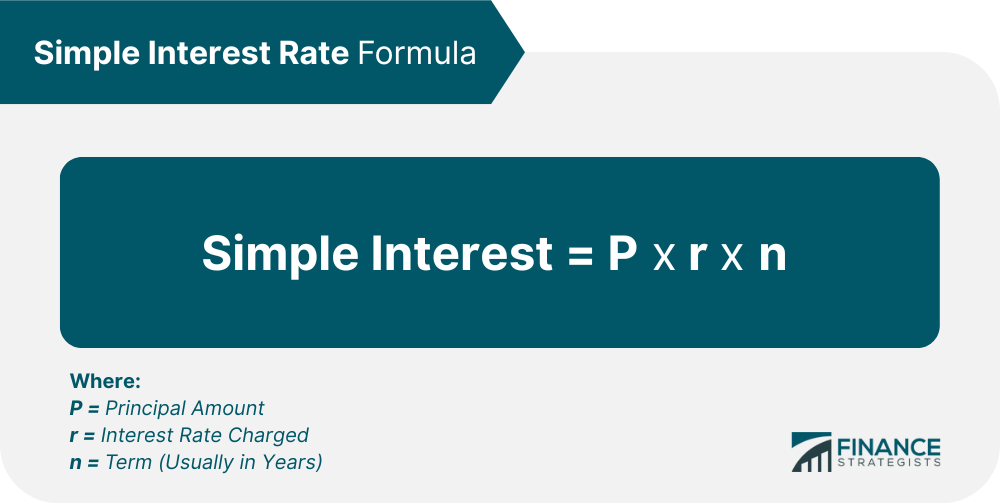

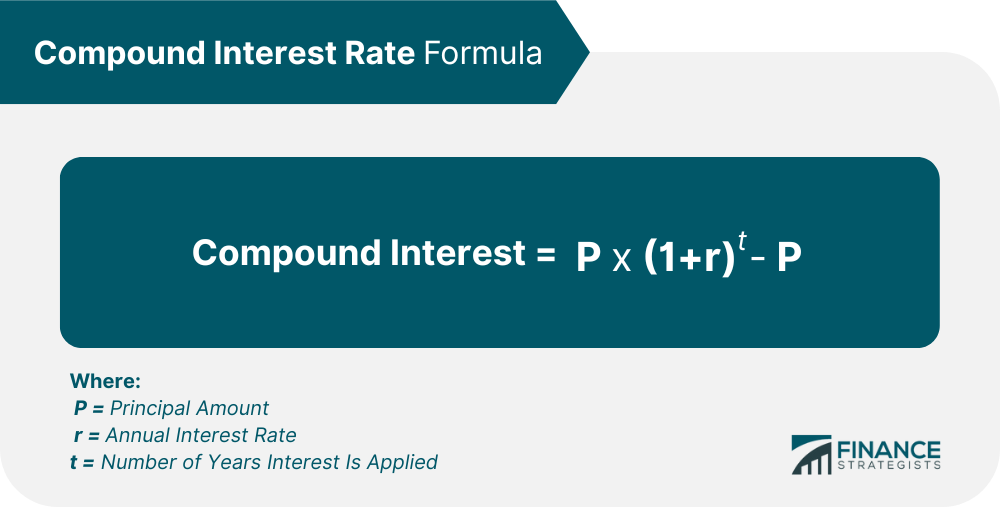

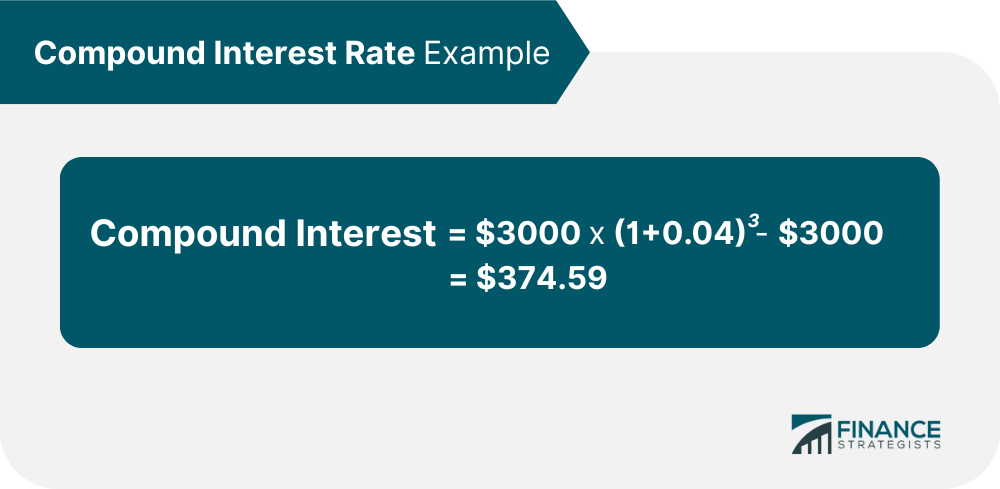

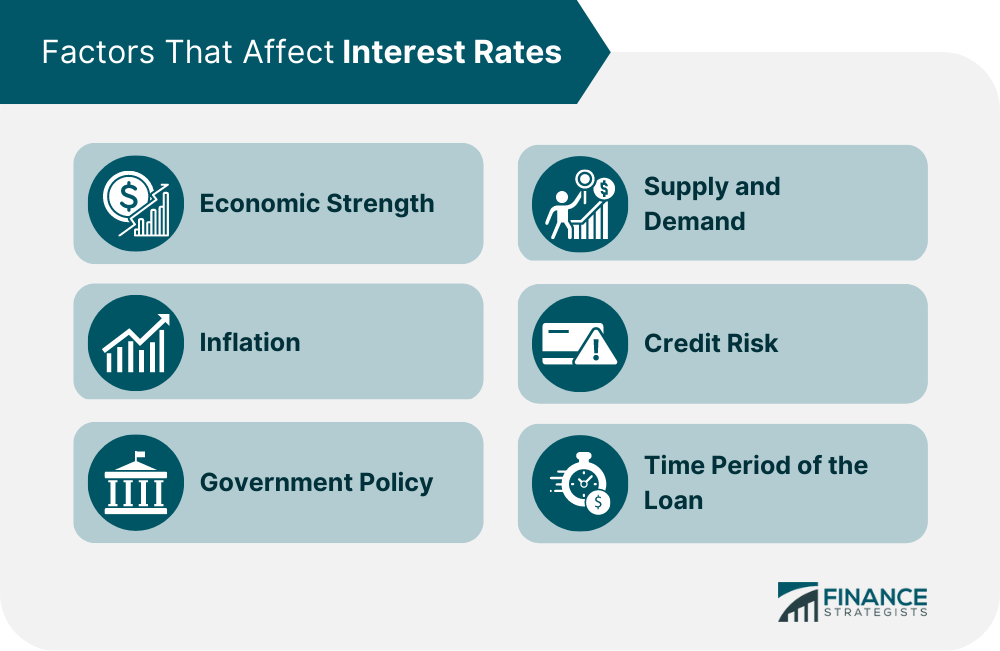

An interest rate is the percentage of principal a lender charges for using its funds. The principal is the amount of cash granted. Borrowers pay interest as compensation for using a lender’s money. Banks also pay interest rates as a reward for saving money. The interest rate charged on any loan or line of credit can vary depending on the type, length, size, and purpose of the loan, as well as other factors such as economic conditions, government policies, creditworthiness, and the risks associated with it. To keep the economy functioning, central banks utilize tools such as interest rates to regulate the supply of cash. People borrow money for various reasons, like buying a house, starting a business, or leasing a car. Lenders charge interest on these as the cost of borrowing. People also save their money in banks, which pay interest for allowing them to use the depositor’s money. Interest rates are calculated by taking into account the principal loan amount and any applicable fees or charges. The interest rate determines how much money you will have to pay back during the life of your loan. Higher interest rates are charged when the risk of default is greater. For instance, if you have poor credit or are applying for a loan with no down payment, the lender may view you as a higher risk and charge a higher interest rate. Interest rates also vary depending on the type of loan. For example, mortgages typically have lower interest rates than credit cards since houses are considered reliable investments that will keep their value over time, while credit cards are seen as liabilities. Similarly, you lend banks money in the form of your deposits. They pay interest rates as compensation for their use of your money to fund loans, investments, and other activities. The Federal Reserve determines deposit interest rates. Interest rates can be simple or compounded. Simple interest is a fixed rate applied to the principal loan or deposit amount, while compound interest applies an additional rate on any accumulated interest from previous periods. Compound interest is also known as “interest on interest.” Simple interest is the principal amount multiplied by the interest rate charged multiplied by the term, such that: For example, if you borrow $3,000 at a 4% interest rate for 3 years, the total amount of simple interest paid over the life of the loan using the formula above is $360 ($3,000 x 0.04 x 3). Compound interest is calculated by multiplying the principal amount by one plus the annual interest rate raised to the number of years interest is applied, minus the principal, to wit: For example, you borrow $3,000 with an interest of 4% compounded annually for 3 years. Using the above formula, the total amount of compound interest paid over the life of the loan is $374.59. Notice from the examples that compound interest is greater than simple interest even with the same principal amount. The reason is that compound interest is charged on the principal plus the accumulated interest from previous years of the loan. Interest rates can be further classified depending on the effects of key economic factors like inflation. They can be nominal, real, or effective interest rates. Knowing the difference between the three can help you make