Probate is the legal process that your estate goes through after you die. A court will begin distributing your estate to the appropriate heirs during this legal proceeding. Probate is always more straightforward if you have a will or living trust that expresses your wishes clearly. These documents are especially useful in naming beneficiaries and an executor responsible for your ultimate wishes. During probate, a court will verify your will, then authorize your executor to settle any bills and taxes and divide your remaining property following your instructions. Most people associate probate with a will. If a person dies and leaves a will, probate is required to carry out the terms of the will. However, a probate process may occur if a person dies without a will and has the property to distribute under state intestacy law. The state's intestacy laws will determine who inherits the decedent's possessions. Typically, the takers are the decedent's relatives. If the decedent had a beneficiary specified in an account, but the beneficiary died before the account's owner, probate law requires that the account goes through the court so that the money can be distributed to the person lawfully entitled to them. Financial instruments such as 401(k)s, IRAs, and life insurance policies with enumerated beneficiaries will not necessitate probate. The assets are transferred automatically from the account holder to the chosen beneficiary upon their demise. When a person dies and leaves behind a valid will, the legal process of probate begins with filing a petition in court by an executor appointed by the deceased. The executor must file a petition for probate in the court of the county where the deceased person lived. This document outlines the decedent's assets and liabilities, identifies any heirs or creditors that need to be notified, and requests permission from the court to administer the estate. Without a will, the court will appoint an administrator to oversee the estate. The court issues a letter of administration to confirm the executor's appointment, giving the executor power over all assets owned by the deceased and any income from those assets generated during probate. The executor must then identify the deceased's assets and debt owed. The assessment includes real estate properties and financial accounts such as bank accounts, stocks, bonds, and other investments. Creditors are informed about the probate process. The executor pays off any debts and taxes owed from the estate funds. After settling liabilities, the executor will distribute assets as specified in the will. When a person dies without a valid will, probate begins with the appointment of an administrator to oversee the estate. The court will usually appoint an administrator to oversee the estate when a valid will is unavailable. The court may appoint someone who is a family member or other interested parties being nominated. Once appointed, the administrator must fulfill all legal duties of administering the estate. The responsibilities include: The next step is to locate any legal heirs of the deceased entitled to inherit assets from the estate. Among them are family members, distant relatives, or others authorized under estate state law. The administrator must then assess all assets owned by the deceased and determine which ones will be inherited by the beneficiaries. The assets can include real estate properties and financial accounts such as bank accounts, stocks, bonds, and other investments. Once all liabilities have been settled, the executor can distribute the remaining assets according to state law. Several options are available to help you avoid probate and simplify estate administration. Transferring ownership of bank accounts into POD accounts allows you to name a beneficiary. Such will automatically inherit the funds upon the owner's death without going through probate court. Placing assets in a living trust before your death can help you avoid probate for those assets since they are now legally owned by the trust. When the settlor dies, their successor trustee takes over and distributes the assets according to the wishes stated in the living trust documents. You can also gift your property and assets to a friend or family member before you die, allowing the recipients to bypass probate. In 2024, the gift tax limit is up to $18,000 per individual without reporting the gift to the IRS. For 2025, the limit is $19,000. Understanding how probate works and avoiding it can ensure that your estate is managed correctly. Working with an experienced estate planning lawyer can help you make the best decisions for your loved ones. Probate is the legal process that your estate goes through after you die. During probate, the court will recognize the decedent's will and appoint an executor to handle their estate affairs. The process includes collecting assets, paying creditors and taxes, and distributing assets following the terms of their will. If a legally valid will does not exist, then assets are distributed according to state law. Probate typically takes between three months and two years to complete; however, complex cases can take substantially longer than this. It can be helpful to work alongside an experienced attorney versed in state probate laws to finalize matters in court successfully.What Is Probate?

When Is Probate Required?

