In the context of estate planning, a beneficiary is a person or entity who is designated to receive assets or property from a person's estate after they pass away. The beneficiary can be named in a variety of legal documents, such as a will, trust, life insurance policy, retirement account, or other financial instrument. The purpose of naming a beneficiary is to ensure that the assets in question are distributed according to the person's wishes and that their loved ones or chosen organizations receive the intended benefits. Beneficiaries can be individuals, such as family members, friends, or charitable organizations, or entities like a business or a trust. It is important to review and update beneficiary designations periodically, especially after significant life events like marriage, divorce, birth of a child, or death of a beneficiary. This can help ensure that the assets are distributed in the desired manner and to the intended recipients. Primary beneficiaries are the first in line to inherit an individual's assets or property. Common examples of primary beneficiaries include: Spouse: A person's legal spouse is often the default primary beneficiary, particularly for retirement accounts, life insurance policies, and jointly owned property. Children: Children, both biological and adopted, are often named as primary beneficiaries in estate planning documents. Other relatives: Extended family members, such as siblings, parents, or nieces and nephews, may be named as primary beneficiaries. Contingent beneficiaries are individuals or entities that will inherit assets only if the primary beneficiary is unable or unwilling to do so. Contingent beneficiaries serve as a backup plan, ensuring that the assets are distributed according to the individual's wishes. Charitable beneficiaries are non-profit organizations or charitable institutions that receive assets as part of an individual's estate plan. These beneficiaries can include educational institutions, religious organizations, or other non-profit entities. Including charitable beneficiaries in one's estate plan can provide significant tax benefits and support causes that were important to the individual. Selecting beneficiaries is a critical aspect of estate planning. Factors to consider when choosing beneficiaries include: Age: Consider the age of potential beneficiaries, particularly when it comes to minors. Designating a guardian or establishing a trust may be necessary to protect their interests. Relationship: Reflect on the relationship between the individual and potential beneficiaries. Stronger relationships may indicate a higher level of trust and a more suitable choice. Financial needs: Assess the financial needs of potential beneficiaries, including their ability to manage inherited assets responsibly. Tax implications: Consider the tax consequences for both the estate and the beneficiaries, including potential estate, gift, and income taxes. Regularly review and update beneficiary designations to ensure they remain consistent with the individual's wishes and circumstances. Life events, such as marriage, divorce, or the birth of a child, may necessitate changes to the designated beneficiaries. Communicating with potential beneficiaries about their role in the estate plan can help prevent misunderstandings and disputes. Sharing one's wishes and intentions with beneficiaries can provide clarity and peace of mind for all parties involved. A Last Will and Testament is a legal document that outlines an individual's wishes for the distribution of their assets after death. Beneficiaries can be designated to receive specific assets (testamentary gifts) or a portion of the remaining estate (residuary estate). Trusts are legal arrangements that allow a third party (the trustee) to hold and manage assets on behalf of beneficiaries. Trusts can be either revocable (changeable) or irrevocable (not changeable) and offer greater control over asset distribution than a will alone. Beneficiary designations on retirement accounts and life insurance policies supersede instructions in a will. It is essential to review and update these designations regularly to ensure they align with the individual's wishes. POD and TOD accounts are financial accounts that automatically transfer to a designated beneficiary upon the account holder's death. These accounts bypass probate, allowing assets to be transferred more quickly and efficiently. It is crucial to keep the beneficiary designations for these accounts up to date. Disputes can arise over the validity of beneficiary designations, particularly if the designations were made under suspicious circumstances, such as undue influence or mental incapacity. In such cases, legal challenges may be brought to contest the designations. In some cases, an individual may choose to disinherit a beneficiary, excluding them from receiving any assets. To effectively disinherit a beneficiary, it is essential to explicitly state this intention in the estate planning documents to avoid potential disputes. If a beneficiary is unintentionally omitted from an estate planning document, they may still have a claim to a portion of the estate, depending on state law. Reviewing and updating estate planning documents regularly can help avoid such issues. Proactively addressing potential disputes through clear communication, thorough documentation, and professional guidance can help preserve family harmony and minimize conflicts over beneficiary designations. Estate planning attorneys can provide valuable guidance and advice on selecting and designating beneficiaries. They can also help draft and review estate planning documents, ensuring that they accurately reflect the individual's wishes and comply with relevant laws. Financial advisors can offer valuable insight into the financial needs and capabilities of potential beneficiaries. They can also help assess the tax implications of various estate planning strategies and recommend options that maximize the benefit for both the estate and the beneficiaries. Tax professionals, such as certified public accountants (CPAs), can provide expert guidance on tax planning strategies related to estate planning and beneficiary designations. They can help minimize potential tax liabilities and ensure compliance with tax laws. Choosing a beneficiary is a vital component of successful estate planning. Understanding the different types of beneficiaries, such as primary, contingent, and charitable beneficiaries, allows individuals to make informed decisions about asset distribution. Regularly reviewing and updating beneficiary designations, considering factors such as age, relationship, financial needs, and tax implications, helps ensure that estate plans remain aligned with the individual's intentions. Utilizing estate planning documents like Last Will and Testament, trusts, and beneficiary designations on accounts and policies can further streamline the transfer of assets. Additionally, working with professionals, such as estate planning attorneys, financial advisors, and tax professionals, can provide valuable guidance and support throughout the process. By engaging in comprehensive beneficiary planning, individuals can safeguard their assets, promote family harmony, and minimize potential disputes over inheritance.What Is a Beneficiary?

