A credit score is a numerical scale ranging from 300 to 850 that reflects a borrower’s trustworthiness. It is based on a person's credit history, including the number of open accounts, total amounts owed, and payment track record. Lenders look at this to determine if someone will pay back loans on time. A high credit score means you are a low-risk borrower, which can lead to better interest rates on loans and credit cards. A low credit score could mean you will pay higher interest rates, or may not be approved for a loan or credit card at all. Understanding what a credit score is, how it is calculated, and what you can do to improve it, is crucial to maintaining a good credit history. Your credit score is calculated using information from your credit report. This information is then plugged into a mathematical formula that evaluates various factors, such as your payment history, the amount of debt you have, the length of your credit history, and more. Based on this information, the formula assigns you a numerical score between 300 and 850. The higher your score, the better your credit is considered to be. There are several different credit scoring models in use today, but the most popular one is the FICO score. This scoring model is used by the vast majority of lenders in the United States. Accounts that have a positive payment history are preferred by banks. The reports show any late or missed payments, as well as bankruptcy or collection actions, according to each line of credit. Having a lot of debt does not necessarily indicate low credit ratings. Rather, FICO takes into account the proportion of outstanding debt to total credit volume. For example, someone who owes $10,000 but has all of their lines of credit fully extended and all loans at their maximum would have a lower score than someone who owes the same $10,000 but has only used half of their lines of credit and loan balances. Lenders will also want to know how long you have been using credit. Longer credit history is generally better than a shorter one because it shows you have a track record of responsible borrowing. This refers to the different types of credit you have, such as revolving credit (e.g., credit cards) and installment loans (e.g., auto loans). Having a mix of different types of credit can improve your FICO score. It is not required to have all types of credit but having a variety shows that you can responsibly manage different obligations that come with each type. Opening new lines of credit can be seen as a sign of financial instability. Lenders will want to know if you have been opening new lines of credit frequently. While there are many different credit scoring algorithms available, VantageScore is the most popular one outside of FICO. Several different factors go into calculating your VantageScore. These include: This includes on-time payments, late payments, collections, bankruptcies, and foreclosures. This is the variety of types of credit accounts you have, such as credit cards, mortgages, and car loans. A diversified mix of credit accounts is generally seen as being more positive than having just one type of account. This is the amount of debt you have compared to the amount of credit available to you. A high credit utilization ratio can indicate that you are overextended and may be more likely to default on your debts. This is the outstanding balance on each of your credit accounts. This includes new credit accounts, inquiries, and derogatory information such as late payments. For the purpose of VantageScore, a consumer's credit limit is considered less significant. That said, this variable accounts for 3% of the calculation. If you do not have a lot of debt on your credit report, consider requesting higher credit limits on current cards or obtaining a secured credit card. 1800s - The first forms of credit reporting emerged in the United States, when commercial lenders utilized them to assess the risk involved in lending to various prospective business clients. Mid-nineteenth century - R.G. Dun & Co and Bradstreet Company became two of the foremost credit reporting agencies. Both organizations used alphanumeric scores to assess commercial risk for credit applicants, but many critics charged them with being discriminatory towards certain demographics. 1970 - The Fair Credit Reporting Act (FCRA) was put into effect in response to consumer complaints about subjective, unjust, and inconsistent credit judgments. 