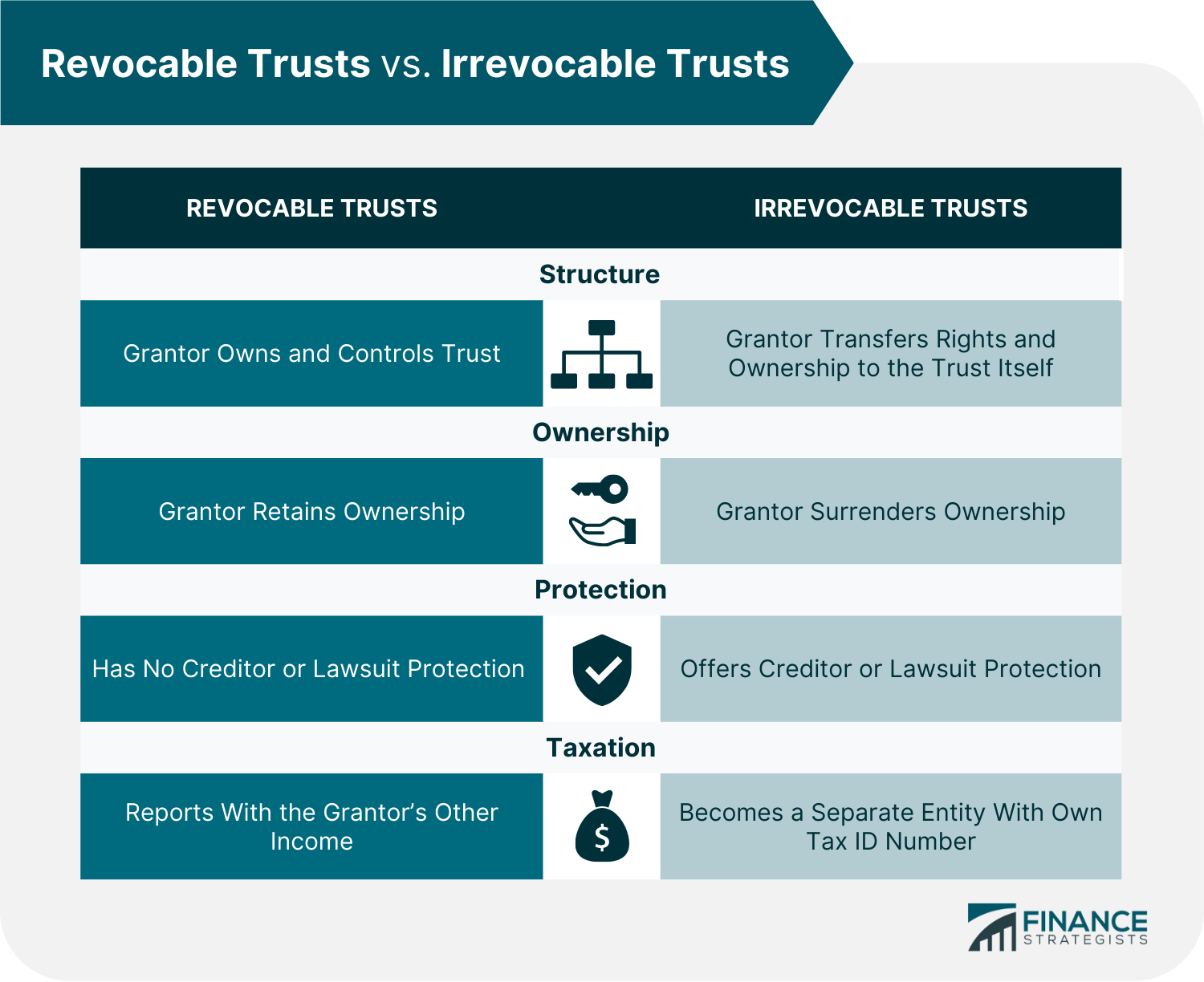

Revocable Trust vs. Irrevocable Trust: Key Differences

Structure

Ownership

Protection

Taxes

Revocable Trust vs. Irrevocable Trust: Which Is Better?

The Bottom Line

Revocable Trust vs Irrevocable Trust FAQs

A revocable trust allows the grantor to maintain control over assets while alive and can be amended or canceled at any time. On the other hand, an irrevocable trust removes all control from the grantor and is considered a separate entity and cannot be changed or terminated once it has been set up.

The main parties involved in an irrevocable trust are the grantor, trustee, and beneficiary. The grantor establishes the trust and contributes assets to it. The trustee governs the trust per the terms outlined by the grantor. The beneficiary is the person who receives benefits from the trust.

The main downside of a revocable trust is its lack of capacity to provide any asset protection. All assets in the trust remain available to creditors and can be subject to lawsuits.

The answer depends on the individual’s goals and circumstances. Generally, an irrevocable trust is better for those who need asset protection, while a revocable trust may be more suitable for those who want to maintain control over assets during life and whose circumstances may constantly be changing.

The major downside of an irrevocable trust is that it removes all control from the grantor, as all assets become part of the trust and cannot be changed or terminated.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.