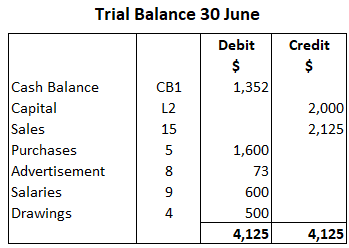

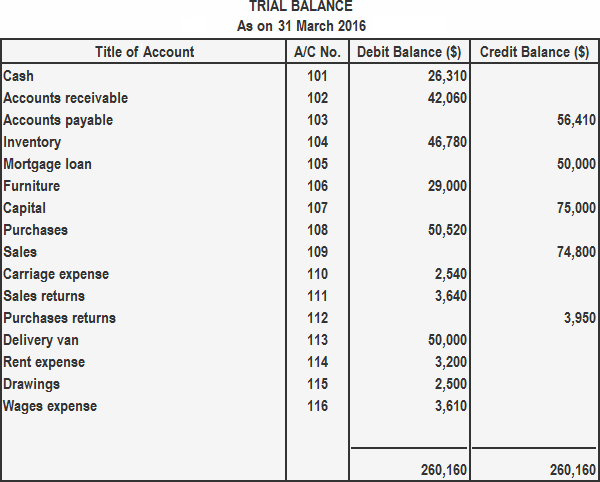

The trial balance is a source of locating errors in a company's ledger. Trial balance is the third phase of the accounting cycle. Before complex accounting procedures are applied, it is necessary to check the accuracy of the work that has already been done. Therefore, a trial balance provides the basis to check the accuracy of a ledger. The trial balance consists of a two-column statement of debit and credit balances derived from the ledger. The total of the debit and credit balances should be equal; otherwise, the work done to maintain the ledger cannot be considered accurate. In a nutshell, a trial balance is an informal accounting statement, prepared with the help of ledger account balances. It is prepared on a particular date to summarize the records and check the arithmetical accuracy of the books of accounts. The stage after completing all postings involves extracting information from the books of all balances to create a trial balance. The trial balance is not an account; it is simply a list of all the debit and credit balances. The financial information, which is classified and grouped in the various ledger accounts, is now totaled for each account. Also, the debit and credit balances are listed on the trial balance, including the final balance of the cash account. The grouping of account balances does not happen in a specific order. However, to avoid omission, it is recommended to extract the final cash balance first, after which the remaining ledger balances can be listed in either page or book sequence. There are no complexities regarding double entries here; at this stage, it has been completed. Debit balances are merely listed on the debit of the trial balance, with credit balances on the credit. The basic purpose of preparing a trial balance is to test the arithmetical accuracy of the ledger. If all debit balances listed in the trial balance equal the total of all credit balances, this shows the ledger's arithmetical accuracy. Importantly, the trial balance is not an account. It is not part of the double-entry system of accounting. The trial balance is simply a list of debit and credit balances taken from the books, normally at the end of a specific trading period (monthly, biannually, or annually) for the purpose of: It is worth noting that the balances of the accounts are bought onto the trial balance. For example, the debit balance of $1,352 is extracted from the cash account, and not the two totals for receipts and payments. The sales account is totaled to show total sales of $2,125 for the month, which in effect is the credit balance taken to the trial balance. The same applies to purchases, and so on. If no mistakes are made when posting the cash book to the various ledger accounts (debit for credit and vice versa), the sum total of the debit balances on the trial balance should equal the sum total of the credit balances. Consider the following trial balance from a trading business: The above trial balance shows that on 31 March 2016, the total of debit balances in the ledger amounted to $260,116, which is equal to the total of credit balances. This fact provides a reasonable assurance that every debit entry in the ledger accounts does have a corresponding credit entry and that no arithmetical error has been made during the balancing process. It also shows that all accounts with a non-zero balance have been duly reported in the trial balance on its correct side (i.e., those having debit balance are reported in the debit column, and those having credit balance are reported in the credit column). In addition to the above, trial balance performs another important function. If you check the above trial balance again, you'll realize that this list of balances is also a summary of all transactions made during the accounting period. Let's analyze the contents of the above trial balance: Regarding the final point, examining the balance of any of these accounts, the accountant or business owner can know what has been spent on various expense items during the accounting period to which the trial balance relates. Similarly, the balances of accounts relating to income or revenue show income earned from each source in the accounting period to which the trial balance relates. We can say that a trial balance not only provides evidence of the arithmetical accuracy of the ledger but that it also serves as a summary of all transactions made since the end of the previous accounting period. If the trial balance totals do not agree, you should try to find the error. To achieve this, it is often useful to calculate the difference between the totals as an initial step. You may find that this gives a figure that you can find in the original list of balances and which you have either not included in the trial balance, or have not included in your addition of the trial balance figures. If this isn't the case, try halving the difference (if the number is even) and seeing if a balance of that amount has been included in the wrong side of the trial balance, where it would have a double impact on the discrepancy. Finally, try dividing the difference by 9. If it divides exactly, you may have made a transposition error (e.g., entering 1985 rather than 1895). Errors that will still leave the trial balance totals equal are: Errors that cause the trial balance totals to be unequal are:What Is a Trial Balance? The Third Phase of Accounting

Trial Balance: Explanation

Objectives

Purpose of Preparing a Trial Balance

Example

When Trial Balance Totals Do Not Agree

Remember this:

Focus Points

Trial Balance FAQs

Preparation of a trial balance starts with the calculation of the balances of each of the ledger accounts, next is the calculation of the debit column and the credit column, and lastly is checking if the debit total is equal to the credit total.

A trial balance is a worksheet prepared periodically before the final set of financial statements are completed. The trial balance summarizes all accounts and balances the totals in the debit and credit columns.

Trial balance has no formula but it is an equation which is total debit entries = total credit entries.

A trial balance is called a trial balance because there will always be equal amounts entered on the debit and credit sides of the ledger.

The purpose of the trial balance is to ensure that all entries made into an organization's General Ledger are accurate and balanced.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.