Types of Beneficiaries

Primary Beneficiaries

Contingent Beneficiaries

Charitable Beneficiaries

Choosing Beneficiaries

Factors to Consider

Periodic Review and Updates

Communicating With Beneficiaries

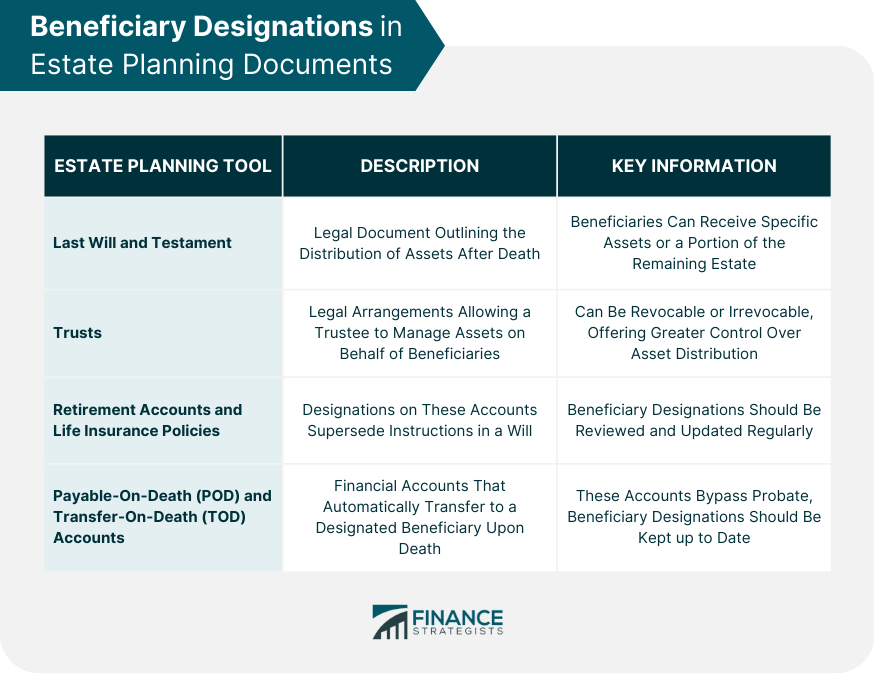

Beneficiary Designations in Estate Planning Documents

Last Will and Testament

Trusts

Retirement Accounts and Life Insurance Policies

Payable-On-Death (POD) and Transfer-On-Death (TOD) Accounts

Potential Issues and Disputes

Challenges to Beneficiary Designations

Disinheriting a Beneficiary

Inheritance Rights of Omitted Beneficiaries

Solutions for Avoiding Disputes

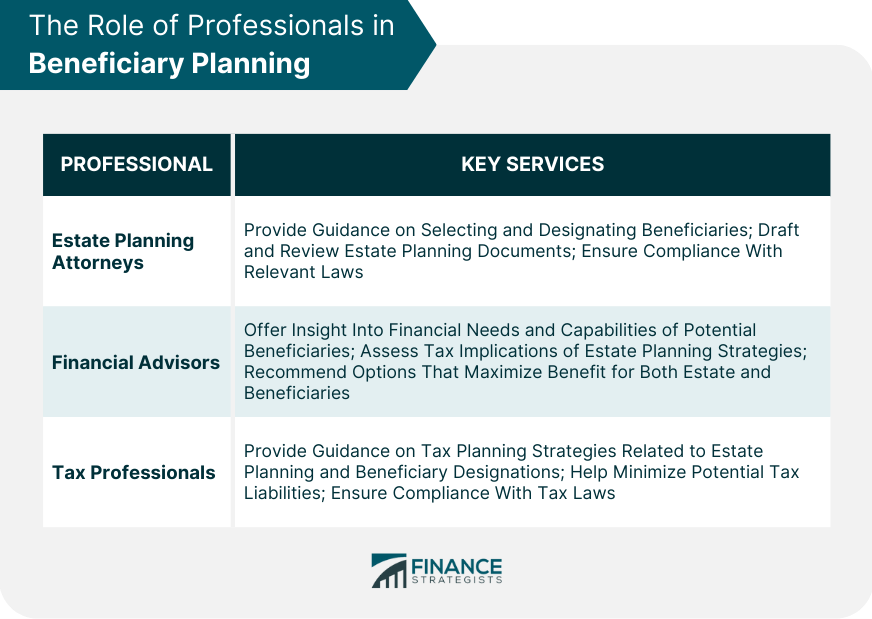

The Role of Professionals in Beneficiary Planning

Estate Planning Attorneys

Financial Advisors

Tax Professionals

Conclusion

Beneficiary FAQs

A beneficiary is an individual or entity designated to receive assets, property, or other benefits from an estate after the owner's death. Beneficiaries play a crucial role in estate planning and administration, ensuring that assets are distributed according to the individual's wishes.

There are three main types of beneficiaries in estate planning: primary, contingent, and charitable beneficiaries. Primary beneficiaries are the first in line to inherit assets, while contingent beneficiaries inherit only if the primary beneficiary is unable or unwilling to do so. Charitable beneficiaries are non-profit organizations or institutions that receive assets as part of an individual's estate plan.

To choose the right beneficiary, consider factors such as age, relationship, financial needs, and tax implications. Regularly review and update beneficiary designations to ensure they remain consistent with the individual's wishes and circumstances. It is also essential to communicate with potential beneficiaries about their role in the estate plan to prevent misunderstandings and disputes.

Beneficiary designations in estate planning documents, such as Last Will and Testament, trusts, retirement accounts, life insurance policies, and payable-on-death (POD) or transfer-on-death (TOD) accounts, determine how assets are distributed after the owner's death. These designations supersede any conflicting instructions in a will, making it essential to keep them up to date and aligned with the individual's wishes.

To minimize disputes and issues related to beneficiary designations, proactively address potential conflicts through clear communication, thorough documentation, and professional guidance. Work with estate planning attorneys, financial advisors, and tax professionals to ensure that the estate plan accurately reflects the individual's intentions and complies with relevant laws. Regularly reviewing and updating beneficiary designations can also help prevent disputes arising from outdated or unintentionally omitted beneficiaries.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.