1974 - The Equal Credit Opportunity Act (ECOA) was passed, outlawing lenders from discriminating against credit applicants based on irrelevant factors such as their capacity to repay. 1989 - The Fair Isaac Corporation (now FICO) created the first credit score, which was based on information from consumers' credit reports. This was a breakthrough in credit scoring as it focuses on an individual’s ability to repay a loan instead of on subjective factors that instigated discrimination in the past. 2006 - VantageScore was created by the three major credit bureaus (Equifax, Experian, and TransUnion) as an alternative to the FICO score. Although it is not used as widely as the FICO score, it is still used by a significant number of lenders. Credit score is a numerical representation of a borrower’s creditworthiness, while credit report is a detailed history of a borrower’s credit accounts and activity. Your credit report includes information such as: Your credit score is calculated using the information in your credit report. However, not all of the information in your report is used to calculate your score. For example, inquiries are not included in your FICO Score, but they are included in your credit report. You can get your credit score from a number of sources, including credit card companies, banks, and personal finance websites. Many of these sources offer free credit scores, such as Credit Karma, Credit Sesame, and Credit.com. You can also get your credit score directly from the three major credit bureaus: Experian, Equifax, and TransUnion. It is imperative to check your credit report regularly to ensure that it is accurate. You can get a free copy of your credit report from each of the three major credit bureaus once per year at AnnualCreditReport.com. Aside from the obvious advantage of being able to obtain financing for a large purchase, having a good credit score can assist you in a variety of ways. People with better credit scores pay less for auto insurance in many states. Furthermore, some landlords check prospective tenants' credit histories. Good credit is not necessary to get a mortgage loan, credit card loan or individual business loan. However, since credit scores estimate the risk of you not paying back the loan, lenders will favor a higher score with more alternatives and lower interest rates. If you have a bad credit score, you may have difficulty qualifying for loans or lines of credit. You may also be charged higher interest rates. Payment history is the heaviest factor in credit scoring so, it should be no surprise that paying bills on time is one of the most important things you can do to improve your credit score. It is important to increase your credit line so that your credit utilization ratio is low given that your spending habits remain the same. Even with an increased credit line, a drastic increase in your spending will still hurt your credit score. You can ask your credit card company to increase your credit line. They may do so if you have a good payment history with them. Credit utilization ratio is one of the most important factors in credit scoring. A maxed out credit limit means high credit utilization ratio, which can have a negative impact on your credit score. If you have any past due accounts, it is important to catch up on them as soon as possible. This will help improve your score in payment history which weighs the heaviest among the factors in credit scoring. There may be errors on your credit report that are negatively impacting your credit score. You can check your credit report for free through AnnualCreditReport.com. If you find any errors, you can dispute them with the credit reporting agency. You can also find information on disputes from the FTC and CFPB websites. To become an authorized user, you will need to have a friend or family member add you to their credit card account. This can help improve your score as long as the account is in good standing. Your credit score is a key factor in your financial life. It is used to determine whether you are eligible for loans and lines of credit, and it can also affect the interest rates you are offered. Checking your credit score regularly and taking steps to improve it can help you save money and make it easier to qualify for the credit products you need.What Is Credit Score?

