A Certificate of Deposit (CD) is a financial product offered by banks and credit unions that allows individuals to save money and earn interest over a predetermined period. CDs differ from traditional savings accounts and other investment options in terms of liquidity, risk, and potential returns. To open a CD account, you must first select a financial institution such as a bank or credit union. These institutions have varying minimum deposit requirements and offer different term lengths, ranging from a few months to several years. When opening a CD, consider your financial goals and liquidity needs, as your funds will be locked in for the term length. CD interest rates can be either fixed or variable, depending on your CD type. Fixed-rate CDs have a set interest rate for the entire term, while variable-rate CDs may change over time based on market conditions or other factors. In general, longer-term CDs offer higher interest rates than shorter-term CDs, but the specific rates will depend on the financial institution and current economic conditions. When your CD reaches its maturity date, you have several options. Many financial institutions offer automatic renewal, in which your CD will roll over into a new term with a similar or updated interest rate. You may also have a grace period, typically ranging from 7 to 10 days, during which you can withdraw your funds or make changes to your CD without penalties. Withdrawing funds from your CD before its maturity date can result in penalties and fees. These may include loss of interest or even a portion of your principal. However, some CDs offer penalty-free withdrawals under certain circumstances, such as financial hardship or reaching a specific age. Traditional CDs are the most common type, offering a fixed interest rate for a specified term. These CDs provide a predictable return on investment and are best suited for conservative investors looking for a low-risk savings option. Bump-up CDs allow investors to increase their interest rate if rates rise during the term. Typically, you can "bump up" your rate once or twice during the CD's term, but the initial interest rate may be lower than that of a traditional CD. These CDs offer greater flexibility than traditional CDs, allowing for penalty-free withdrawals or additional deposits during the term. However, this liquidity often comes at the cost of a lower interest rate. Callable CDs give the issuing financial institution the right to "call" or redeem it before maturity. This typically occurs when interest rates fall, and the institution can reissue the CD at a lower rate. Callable CDs often have higher initial interest rates but carry the risk of early redemption. These CDs do not pay periodic interest but are instead purchased at a discount to their face value. At maturity, the investor receives the full face value, with the difference between the purchase price and face value representing the interest earned. Jumbo CDs require a significantly higher minimum deposit, typically $100,000 or more. In return, these CDs often offer higher interest rates than smaller-denomination CDs. Brokered CDs are sold through brokerage firms rather than directly from banks or credit unions. They can offer higher yields and a wider selection of terms but may have additional fees or risks associated with the brokerage firm. Step-up CDs feature periodic increases in interest rates over the term, providing investors with higher returns as time goes on. The initial interest rate may be lower than that of a traditional CD, but the scheduled rate increases can provide an attractive option for investors who believe rates will rise in the future. High-yield CDs offer interest rates significantly higher than traditional CDs. Online banks or credit unions typically offer these products, which can afford to pay higher rates due to lower operating costs. However, high-yield CDs may come with additional risks or requirements, such as higher minimum deposits or more restrictive withdrawal policies. CDs are considered a low-risk investment because they offer a guaranteed return on investment and are insured by the Federal Deposit Insurance Corporation (FDIC) or National Credit Union Administration (NCUA) up to applicable limits. Unlike other investment options, such as stocks or mutual funds, CDs provide a guaranteed return on investment in the form of interest payments. This makes them an attractive option for conservative investors looking for predictable income. CDs offered by FDIC-insured banks or NCUA-insured credit unions are protected up to $250,000 per depositor, per institution, ensuring the safety of your investment. Including CDs in your investment portfolio can provide diversification and help balance the risk associated with other investment options, such as stocks or bonds. CDs have limited liquidity compared to other savings options, as funds are locked in for the term length. Early withdrawals may be subject to penalties and fees. Because CDs have fixed interest rates, they may not keep pace with inflation. If inflation rises faster than the interest rate on your CD, the real value of your investment could decrease over time. CDs generally offer lower returns than riskier investment options like stocks or mutual funds. Investors seeking higher returns may find CDs to be an unsuitable option. Withdrawing funds from a CD before its maturity date can result in penalties, which may include loss of interest or even a portion of the principal. CD laddering involves investing in multiple CDs with staggered maturity dates. This strategy can help balance liquidity and interest rate risk while providing a steady stream of income. Keep an eye on interest rates and economic trends to make informed decisions about when to invest in CDs and which term lengths to choose. Research and compare CD offers from various financial institutions to find the best interest rates and terms for your financial goals. Some banks or credit unions may offer special promotions or bonuses to attract new customers, which can boost the overall return on your CD investment. Interest earned on CDs is considered taxable income and must be reported on your federal income tax return. The financial institution will provide a Form 1099-INT detailing the interest earned for the year. Some CDs, such as Individual Retirement Account (IRA) CDs, offer tax-deferred interest, allowing you to delay paying taxes on the interest earned until you withdraw the funds. Be aware of your reporting requirements for interest earned on CDs, as failing to report this income can result in penalties from the Internal Revenue Service (IRS). Determining whether a CD is the right investment choice depends on your financial goals, risk tolerance, and liquidity needs. By researching and comparing CD options from different financial institutions, you can make an informed decision that aligns with your financial objectives. Remember to balance risk, return, and liquidity when building your investment portfolio to achieve long-term financial success.What Is a Certificate of Deposit (CD)?

