Overdraft fees are fees charged by your bank when you have too low a balance to cover a payment you've made. To avoid the transaction being cancelled, the bank provides what is called an 'overdraft protection service' in which they cover the balance difference for you, but also charge a fee for doing so. It's a penalty for spending more money than one possesses, causing the account balance to go into a negative state. Overdraft fees are generally around $30, although this will vary based on your individual bank. For someone who is frequently over-drafting on their account, that can add up to hundreds of extra dollars per year. This type of fee emerged as a way for banks to compensate for the risk associated with covering a deficit in funds. While it can sometimes provide a short-term safety net for consumers, allowing transactions to go through despite insufficient funds, the accompanying fees can be a financial burden. An overdraft occurs when an individual's bank account balance drops below zero. This can happen for various reasons. This can happen when a check is cashed when there aren’t enough funds to cover it, or an automatic payment being processed when the account is low. When an overdraft happens, the bank or financial institution essentially provides a short-term loan to cover the deficit. While this service can be beneficial, preventing declined transactions or returned checks, it comes at a price. This price, charged for the convenience and risk the bank takes on, is the overdraft fee. Overdraft fees are triggered by specific events related to an account's balance and transactions. Common triggers include checks presented for payment that exceed account balances, ATM withdrawals surpassing available funds, and automatic bill payments processed when there's insufficient money in the account. Some banks also charge fees for every day an account remains overdrawn, which can quickly exacerbate the financial strain on the account holder. It's essential for consumers to be aware of their bank's specific policies and fee structures to avoid unexpected charges. Standard overdraft fees are the most common and are levied each time an overdraft occurs. The fee amount can vary by institution, but they often range from $25 to $35 per occurrence. This means that even a small purchase, such as a cup of coffee, can result in a substantial fee if it causes the account to be overdrawn. Given the high cost, these fees can quickly accumulate if multiple overdrafts occur within a short period. And while they're intended as deterrents to overspending, their frequency and magnitude can catch many consumers off guard. Extended overdraft fees come into play when an account remains negative for an extended period, usually more than five consecutive days. This fee is in addition to the standard overdraft fee and serves as a further penalty for not bringing the account back to a positive balance promptly. Such fees can compound the financial difficulties of those already struggling to maintain a positive balance. They emphasize the importance of regularly monitoring one's bank account and addressing any overdrafts immediately. Overdraft protection is a service that banks offer to automatically transfer funds from a linked savings or credit account to cover overdrafts. While this service can help avoid standard overdraft fees, it often comes with its own fee structure. Typically, overdraft protection fees are lower than standard overdraft fees. However, they can still add up, especially if overdrafts are a frequent occurrence. Additionally, if the protection source is a line of credit, interest might be charged on the borrowed amount. An overdraft fee is typically around $35 dollars, but it varies by banking institution. According to the Consumer Financial Protection Bureau, overdraft fees cost Americans almost 17 billion dollars annually. With a few easy steps you can make sure that you are easily preventing this unnecessary pocketbook expense. How can I avoid overdraft fees? As a part of Federal Law, the government requires financial institutions to obtain your permission before adding overdraft protection to your account. This allows the bank to apply a fee if you accidentally remove too much cash from your account. While the goal is to not overdraft your account at all, this protection service is useful and can save you some potential embarrassment by preventing your debit or credit card from getting declined! Sign up for online banking - online banking allows a person to track their spending and account balances much easier and on the go, making it much less likely for you to overdraw your account Set up balance alerts - most banks offer an option to send you an alert if your balance is running low. This can be a helpful reminder if you know you have upcoming payments to be made Keep a cushion in your account - by keeping some extra money in your account to protect against unexpected expenses, you can help eliminate overdraft fees and save yourself more money in the long run Overdraft fees, while intended to deter overspending, can place significant financial strain on consumers. The reality is that many people live paycheck to paycheck, and even a small unexpected expense can lead to an overdraft. With fees ranging from $25 to $35 per occurrence, a single overdraft can represent a substantial portion of someone's weekly take-home pay. Repeated overdrafts and the accompanying fees can create a vicious cycle, with individuals struggling to get back on solid financial footing, only to be hit with another fee. Overdraft fees disproportionately impact vulnerable populations, such as low-income individuals and families. These groups are more likely to experience financial instability, making them more susceptible to overdrafts. Moreover, they're less likely to have a financial cushion, such as savings, to fall back on. The result is that the very people who can least afford these fees are often the ones most frequently subjected to them. This exacerbates economic disparities and makes financial upward mobility even more challenging. Overdraft fees can be a gateway to accumulating debt. As individuals struggle to cover these fees, they may resort to other forms of borrowing, such as credit cards or payday loans, leading to even higher fees and interest rates. This can trap individuals in a cycle of debt, where they're constantly borrowing to cover past dues. What's more, the stress of this debt can have broader implications, impacting mental health and overall well-being. The weight of constantly trying to catch up can be overwhelming, leading to feelings of hopelessness and despair. Overdraft fees are charges imposed by banks when an account lacks sufficient funds to cover a transaction. These fees are incurred due to an 'overdraft protection service' that covers the deficit but levies a fee. Essentially, overdraft fees penalize overspending, causing negative balances. These charges, commonly around $30, vary between banks and can accumulate significantly, particularly for repeat offenders. While intended as a safety net, overdraft fees can strain finances, especially for vulnerable populations with limited means. They can also trigger a cycle of debt, forcing individuals into borrowing to cover fees and leading to higher financial burdens. To mitigate such consequences, consumers can monitor their accounts, opt for alerts, and maintain a financial cushion. It's imperative to understand the nuances of overdraft fees, their impact, and available strategies to navigate the potential financial pitfalls they pose.Overdraft Fee Definition