How Is Credit Score Calculated?

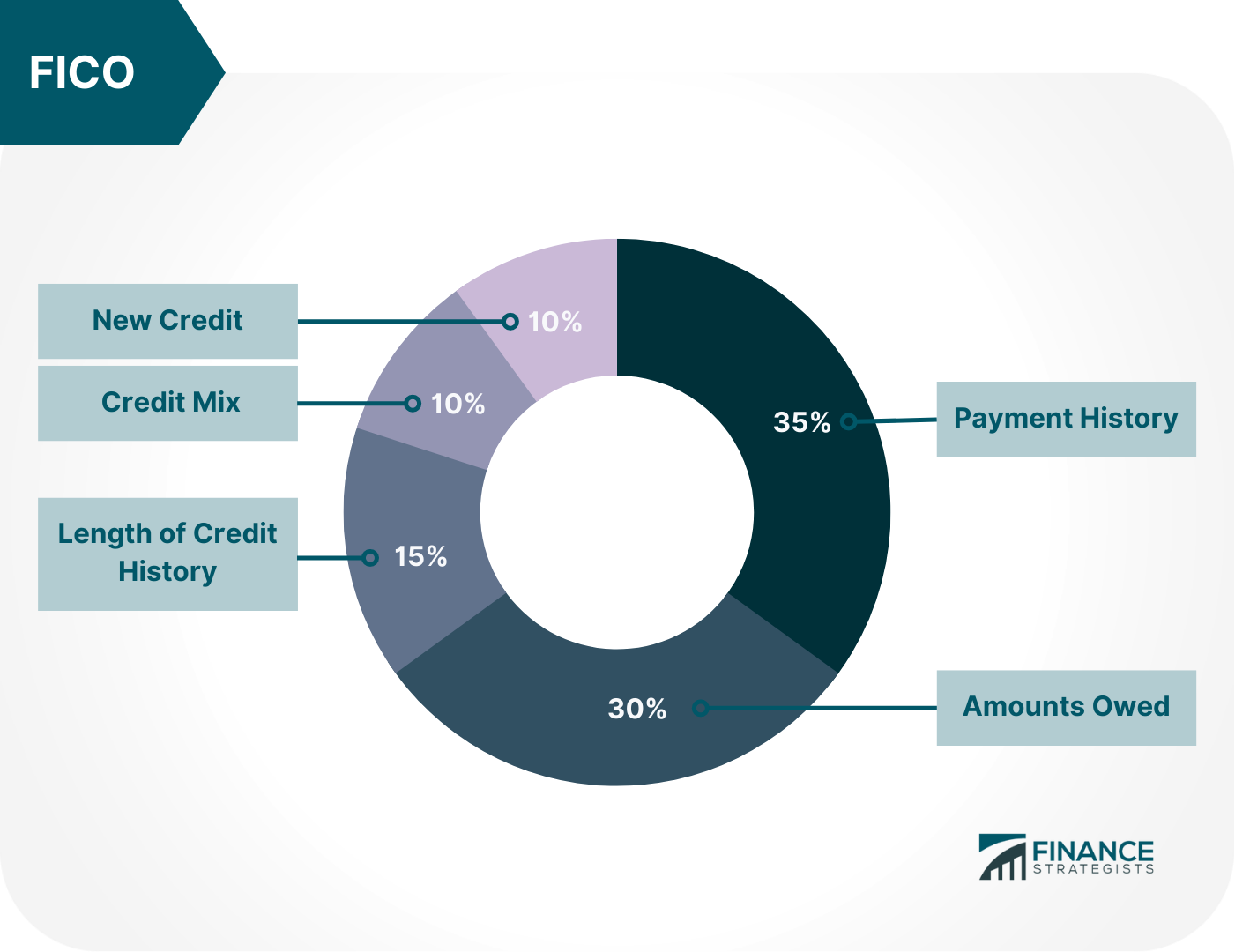

FICO Score

Payment History (35%)

Amounts Owed (30%)

Length of Credit History (15%)

Credit Mix (10%)

New Credit (10%)

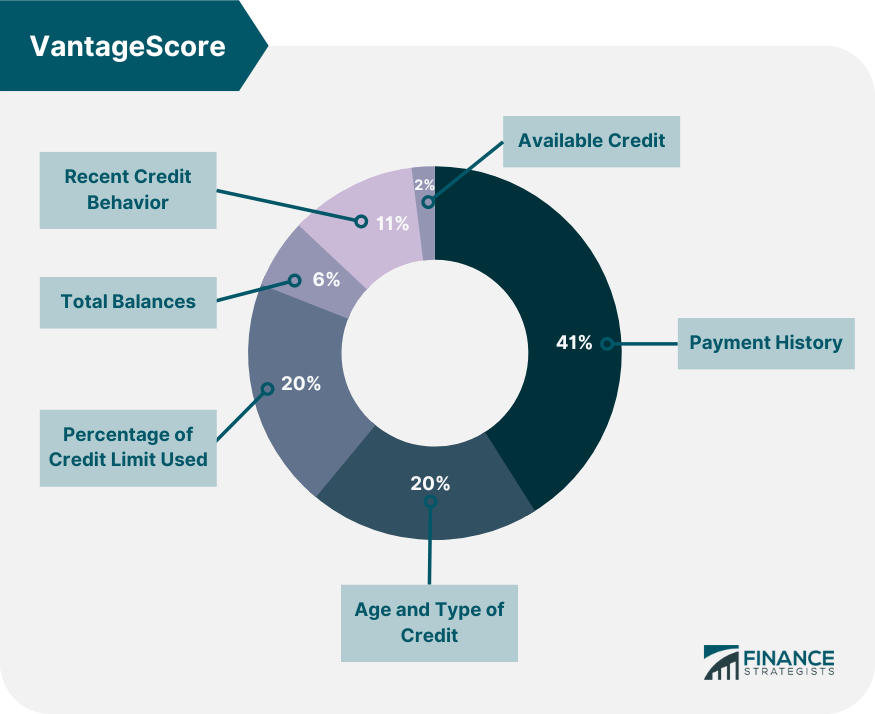

VantageScore

Payment History (41%)

Age and Type of Credit (20%)

Percentage of Credit Limit Used (20%)

Total Balances (6%)

Recent Credit Behavior (11%)

Available Credit (2%)