better decisions when borrowing or investing and better understand the total cost of a loan or return on a deposit. The nominal rate is the stated annual interest rate charged on a loan or returns on a deposit. Also known as coupon rate, it does not consider any additional fees or costs associated with the product or the effects of inflation. For example, a bank’s advertised interest rate is typically nominal, say a 4% annual yield for a six-year certificate of deposit (CD). Focusing solely on the nominal interest rate can result in overlooking important details and creating false expectations on total charges or returns. The real interest rate considers inflation by subtracting expected future price increases from the nominal rate. For example, if a loan or deposit has an 8% nominal interest rate, but 5% inflation is expected for the year, the real interest rate would actually be 3%. Real rates are more useful for comparing various investment options over long-term periods, as they help you determine the true return on an investment after inflation. The effective interest rate is the actual return on deposit or borrowing cost after considering the compounding of interest and all associated fees and charges. This rate can be calculated from the nominal rate and frequency of compounding. For example, a six-year $1,000 CD that offers 4% compounding interest annually will yield a total of $265.32 effective interest after the allotted period. The effective interest rate gives a more accurate picture of the entire loan or deposit product. While interest rates affect investment returns or loan repayment costs, it is also influenced by factors like the economy's strength, inflation, supply and demand, government policy, credit risk, and loan period. A strong economy with low unemployment increases demand for goods and services, which can increase rates as businesses attempt to borrow more money to meet this demand. On the other hand, a weak economy results in lower interest rates as lenders are less confident about lending their money due to the increased risk of default and decreased need for borrowing. When inflation rises, so too do interest rates. This is because lenders require a higher rate of return on their investment to make sure they do not lose out on purchasing power due to rising costs of goods and services over time. In such a scenario, borrowers must pay back more than the principal amount due to the currency's depreciation. The government also plays an important role in determining interest rates, as they use these to influence economic policy. For example, the Federal Reserve can raise or lower short-term interest rates to manage inflation and stimulate the economy. These changes usually have a ripple effect that affects other interest rates, such as mortgage and credit card rates. Interest rates are ultimately determined by supply and demand. When there is high demand for credit, lenders can increase their rates as they have more opportunities to lend out money at higher returns. On the other hand, when there is a low demand for borrowing, lenders will lower their rates to make their services attractive to potential borrowers. Generally, the riskier a loan is deemed by a lender, the higher the interest rate a borrower must pay. This makes sense as it incentivizes lenders to take on more risky investments and compensates them for the higher chance of default. High-risk loans