How Certificates of Deposit Work

Opening a CD Account

Interest Rates

Maturity Date and Renewal

Early Withdrawal

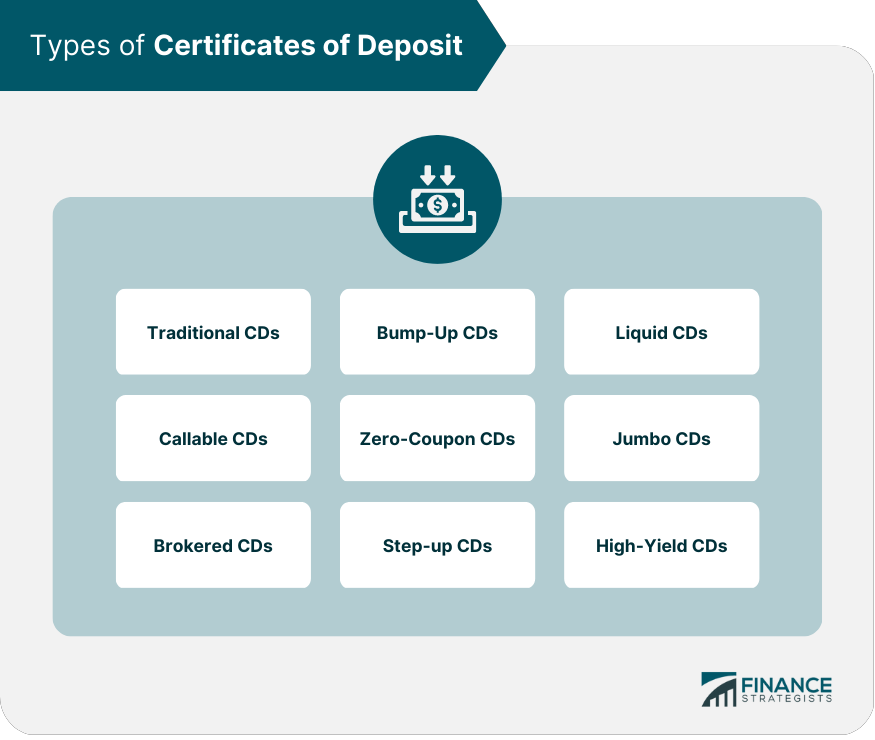

Types of Certificates of Deposit

Traditional CDs

Bump-Up CDs

Liquid CDs

Callable CDs

Zero-Coupon CDs

Jumbo CDs

Brokered CDs

Step-Up CDs

High-Yield CDs

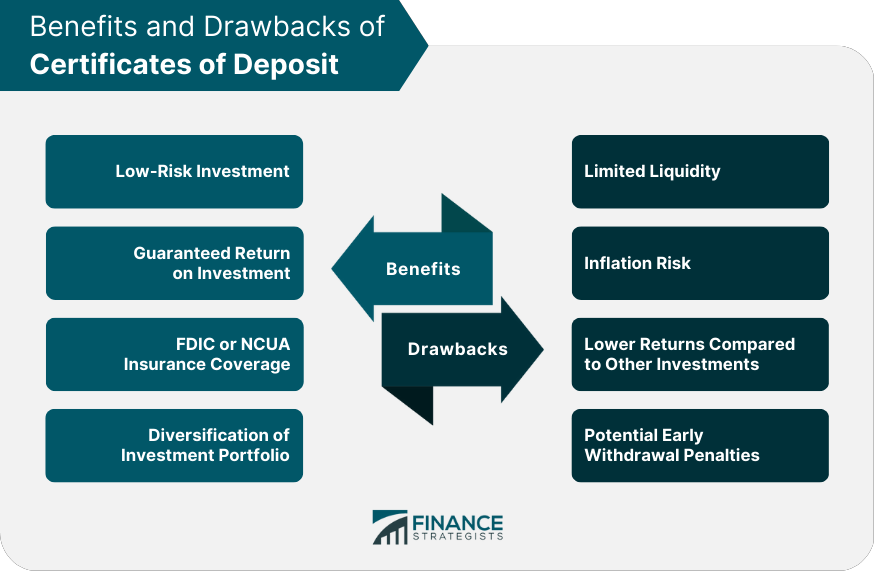

Benefits of Certificates of Deposit

Low-Risk Investment

Guaranteed Return on Investment

FDIC or NCUA Insurance Coverage

Diversification of Investment Portfolio

Drawbacks of Certificates of Deposit

Limited Liquidity

Inflation Risk

Lower Returns Compared to Other Investments

Potential Early Withdrawal Penalties

Strategies for Maximizing CD Returns

CD Laddering

Monitoring Interest Rates

Comparing CD Offers From Different Institutions

Utilizing Special Promotions or Bonuses

Tax Implications of Certificates of Deposit

Interest Income Taxation

Tax-Deferred CDs

Reporting Requirements

Conclusion

Certificate of Deposit (CD) FAQs

A Certificate of Deposit (CD) is a time-based savings product offered by banks and credit unions that allows individuals to deposit money for a specified term and earn interest. CDs differ from other savings options in terms of liquidity, risk, and potential returns, as they typically have higher interest rates than traditional savings accounts but require funds to be locked in for the term length.

When selecting a CD, consider your financial goals, risk tolerance, and liquidity needs. Research and compare various types of CDs, such as traditional, bump-up, liquid, and high-yield, to determine which aligns with your objectives. It is important to review the interest rates, term lengths, and withdrawal policies of each type of CD before making a decision.

Yes, you can withdraw money from a CD before its maturity date, but doing so may result in penalties and fees. These may include loss of interest or even a portion of your principal. However, some CDs, such as liquid CDs, offer penalty-free withdrawals under certain circumstances.

To maximize your returns on a CD, consider using strategies such as CD laddering, monitoring interest rates, comparing CD offers from different institutions, and utilizing special promotions or bonuses. CD laddering, for example, involves investing in multiple CDs with staggered maturity dates, helping to balance liquidity and interest rate risk while providing a steady stream of income.

Yes, the interest earned on a CD is considered taxable income and must be reported on your federal income tax return. The financial institution will provide a Form 1099-INT detailing the interest earned for the year. Some CDs, like Individual Retirement Account (IRA) CDs, offer tax-deferred interest, allowing you to delay paying taxes on the interest earned until you withdraw the funds.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.