How Overdraft Fees Work

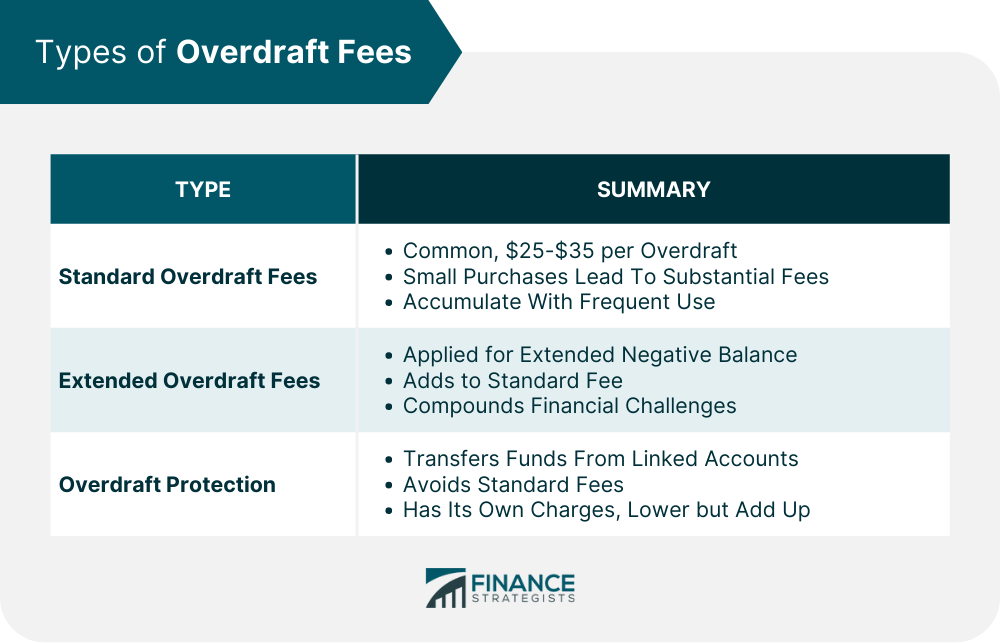

Types of Overdraft Fees

Standard Overdraft Fees

Extended Overdraft Fees

Overdraft Protection Fees

How Much Is an Overdraft Fee?

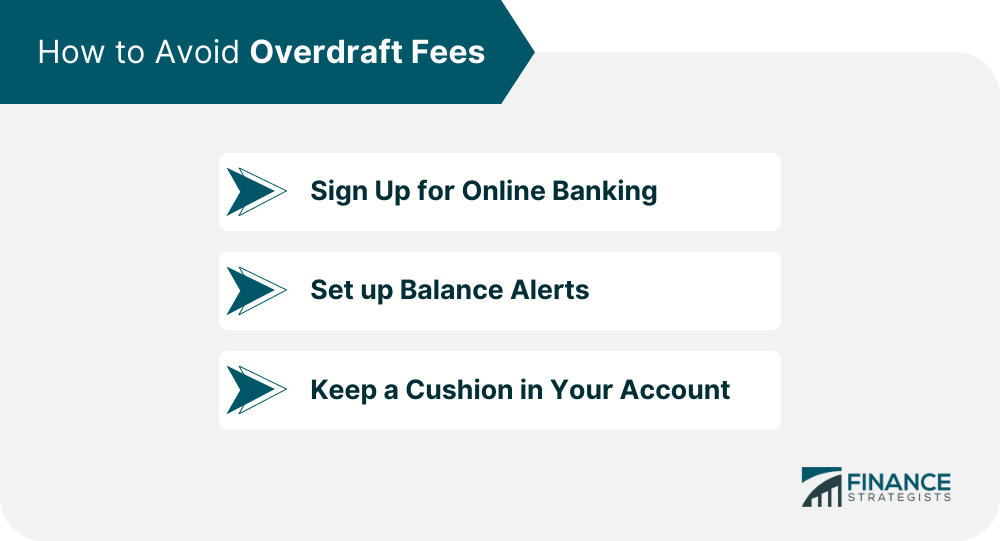

How to Avoid Overdraft Fees

Impact of Overdraft Fees

Financial Strain on Consumers

Disproportionate Impact on Vulnerable Populations

Debt Accumulation

Conclusion

Overdraft Fee FAQs

Overdraft fees are fees charged by your bank when you have too low a balance to cover a payment you’ve made.

An overdraft fee is typically around $35 dollars, but it varies by banking institution.

The best way is to not spend more than you have in your account! After that, try these ideas: set up online banking (it's easier to keep track of account activity); set up balance alerts; build a cushion into your account.

According to the Consumer Financial Protection Bureau, overdraft fees cost Americans almost 17 billion dollars annually.

As a part of Federal Law, the government requires financial institutions to obtain your permission before adding overdraft protection to your account. Without it, withdrawals may be rejected if you try to spend money you don't have.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.