normally come with a base rate and a risk premium. The latter considers the borrower's credit risk and accordingly affects how much interest they will have to pay. The length of the loan can also significantly affect interest rates. Generally, the longer the loan period is, the higher the rate will be to cover any additional risks incurred by lenders over time. For example, short-term loans come with many benefits, such that a 3 or 6-month installment loan usually comes with lower rates compared to long-term ones such as mortgage or car finance loans. Annual percentage rate and annual percentage yield are commonly used terms when discussing interest rates. They are both expressed as percentages but have different implications. The APR is the interest you will be charged when you borrow. The APY is the interest you get when you save. A higher APR is often associated with a loan. It includes not only the interest rate on the principal amount of a loan but also any fees charged by the lender, such as points, origination fees, and other costs involved in obtaining credit. A higher APR indicates a higher cost of borrowing. On the other hand, APY calculates how much return you can expect on an investment over a 12-month period and considers both compounding interest and other fees associated with the investment. When looking for an investment vehicle, it is best to look for one with a higher APY, which means more of your money will be returned to you through compound interest or other benefits. You may also consult with a financial advisor to assist you with your savings or loan needs. Understanding Fluctuations: Average mortgage interest rates aren't static. They're influenced by a complex set of economic factors, primarily the federal funds rate set by the Federal Reserve, inflation levels, and broader economic conditions. Changes in these factors can cause mortgage rates to rise or fall. Importance of Monitoring: It's crucial for potential homebuyers to keep tabs on current average mortgage rates. A seemingly small difference in interest rate can significantly impact the overall cost of a mortgage over many years. Finding the Best Rate: Don't just settle for the first mortgage offer. Comparison shopping between lenders is essential, as rates and terms can vary. Utilizing Online Resources: Several online resources provide up-to-date information on average mortgage interest rates. Additionally, mortgage calculators help visualize how changes in interest rates translate to monthly payments and total loan costs. Interest rates indicate the cost of money. They are a key factor to consider when it comes to borrowing or investing. Further, they give you an idea of how much you need to repay or what investment returns you can expect. Interest rates can be calculated as either simple or compounded. Further, they can be classified depending on the effects of key economic factors. They can be nominal, real, or effective interest rates. Factors that affect interest rates are economic strength, inflation, government policy, supply and demand, credit risk, and loan period. There are two standard terms when discussing interest rates. The APR is the interest you will be charged when you borrow. The APY is the interest you get when you save. Whether you are a lender, a borrower, or both, it is critical to evaluate how changing interest rates may affect your financial decisions.What Are Interest Rates?