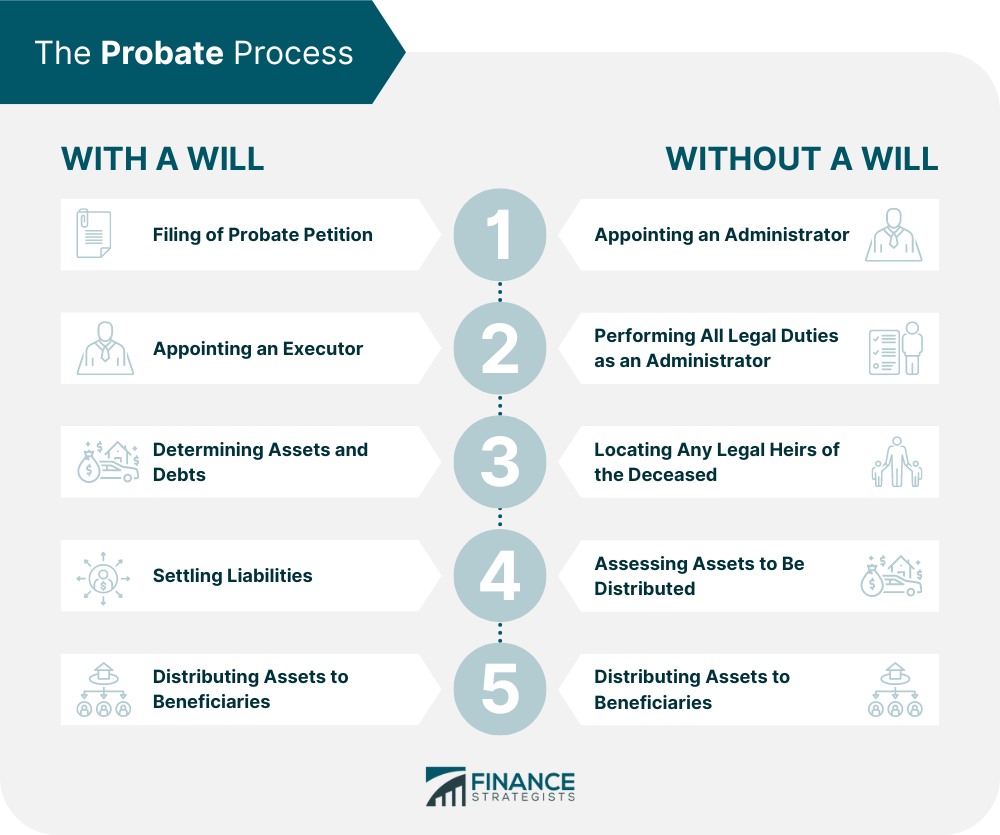

The Probate Process With a Will

Step 1: Filing of Probate Petition

Step 2: Appointing an Executor

Step 3: Determining Assets and Debts

Step 4: Settling Liabilities

Step 5: Distributing Assets to Beneficiaries

The Probate Process Without a Will

Step 1: Appointing an Administrator

Step 2: Performing All Legal Duties as an Administrator

Step 3: Locating Any Legal Heirs of the Deceased

Step 4: Assessing Assets to be Distributed

Step 5: Distributing Assets to Beneficiaries

How to Avoid Probate

Convert Banking Accounts Into Pay-On-Death (POD) Accounts

Open a Revocable Living Trust

Gift Your Property and Assets

Final Thoughts

Probate FAQs

The probate length depends on the estate's complexity. Still, it usually takes several months to a few years for all assets to be distributed.

You can avoid probate by transferring ownership of assets into pay-on-death accounts, placing assets in a revocable living trust, or gifting your property and assets to a friend or family member.

Probate is usually required when the deceased had substantial assets in their name at the time of death, such as real estate properties, investments, and financial accounts.

Probate aims to ensure that all assets are distributed according to the deceased's wishes or following state law. It also ensures that creditors and beneficiaries are satisfied before any remaining assets can be distributed.

If the deceased did not have a valid will, their estate would be administered following state intestacy laws. Such a law dictates how an estate should be divided amongst heirs and beneficiaries. In this case, the probate court would still need to appoint an administrator to administer the estate.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.