History of Credit Scores

Credit Scores vs Credit Reports

How to Check Your Credit Score

How to Check Your Credit Report

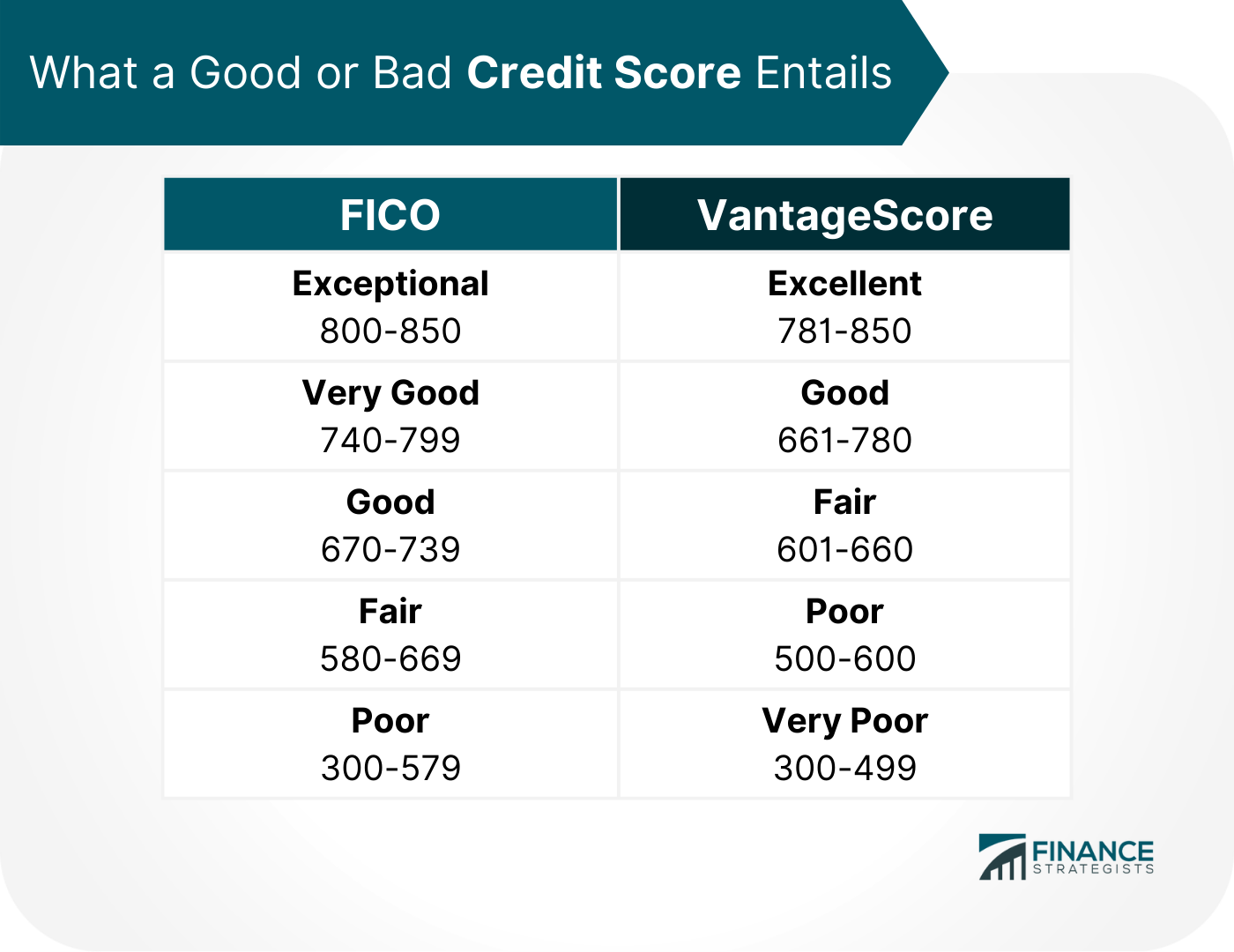

What a Good or Bad Credit Score Entails

How to Improve Credit Scores

Pay bills on time.

Have the credit line increased.

Do not max out credit limits.

Catch up on past due accounts.

Check the credit report for errors.

Become an authorized user.

The Bottom Line

Credit Score FAQs

A good credit score is generally considered to be a score of 740 or higher. This is the level at which you are likely to qualify for the best interest rates on loans.

The credit utilization ratio is the percentage of your available credit that you are using. For example, if you have a credit limit of $1,000 and you are using $500, your credit utilization ratio would be 50%.

The requirements for increasing your credit line vary from lender to lender. In general, you will need to have a good payment history and a low credit utilization ratio. You may also need to provide additional documentation, such as proof of income or assets.

You should check your credit report at least once a year to make sure there are no errors. You can get a free copy of your report from each of the three major credit bureaus: Equifax, Experian, and TransUnion.

The credit bureaus are required by law to protect your personal information. They use a variety of security measures, such as encryption and physical security, to protect your data.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.