How Does Interest Rate Work?

Interest Rate Calculation

Simple Interest Rate

Compound Interest Rate

Types of Interest Rates

Nominal Interest Rate

Real Interest Rate

Effective Interest Rate

Factors that Affect Interest Rates

Economic Strength

Inflation

Government Policy

Supply and Demand

Credit Risk

Time Period of the Loan

Annual Percentage Rate (APR) vs Annual Percentage Yield (APY)

Average Interest Rates of Mortgages

Final Thoughts

Interest Rate FAQs

Interest rates can be calculated in two ways: simple or compounded. Simple interest is determined by multiplying the principal by the interest rate and the term. Compound interest is calculated by multiplying the principal by one plus the interest rate raised to the power of the number of periods, deducting the principal. Compound interest is also known as "interest on interest."

Market conditions and the risks associated with lending largely influence interest rates. Factors such as inflation, economic growth, and availability of funds also play a role in determining interest rates.

The Federal Reserve uses interest rates to help manage the economy. Lowering interest rates can boost economic activity and encourage borrowing, while increasing interest rates can slow growth and reduce inflation. The Federal Reserve sets a target federal funds rate used to influence short-term interest rates in the economy.

Interest rate hikes increase borrowing costs. This can lead to higher consumer prices and reduced spending. This can then slow the economy and lead to recession. Higher interest rates also make it more expensive for businesses to borrow capital which can reduce their ability to expand or hire new employees.

Generally, lenders benefit from rising interest rates as they can charge higher rates for loans. Depositors and investors with access to these higher rates also tend to benefit as it increases their returns.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.